Assessing XtalPi Holdings (SEHK:2228) Valuation After Recent Surge in Trading Volume and Volatility

Price-to-Book of 5.8x: Is it justified?

XtalPi Holdings is currently seen as expensive when measured by its price-to-book (P/B) ratio, which stands at 5.8x. This is considerably higher than both the peer group average (3.8x) and the wider Asian Life Sciences industry average (2.8x).

The price-to-book ratio compares a company's market value to its book value. This helps investors judge how much they are paying relative to the company's net assets. For biotech and life sciences firms, where future growth can be speculative, a high ratio can indicate high investor expectations for future breakthroughs or revenue growth.

An elevated P/B multiple suggests that the market is pricing in significant optimism for XtalPi Holdings, beyond what its current assets or past profitability justify. This premium may reflect investor hope for future growth but also signals potential overvaluation compared to peers.

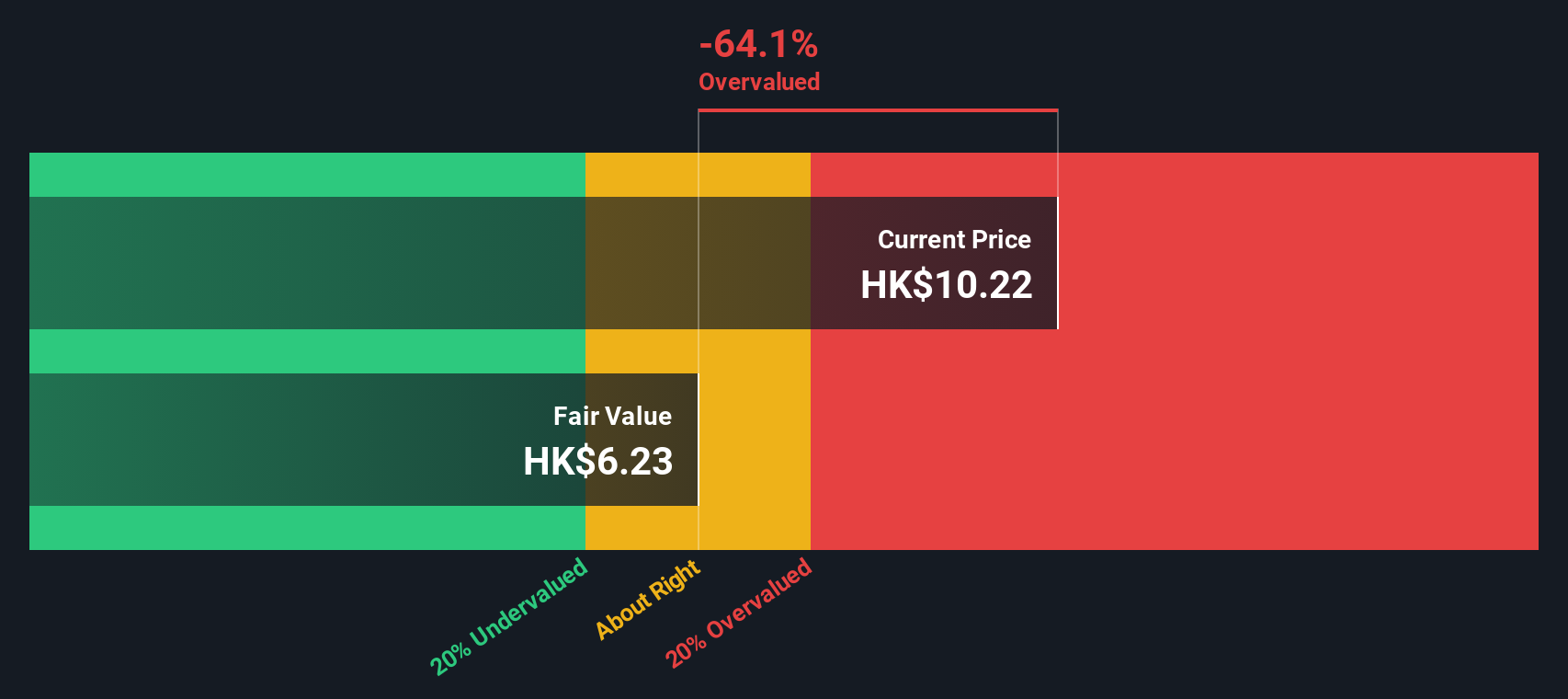

Result: Fair Value of HK$6.21 (OVERVALUED)

See our latest analysis for XtalPi Holdings.However, slowing revenue growth or unexpected regulatory hurdles could reverse the current optimism. This may trigger renewed volatility in XtalPi Holdings’ share price.

Find out about the key risks to this XtalPi Holdings narrative.Another View: What Does Our DCF Model Suggest?

Looking from a different angle, the SWS DCF model also points to shares trading above fair value. While both methods raise caution, the question remains: does the DCF capture long-term realities better than market multiples?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own XtalPi Holdings Narrative

If you want to check the numbers for yourself or have a different perspective, you can dig deeper and form your own view in just a few minutes. Do it your way

A great starting point for your XtalPi Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You owe it to yourself to seize game-changing opportunities across different trends and strategies. Check out these hand-picked themes before the next big move passes you by:

- Get ahead of technology shifts by tracking market movers in artificial intelligence with our AI penny stocks.

- Unlock long-term value and secure your portfolio with companies boasting reliable income through our dividend stocks with yields > 3%.

- Capture hidden bargains and strong future growth by pinpointing tomorrow’s standouts using our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English