Archer-Daniels-Midland (ADM): Assessing Valuation After Windsor Expansion and Soy Protein Production Consolidation

Archer-Daniels-Midland (ADM) just rolled out some big operational moves that are catching the attention of both longtime shareholders and new investors. After completing a $76-million expansion in Windsor, Ontario, which added brand new silos and grain dryers, and announcing the consolidation of its global soy protein production, ADM is signaling a sharper focus on efficiency. These updates are not just about shuffling facilities; they show how the company is responding to customer needs and working to strengthen its competitive edge, all while drawing in government support for its growth projects.

These operations come at a time when ADM’s stock has had a modest 9% gain over the past year, following a 24% rally so far in 2025 and nearly 28% growth over the past three months. While ADM’s longer three-year return is still in the red, momentum appears to be shifting alongside management’s drive for a more streamlined portfolio. The recently recommissioned Decatur facility, together with the Windsor investment, tie strategically into ADM’s goal to meet increasing global demand without overextending its resources.

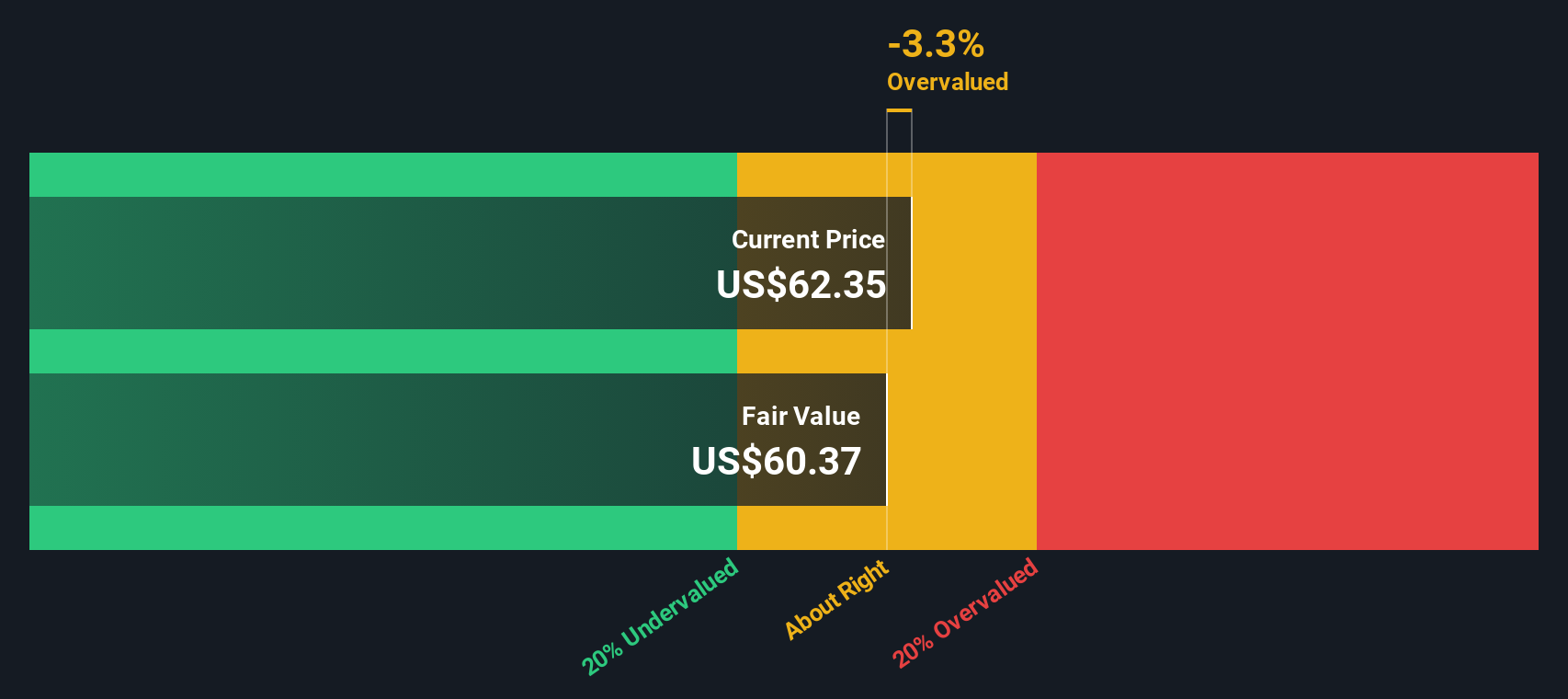

With all these moves, the real question for investors is whether ADM’s current share price still offers value, or if the market is already factoring in the company’s operational improvements and future earnings potential.

Most Popular Narrative: 6.9% Overvalued

According to the widely followed narrative, Archer-Daniels-Midland is currently trading above what analysts consider its fair value by nearly 7%. This indicates that market participants may be pricing in future growth and improvements more aggressively than the latest consensus suggests.

Policy clarity and ongoing government support for biofuels, including the extension of the 45Z tax credit, favorable RVOs, and domestic feedstock incentives, are expected to drive increased soybean oil demand and improved crush margins. This directly supports ADM's revenue and net margins from late 2025 into 2026.

Want to know what’s propelling this bullish price? The answer lies in a mix of anticipated margin improvement, government incentives, and analyst profit forecasts. The methodology behind this valuation is built on a blend of future revenue and earnings gains, but which key assumption tips the balance? Dig into the full narrative to discover the quantitative pivot that makes or breaks the case for ADM’s fair value.

Result: Fair Value of $58.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent policy uncertainty or a significant drop in demand for traditional agricultural products could undermine ADM's expected margin gains and growth trajectory.

Find out about the key risks to this Archer-Daniels-Midland narrative.Another View: What Does Our DCF Model Show?

Taking a closer look, the SWS DCF model also suggests ADM could be priced above its underlying value. This perspective relies less on earnings multiples and more on cash flows. Could the true answer be found somewhere in the details?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Archer-Daniels-Midland Narrative

If you think there’s more to the story or would like to crunch your own numbers, it’s easy to put together a custom view in just a few minutes. Do it your way

A great starting point for your Archer-Daniels-Midland research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by. Supercharge your strategy with proven performers, the latest trends, and overlooked gems you might wish you had found sooner.

- Tap into smart growth by checking out undervalued stocks based on cash flows. These could bring real value and strong upside to your portfolio.

- Unlock passive income potential with dividend stocks with yields > 3%. These options boast high yields and stable returns for long-term investors.

- Ride the innovation wave by spotting tomorrow’s breakthroughs with AI penny stocks leading in artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English