Is WNS (Holdings) (NYSE:WNS) Still Undervalued After Its Recent Quiet Rally? Taking a Fresh Look at Valuation

If you’ve been tracking WNS (Holdings) (NYSE:WNS), you might be wondering what’s behind the recent buzz. There hasn’t been a flashy headline or game-changing announcement this week, yet the stock has quietly continued to draw attention. Sometimes, a stock’s quiet moves speak louder than an obvious headline. A subtle uptrend, slight changes in sentiment, or a nudge in valuation can get investors asking if something is brewing beneath the surface.

Looking at WNS (Holdings) through a wider lens, the stock has seen a strong 35% rally over the past year and has picked up considerable momentum since the start of the year. While no single event has driven this climb, investors haven’t ignored WNS’s steady revenue growth and improving bottom line. The share price has bounced back after a challenging three-year stretch, suggesting the market’s attitude toward future growth has shifted in recent months.

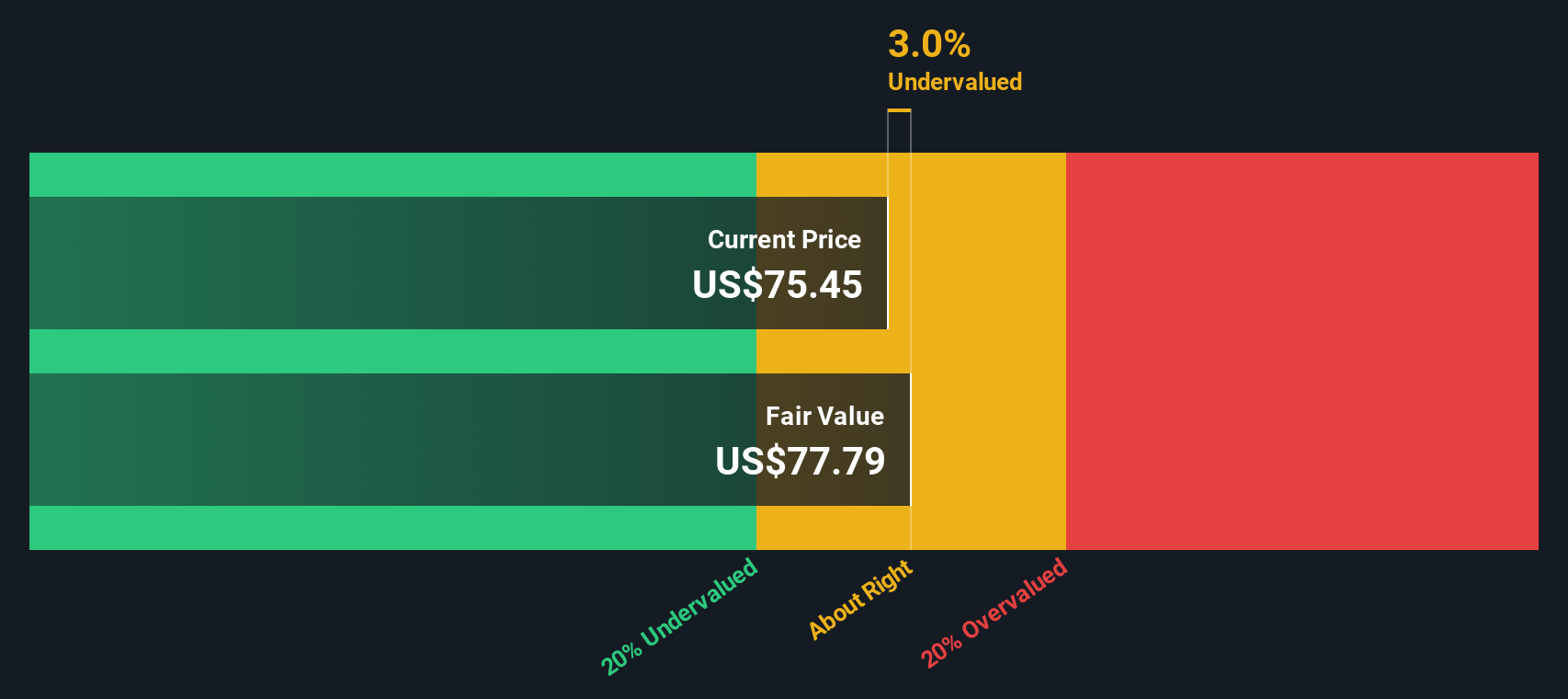

After this solid run, is WNS (Holdings) still undervalued or are investors already banking on future gains? Let’s dig into the numbers and see what the valuation is really telling us.

Most Popular Narrative: 14.7% Undervalued

The prevailing narrative suggests that WNS (Holdings) is trading significantly below its calculated fair value, potentially offering investors a meaningful discount if the narrative’s forecasts hold true.

Maintain gross and operating margins at or above 31% and 12% respectively over the next 2-3 years. Adjust for impairment write downs and do not worry about revenue growth.

Curious what is powering this undervalued call? The calculation leans heavily on robust margins and aggressive profit assumptions. The real surprise is the future profit multiple that underpins the valuation. Want to see exactly what makes this fair value stand out and which financial levers are driving the target? Keep reading to unpack the bold bets behind this narrative’s price estimate.

Result: Fair Value of $88.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, potential shifts in global outsourcing trends or rapid advances in automation could threaten the core assumptions behind the undervaluation narrative.

Find out about the key risks to this WNS (Holdings) narrative.Another View: SWS DCF Model Chimes In

Looking through the lens of our DCF model, WNS also appears undervalued. This method factors in future cash flows, which points in the same direction as the fair value argument. However, will reality match these forecasts, or is the market seeing something both models have missed?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own WNS (Holdings) Narrative

If you see things differently or want to dig into the numbers yourself, it’s easy to craft your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding WNS (Holdings).

Looking for more investment ideas?

Stay ahead of the market by targeting stocks that match your ambitions. Find the next opportunity before everyone else with these powerful strategies.

- Amplify your search for value by targeting companies currently undervalued stocks based on cash flows that are positioned for strong recovery potential.

- Accelerate your growth strategy with AI-driven innovators by checking out emerging leaders in AI penny stocks.

- Boost your passive income by zeroing in on shares offering attractive yields and consistent payouts through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English