A Look at CommScope (COMM) Valuation Following DOCSIS 4.0 Speed Milestone and Market Attention

If you have been following CommScope Holding Company (COMM) lately, you have likely seen the buzz surrounding its recent achievement at the CableLabs interoperability event. The company managed to hit record-breaking downstream speeds using its DOCSIS 4.0 technology, while showcasing the flexibility and interoperability of its vCCAP Evo platform. For tech investors and curious market watchers, this sort of product breakthrough is a clear signal that CommScope is doubling down on innovation, aiming to give fiber-optic networks a run for their money, but without the hefty installation burden.

This headline-making demo comes after some interesting share price momentum for CommScope. Over the past year, the stock has climbed upward, building on renewed optimism around its technology roadmap and market positioning. With a year-to-date return north of 2%, the company is far from standing still, though the long-term story has been more mixed, reflecting both the ups and downs of a highly competitive sector. The recent pop in short-term returns suggests investors are responding positively to tangible proof of execution like the DOCSIS 4.0 results, rather than simply buying into a vision.

The question now, after a year marked by steady gains and fresh product leadership, is whether these achievements make CommScope a value play still trading at a discount, or if the market has already priced in all the expected growth?

Most Popular Narrative: 17.7% Undervalued

According to the most widely followed narrative, CommScope Holding Company is significantly undervalued. Valuation models suggest the stock price could be nearly 18% higher based on forward-looking growth expectations and recent business developments.

Rapid adoption of Wi-Fi 7 and AI-powered enterprise solutions is boosting RUCKUS performance. Robust growth is expected as enterprises and service providers modernize networks to meet the data and connectivity needs of digital transformation, which could increase both top-line revenue and net margins through higher software and subscription revenue.

What is fueling the bullish outlook? Transformative shifts, ambitious revenue targets, and profit growth projections are all factors that could make CommScope’s current price tag look modest. Interested in understanding the factors behind this double-digit discount and the bold forecasts supporting it? Explore the full narrative for a thorough analysis of the key numbers and the logic behind this valuation.

Result: Fair Value of $19.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if the DOCSIS rollout slows or there is overreliance on key customers, CommScope’s growth outlook could be quickly challenged and current bullish valuations may be threatened.

Find out about the key risks to this CommScope Holding Company narrative.Another View: What Do Market Comparisons Say?

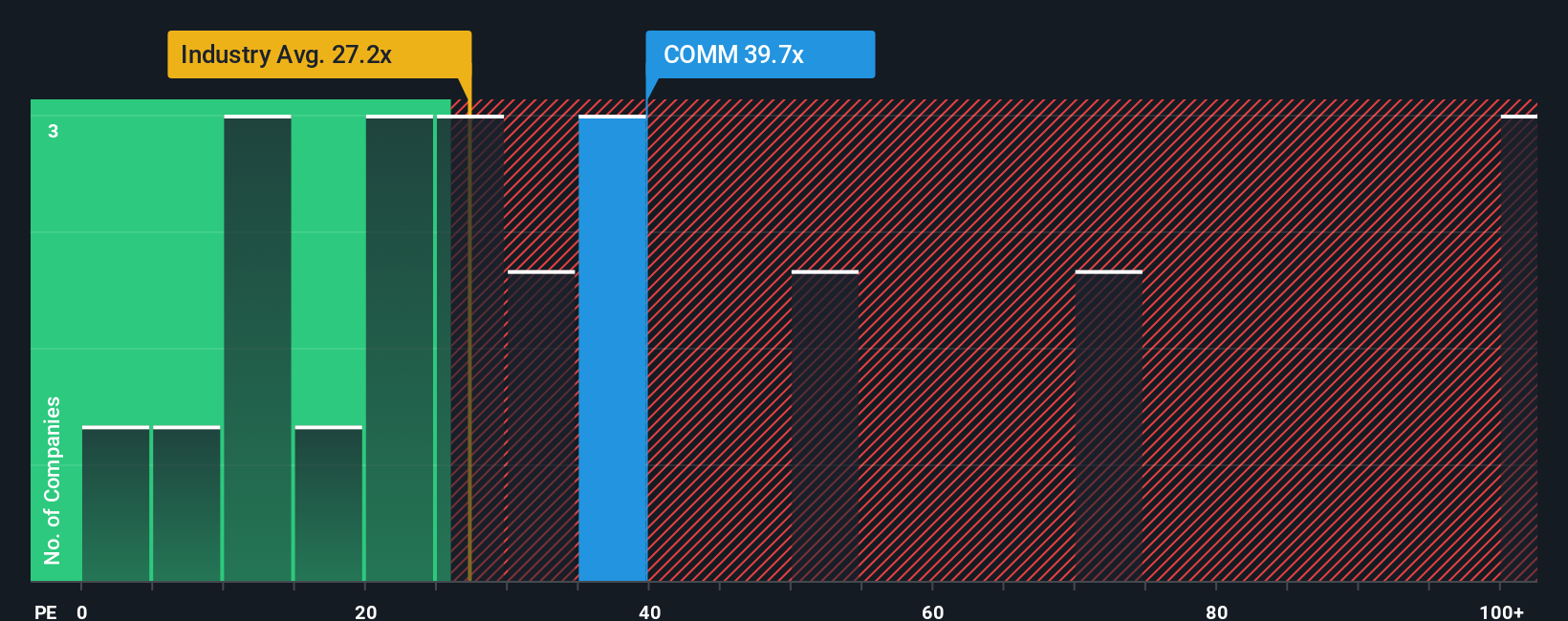

Looking at CommScope’s valuation from a market perspective tells a different story, as the stock appears expensive compared to its industry on earnings. Could this mean optimism is running ahead of reality, or is there more beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CommScope Holding Company Narrative

If you want to dig into the numbers yourself or believe there is another angle to the story, you have the option to shape your own take in just a few minutes: Do it your way.

A great starting point for your CommScope Holding Company research is our analysis highlighting 4 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their options open. Expand your watchlist by tapping into fresh stock ideas handpicked for growth potential, future technologies, and robust fundamentals using the Simply Wall Street Screener.

- Spot stocks with the possibility for substantial gains among under-the-radar companies with strong financials by checking out these penny stocks with strong financials.

- Fuel your strategy with companies shaping the future of artificial intelligence by browsing through exciting AI penny stocks opportunities.

- Unlock value prospects easily overlooked by the market and see what stands out in our handpicked list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English