These 2 Auto Stocks Are Beginning To Lose Strength: Momentum Score Drops

Two auto stocks are seeing their strength fade over the past week, with their Momentum scores in Benzinga’s Edge Stock Rankings witnessing steep declines.

2 Auto Stocks With A Dip In Momentum

In Benzinga’s Edge Rankings, the Momentum score is calculated based on the relative strength of a stock and is ranked as a percentile against all other stocks. It takes into account the price movements and volatility across multiple time frames before arriving at the relevant figure.

See Also: 3 Bloated Software Stocks Screaming ‘Short Me’ At Insane Valuations

Over the past week, these two auto stocks have witnessed a significant decline in their Momentum scores, so let’s see why.

1. Polestar Automotive

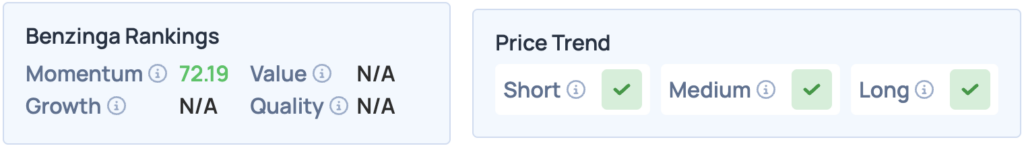

Swedish automaker, Polestar Automotive Holding (NASDAQ:PSNYW), saw its Momentum scores drop from 80.69 to 25.7 within the span of a week.

This can primarily be attributed to the company’s widening net loss of $1.19 billion in Q2, primarily due to a $739 million non-cash impairment charge during the quarter. Additionally, it issued a going concern warning, stating it may not be able to continue operations without restructuring or additional funding.

According to Benzinga’s Edge Stock Rankings, Polestar has a favorable price trend in the short, medium and long terms. Click here for deeper insights on the stock, and to see how it compares with other automotive giants and startups.

2. Stoneridge Inc.

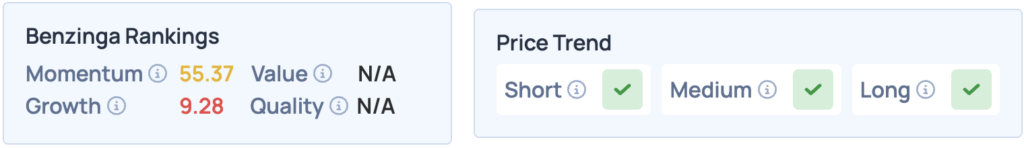

Auto components maker, Stoneridge Inc. (NYSE:SRI), is down 48.01 points in Momentum rankings, from 83.32 to 35.31, largely owing to its disappointing second-quarter performance, with the company missing consensus estimates by miles during the quarter.

In addition, Stoneridge faced substantial pressure from unfavorable currency movements, tariffs, and a costly product mix that weighed on the bottom line.

The stock stocks poorly on Momentum and Growth in Benzinga’s Edge Rankings, but has a favorable price trend in the short, medium and long-term. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English