Aurora Innovation (AUR): Reassessing Valuation After Strategic Partnership With McLeod Software for Autonomous Truck Integration

If you are watching Aurora Innovation (AUR) lately, the news may have caught your attention: the company has just announced a strategic partnership with McLeod Software to create the transportation sector’s first autonomous truck-ready Transportation Management System. This is not just another software tweak; it is a move aimed at making self-driving trucks a seamless part of carriers’ daily operations. By integrating Aurora’s technology directly into the TMS used by over 1,200 McLeod clients, both companies are laying groundwork for wider and possibly more rapid industry adoption of autonomous freight.

For investors, this partnership comes on the back of a year marked by significant share price swings. Aurora’s stock has climbed an eye-catching 50% in the past twelve months, even though it dipped 6% this past month and is down a bit over 3% in the past quarter. Broader momentum is visible when you step back further, with the stock more than doubling over the past three years. Recent company events, including a high-profile industry conference appearance and a consistent push into technology integrations, have kept Aurora in the news and investors’ crosshairs.

So with this big step toward mainstream deployment, is Aurora actually undervalued at today’s price, or has the market already factored in the promise of self-driving trucks?

Price-to-Book of 5.3x: Is it justified?

Aurora Innovation trades at a price-to-book (PB) ratio of 5.3x, which is significantly higher than the 3.9x average for the US Software industry. This suggests the stock appears expensive relative to its sector peers on this common valuation benchmark.

The price-to-book ratio measures a company’s market value compared to its book value. It reflects how much investors are willing to pay for each dollar of net assets. For technology firms like Aurora, a higher PB ratio can sometimes be justified by rapid growth expectations or potential for future profitability.

However, Aurora remains unprofitable. Its premium PB ratio means the market is already pricing in substantial future growth and operational improvement. This raises the question of whether current expectations are too high given the company’s loss-making position and the long runway to achieve consistent profits.

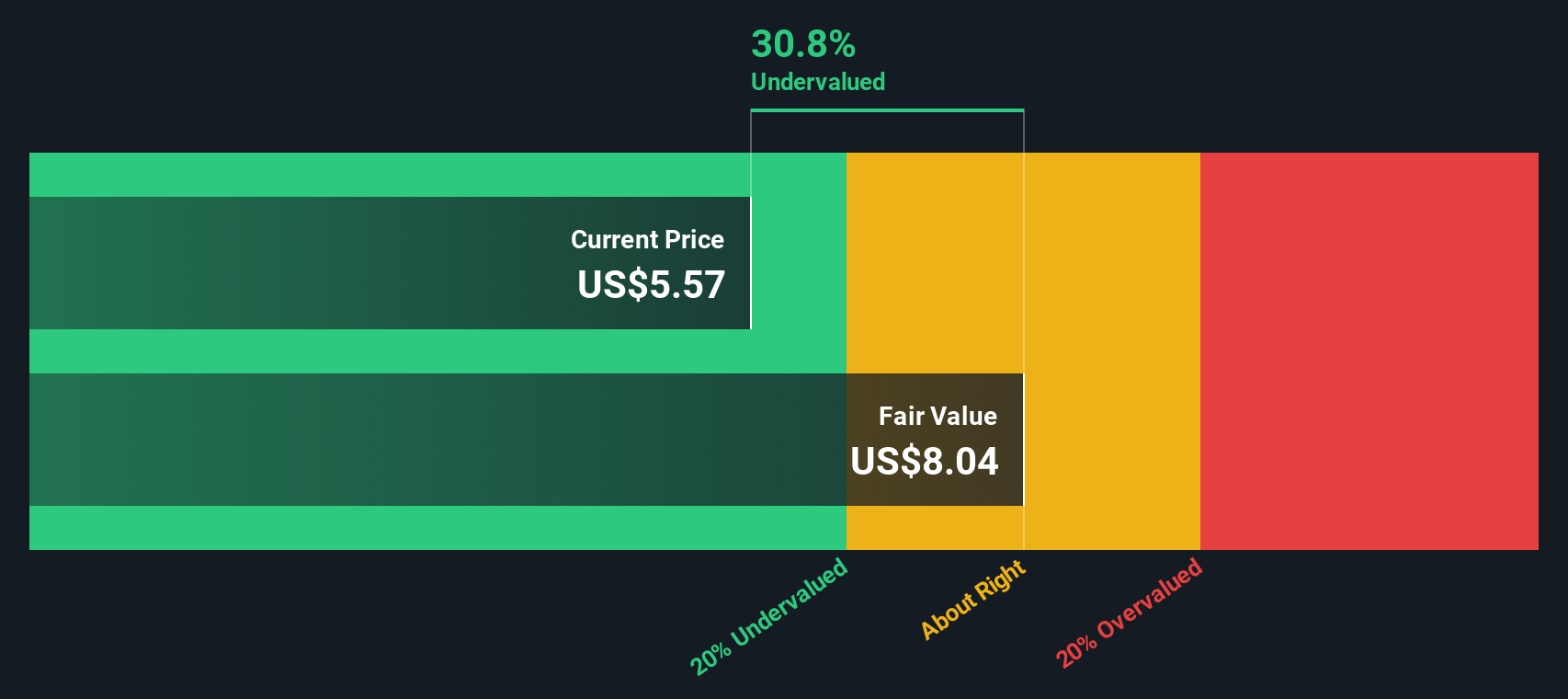

Result: Fair Value of $8.16 (UNDERVALUED)

See our latest analysis for Aurora Innovation.However, Aurora’s persistent unprofitability and the challenging path to widespread autonomous truck adoption could temper near-term optimism. This serves as a reminder to investors of potential setbacks ahead.

Find out about the key risks to this Aurora Innovation narrative.Another View: What Does the SWS DCF Model Say?

While comparing Aurora Innovation to its sector shows it looks expensive, our SWS DCF model tells a different story. This approach, instead, points to undervaluation. Could the fundamentals be stronger than they appear?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aurora Innovation Narrative

If you see things differently or would rather rely on your own analysis, the process of building your own perspective can be done in just a few minutes. Do it your way Do it your way.

A great starting point for your Aurora Innovation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let unique opportunities slip by. Put the Simply Wall Street Screener to work and uncover stocks that match your strategy before others spot them.

- Target reliable income streams when you browse companies boasting strong yields with dividend stocks with yields > 3% right now.

- Find tomorrow’s tech stars by searching for innovative leaders in artificial intelligence through AI penny stocks.

- Spot undervalued gems waiting to be recognized by the market using undervalued stocks based on cash flows and make smarter entry decisions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English