Is Synaptics' (SYNA) New Edge AI Showcase at IBC 2025 Shaping Its IoT Investment Story?

- Earlier this week, Synaptics Incorporated showcased its latest AI-native processing technologies for set-top boxes and OTT streaming devices at IBC 2025 in Amsterdam, demonstrating real-time enhancements in picture and audio quality, security, and device personalization using its Astra line of MPUs and MCUs.

- This event highlights Synaptics’ push to leverage Edge AI for richer user experiences and expanded capabilities in smart home and media devices, potentially broadening its influence in the fast-evolving connected device market.

- Let’s explore how Synaptics’ AI-powered demonstrations at IBC 2025 may reshape its Core IoT and Edge AI investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Synaptics Investment Narrative Recap

For anyone considering Synaptics, the key conviction lies in the company's ability to capitalize on the rapidly expanding IoT and Edge AI markets by delivering differentiated, AI-centric silicon and software solutions. While Synaptics’ recent AI demonstrations at IBC 2025 align squarely with its Core IoT and Edge AI ambitions, they did not materially alleviate the short-term catalyst of scaling its customer base beyond its current reach. The largest risk, executing this transition in sales channels and customer acquisition, remains highly relevant at this stage.

The launch of Synaptics' Wi-Fi 7 SoCs for IoT earlier this year stands out as particularly relevant, reinforcing the company’s push to enhance device connectivity and support the broader portfolio strategy displayed at IBC 2025. Expanding capabilities in both connectivity and on-device intelligence represents a natural extension of the Astra solutions, supporting the bigger goal of capturing more value per IoT device as new markets emerge.

However, despite this product momentum, investors should also be mindful of risks tied to ramping up new sales channels and whether Synaptics can truly accelerate customer adoption in a...

Read the full narrative on Synaptics (it's free!)

Synaptics’ narrative projects $1.4 billion revenue and $199.5 million earnings by 2028. This requires 9.6% yearly revenue growth and a $247.3 million increase in earnings from -$47.8 million currently.

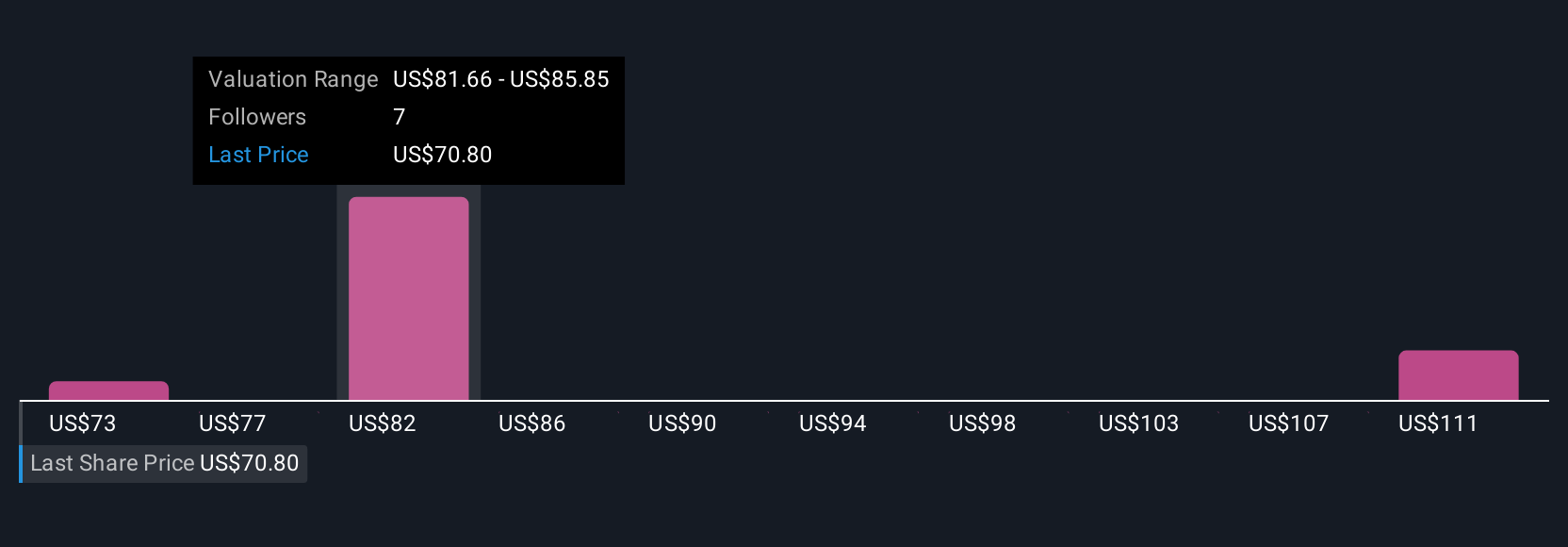

Uncover how Synaptics' forecasts yield a $82.25 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range between US$73.28 and US$117.94. Community members have differing expectations, while the company's challenge of broadening its sales channels could shape future outcomes.

Explore 3 other fair value estimates on Synaptics - why the stock might be worth just $73.28!

Build Your Own Synaptics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Synaptics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Synaptics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Synaptics' overall financial health at a glance.

No Opportunity In Synaptics?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English