Li Ning (SEHK:2331): Is the Sportswear Giant Undervalued After the Recent Share Price Surge?

Li Ning (SEHK:2331) has found its way back into the conversation among investors. While there has not been a major headline event this week, the recent surge in its share price might leave you wondering if something is shifting beneath the surface. Moves like this often raise a classic question for both new and seasoned shareholders: Are we seeing the start of a comeback, or is the market simply catching up to the fundamentals after a long decline?

Looking back over the past year, Li Ning’s stock has seen momentum swing in its favor. The shares are up 44% over the last twelve months, and a strong 15% gain in the past month suggests growing optimism, even as the company comes off a difficult three-year stretch. Despite recent positivity, it is worth remembering that the longer-term performance has been rough, with returns still down significantly if you look over a three- or five-year period.

With fresh momentum and new interest building, the question now is whether Li Ning is trading at a bargain, or if the market is already pricing in much of its turnaround story.

Most Popular Narrative: 12% Undervalued

According to the most widely followed narrative, Li Ning is currently undervalued by 12%. The narrative suggests that the market has not fully priced in the company's future earnings growth, margin improvement, and competitive positioning in China's rapidly evolving consumer landscape.

The steady expansion of Li Ning's e-commerce and omnichannel presence, with e-commerce retail sell-through achieving high single digit growth and online revenue share rising to 31%, positions the company to benefit from accelerating digital consumer adoption in China. This supports future revenue and margin improvement as direct-to-consumer (DTC) channels yield higher profitability.

Curious about what is really powering this optimistic view? There is a bold bet on future growth, profitability shifts, and investor expectations, fueled by numbers that most would never guess. Want to know which key financial dynamics are sparking the double-digit upside in Li Ning's valuation? The secret assumptions driving this target might surprise you.

Result: Fair Value of $21.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak consumer demand and increased discounting could threaten Li Ning’s growth story, which makes the bullish narrative less certain.

Find out about the key risks to this Li Ning narrative.Another View: Valued on a Different Metric

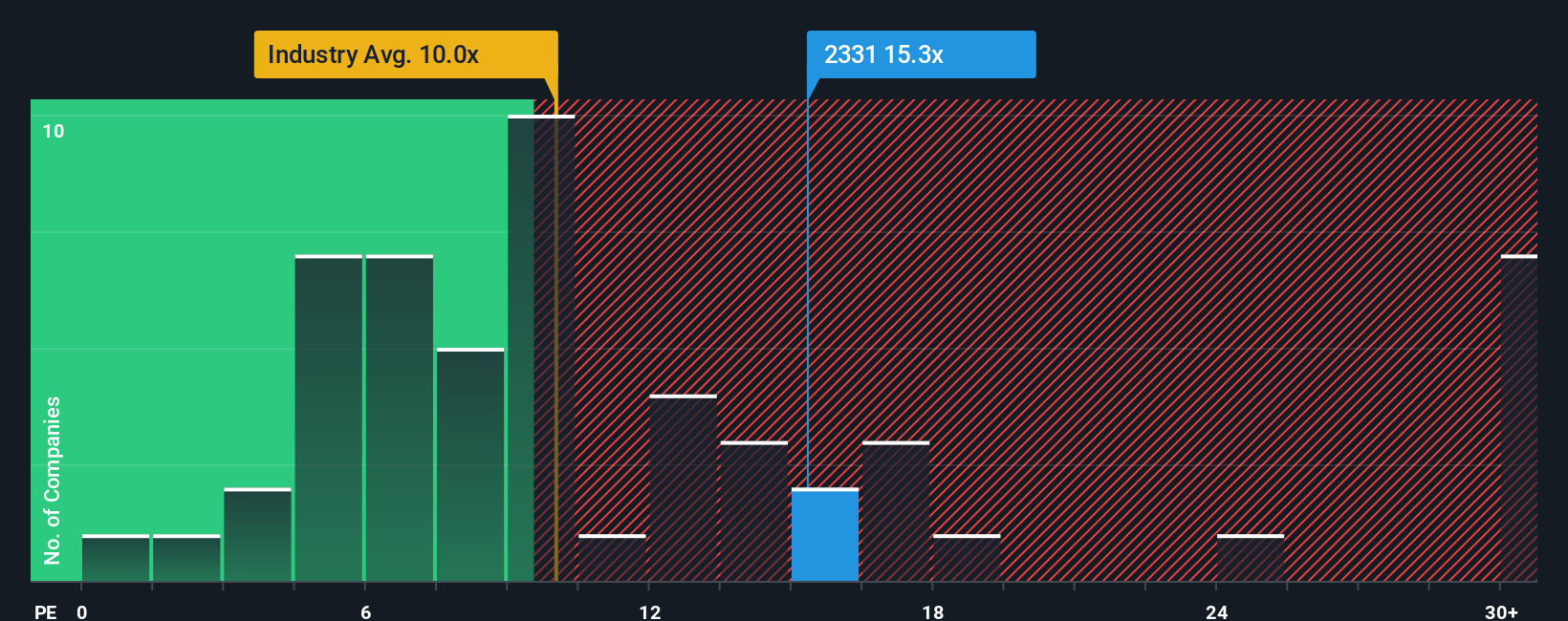

Looking at Li Ning from a market pricing angle, the shares appear expensive relative to others in the industry. This challenges the undervalued outlook and highlights how different approaches can lead to big disagreements. Could the real answer lie somewhere in between?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Li Ning Narrative

Every investor has a unique perspective, and you can dive into the numbers to craft your own view on Li Ning’s future in just a few minutes. Do it your way.

A great starting point for your Li Ning research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you only look at one company, you could miss out on game-changing opportunities. Broaden your search and uncover investments you might not have considered.

- Start building passive income with companies offering generous yields through dividend stocks with yields > 3%.

- Catch early movers in the artificial intelligence boom by checking out AI penny stocks.

- Spot hidden value opportunities others might overlook using our tool for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English