PetroChina (SEHK:857): Evaluating Valuation as Market Overlooks Fundamentals

PetroChina (SEHK:857) has been catching the eye of investors lately, making some wonder whether now is the time to reassess their position. Despite no major event making headlines, the stock’s recent moves have started to raise questions for anyone following the energy sector closely. Sometimes, as we know, those quieter stretches can offer their own signals and invite a closer look at whether the company’s fundamentals are being overlooked or fully appreciated by the market.

Over the past year, PetroChina’s share price has climbed by 39%, and its momentum since January has kept up with a 23% increase. Even as short-term price movement has cooled a bit recently, with a slight dip across the past month, the bigger picture shows steady long-term performance. This comes amid flat annual revenue and profit growth, as well as ongoing shifts in the global energy landscape that could shape future results.

So, is PetroChina trading at a discount that signals opportunity, or has the market already taken future growth into account?

Price-to-Earnings of 7.7x: Is it justified?

PetroChina is currently trading at a price-to-earnings (P/E) ratio of 7.7, which appears undervalued compared to both its industry peers and the broader market. This figure is below the Hong Kong Oil and Gas industry average P/E of 8.7 and also falls short of the peer group average P/E of 11.7.

The P/E ratio measures how much investors are willing to pay for each dollar of a company's earnings. In sectors with stable cash flows such as oil and gas, a lower P/E may suggest market skepticism about future growth, or it could signal an attractive value opportunity if fundamentals remain healthy.

For PetroChina, the discounted P/E could reflect investor caution about future earnings given forecasts of stagnant or declining growth in the coming years. However, with a strong long-term track record and current profitability, the stock may be underappreciated by the market at its current multiple.

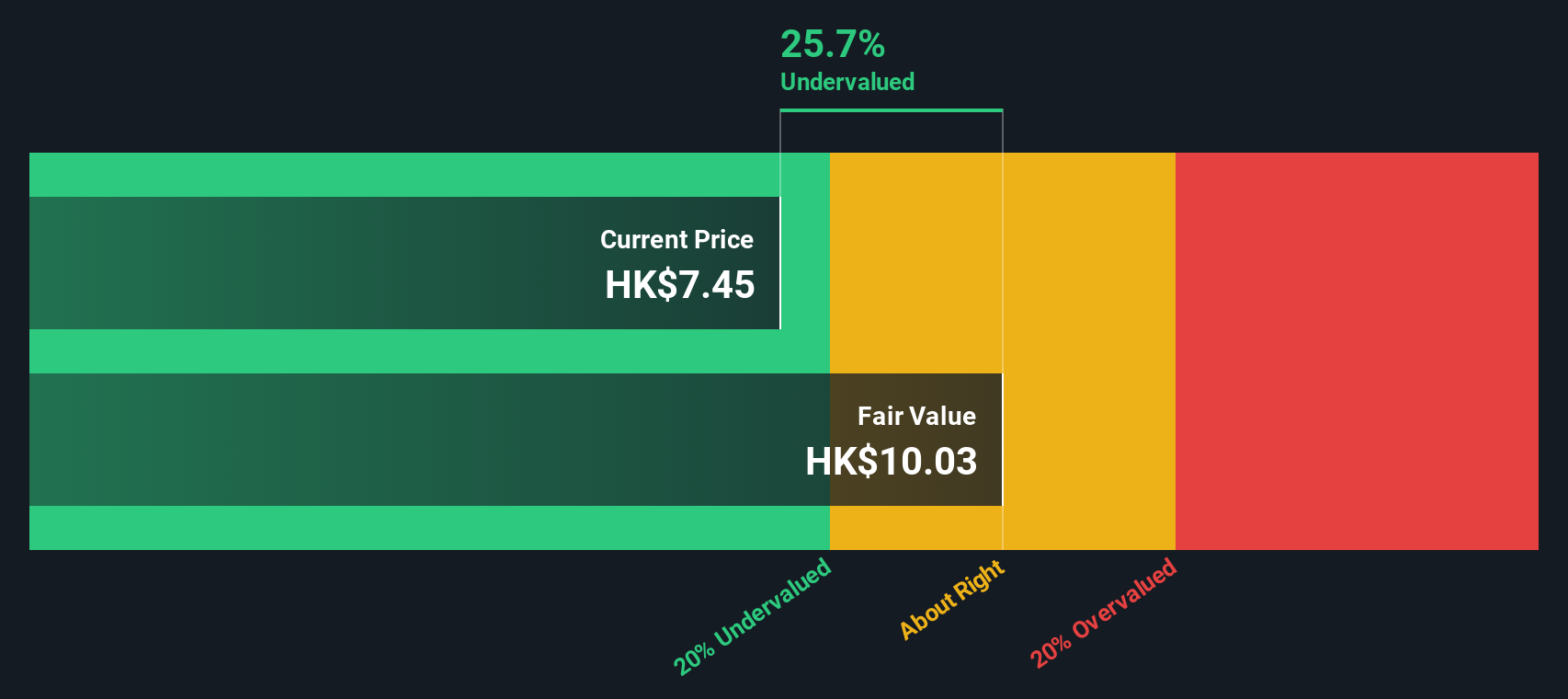

Result: Fair Value of HK$10.04 (UNDERVALUED)

See our latest analysis for PetroChina.However, stagnant revenue and profit growth, along with recent share price dips, could temper enthusiasm and challenge the case for PetroChina’s undervaluation.

Find out about the key risks to this PetroChina narrative.Another View: The SWS DCF Model Perspective

While the current valuation looks attractive based on the price-to-earnings approach, our DCF model also points to the stock being undervalued. However, the agreement between these methods could change if outlooks shift.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PetroChina Narrative

If you see the numbers differently or want to take a hands-on approach to your investment decisions, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your PetroChina research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let great opportunities pass you by. Supercharge your portfolio by checking out handpicked ideas, each designed to match your unique investment strategy and help you stay ahead of the market.

- Seize the chance for steady income by scanning the market for dividend stocks with yields > 3% with yields above 3%.

- Get ahead in the AI revolution by exploring a curated list of AI penny stocks that are powering tomorrow's breakthroughs.

- Challenge conventional wisdom and uncover potential gems trading below intrinsic value with our selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English