Geely (SEHK:175): Assessing Valuation Following Sustained Share Price Gains

Geely Automobile Holdings (SEHK:175) has seen its stock edge higher lately, a move that might spark questions for investors weighing their next steps. Even without a headline-grabbing event, this kind of market action often invites a closer look, as traders and long-term holders alike try to gauge whether there is something meaningful driving the shift or if it is just typical market noise. In times like these, subtle price movements can sometimes reflect changing sentiment, whether that is quiet optimism about future earnings or a shift in how the market assesses risk.

Over the past year, Geely has quietly gained momentum, climbing 119% and putting in a stronger performance than in previous periods. Short-term returns have stayed positive as well, with the stock up almost 3% for the month and 10% across the past three months. While recent headlines have been relatively low-key for Geely, the sustained upward trend suggests some investors see value or growth on the horizon, especially considering the company’s double-digit annual growth in both revenue and net income.

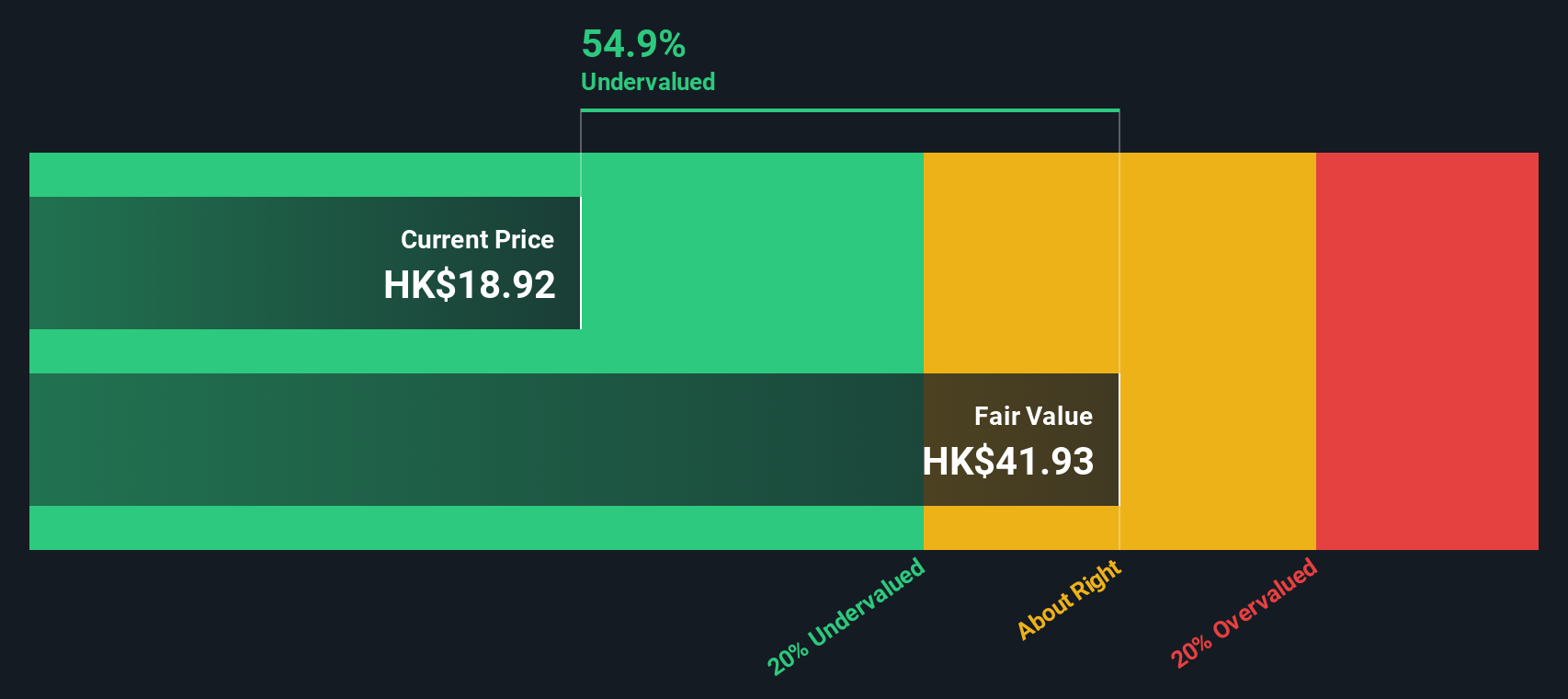

After this steady climb, the question is whether Geely shares are attractively valued for the next leg up, or if the market has already baked in all the good news.

Most Popular Narrative: 28% Undervalued

According to the most widely referenced narrative, Geely Automobile Holdings is currently trading at a significant discount to its estimated fair value, even after its recent run-up in share price.

Geely's strategy of launching 10 new NEV models in 2025 and continuing global expansion is likely to impact revenue positively by increasing market penetration and sales volume. The integration of smart driving technologies, including AI applications and autonomous driving features, is expected to enhance the product offering, potentially leading to higher average selling prices and improved net margins.

Ready to unpack the engine behind this bullish valuation? The narrative hinges on bold assumptions, blending aggressive product rollout, tech enhancements, and ambitious global growth. Want to discover which financial forecasts fuel this double-digit discount? The key drivers might defy your expectations.

Result: Fair Value of $26.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and uncertainties around the adoption of autonomous technology could easily challenge these bullish expectations for Geely’s future performance.

Find out about the key risks to this Geely Automobile Holdings narrative.Another View: SWS DCF Model Paints a Different Picture

Step back from earnings multiples and consider our DCF model, which takes future cash flows into account. This method also suggests the stock is trading well below fair value. Which lens should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Geely Automobile Holdings Narrative

If you have a different perspective or enjoy digging into the numbers yourself, there is always the option to craft your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Geely Automobile Holdings.

Looking for More Smart Opportunities?

Don’t limit yourself to a single stock when there are great investment ideas waiting. Use the screener to unlock trending sectors and spot the next big winner.

- Spot game-changing companies making waves in automation and deep learning by checking out AI penny stocks.

- Find stocks trading below their potential to seize undervalued opportunities with confidence using undervalued stocks based on cash flows.

- Uncover top yield picks with strong payouts in today’s market by using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English