Will Strong Q2 Results and Innovation Efforts Shift Ecolab's (ECL) Long-Term Growth Narrative?

- Ecolab Inc. recently announced strong second-quarter 2025 results with better-than-expected revenues, driven by growth in Life Sciences, Pest Elimination, and technology innovation, alongside ongoing portfolio reshaping efforts.

- Despite these advancements, management drew attention to persistent macroeconomic headwinds, like tariffs and foreign exchange impacts, which tempered the otherwise positive performance across most segments.

- Next, we’ll examine how the mixed earnings and leadership focus on innovation could impact Ecolab’s broader growth narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Ecolab Investment Narrative Recap

Ecolab shareholders are generally buying into a business with leading positions in water, hygiene, and infection prevention solutions, backed by resilient growth engines like Life Sciences and digital innovation. Strong Q2 earnings and segment performance reinforce this long-term vision, but the biggest short-term risk, exposure to macroeconomic pressures such as tariffs and foreign exchange, remains little changed, as highlighted in management’s latest comments. The most important near-term catalyst, expansion of high-margin digital offerings, appears intact despite mixed results.

Among Ecolab’s recent announcements, the introduction of new digital technologies, such as the AI-powered 3D TRASAR Dishmachine Program, stands out for its direct contribution to segment growth and operating margin improvements. These ongoing innovations are central to the company’s push for productivity, recurring revenue, and competitive advantage, directly supporting both the catalysts and longer-term earnings potential cited in the latest quarterly update.

Yet, despite these positives, it’s important for investors to watch closely for further developments relating to...

Read the full narrative on Ecolab (it's free!)

Ecolab's outlook anticipates $18.4 billion in revenue and $2.8 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 5.5% and a $0.7 billion increase in earnings from the current $2.1 billion.

Uncover how Ecolab's forecasts yield a $285.95 fair value, a 4% upside to its current price.

Exploring Other Perspectives

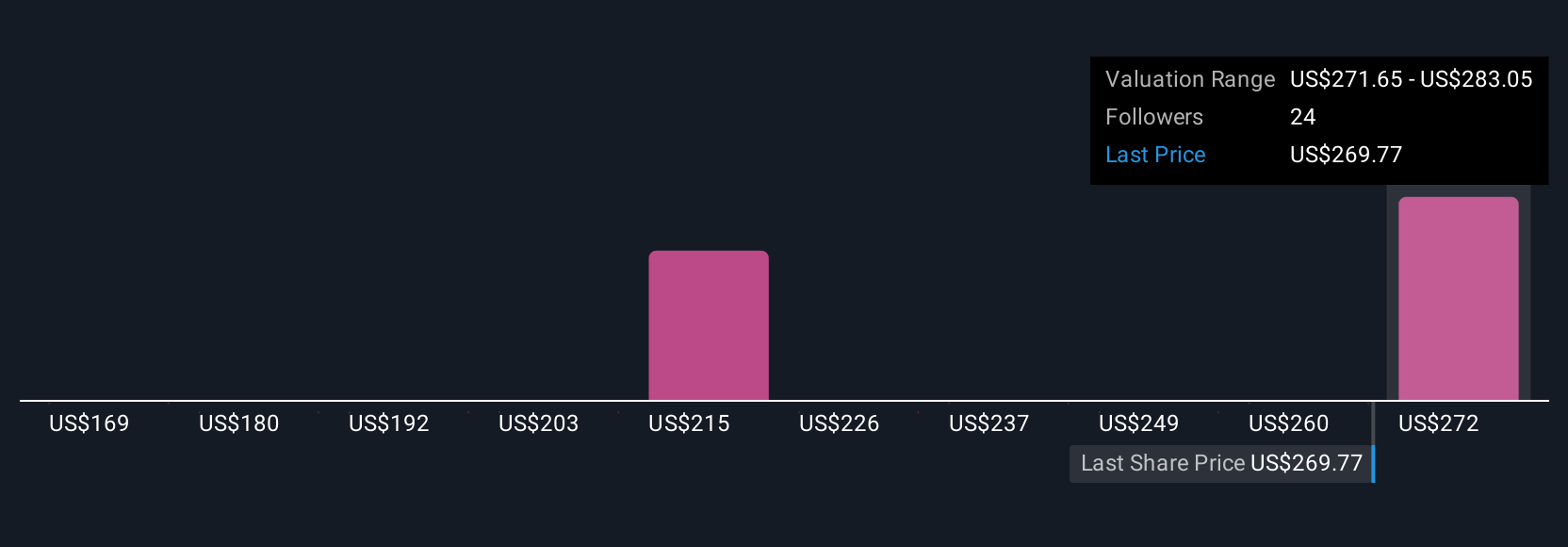

Six fair value estimates from the Simply Wall St Community range from US$169.01 to US$285.95, illustrating widely varied outlooks. With macroeconomic headwinds like tariffs weighing on near-term results, individual expectations for Ecolab’s performance can differ sharply so it’s worth considering several viewpoints.

Explore 6 other fair value estimates on Ecolab - why the stock might be worth 39% less than the current price!

Build Your Own Ecolab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ecolab research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ecolab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ecolab's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English