How V.F’s (VFC) New US$1.5 Billion Credit Facility Could Shape Its Path Through Brand Challenges

- On August 26, 2025, V.F. Corporation and subsidiaries entered into a new five-year, US$1.50 billion senior secured revolving credit facility led by Wells Fargo, replacing its prior agreement and introducing borrowing capacity for Swiss and German entities, multicurrency options, and flexible expansion features.

- The new credit facility provides enhanced financial flexibility at a time when the company is managing brand underperformance and responding to ongoing legal scrutiny following missed quarterly expectations and a decline at Vans.

- We'll assess how V.F. Corporation's expanded credit facility shapes its investment outlook amid persistent challenges with its leading brand, Vans.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

V.F Investment Narrative Recap

To have conviction in VF Corporation as a shareholder, you would need to believe in the company’s ability to successfully turn around Vans and drive profitable growth across its brand portfolio, despite recent setbacks. The new US$1.50 billion credit facility expands VF’s borrowing capacity and flexibility, but does not materially lessen the most important short-term risk: persistent brand underperformance at Vans, particularly as revenue and earnings remain under pressure.

Of the recent announcements, the company’s guidance for a 2 to 4 percent year-over-year revenue decline for Q2 2026 stands out. This outlook reinforces that the effectiveness and timing of any turnaround, especially in core brands, remains the most meaningful catalyst for sentiment and performance in the near term.

However, investors should be aware that while the new credit agreement adds flexibility, it does not fully address the risk of ongoing...

Read the full narrative on V.F (it's free!)

V.F's narrative projects $10.3 billion in revenue and $571.3 million in earnings by 2028. This requires 2.6% yearly revenue growth and a $466.4 million earnings increase from the current earnings of $104.9 million.

Uncover how V.F's forecasts yield a $15.19 fair value, in line with its current price.

Exploring Other Perspectives

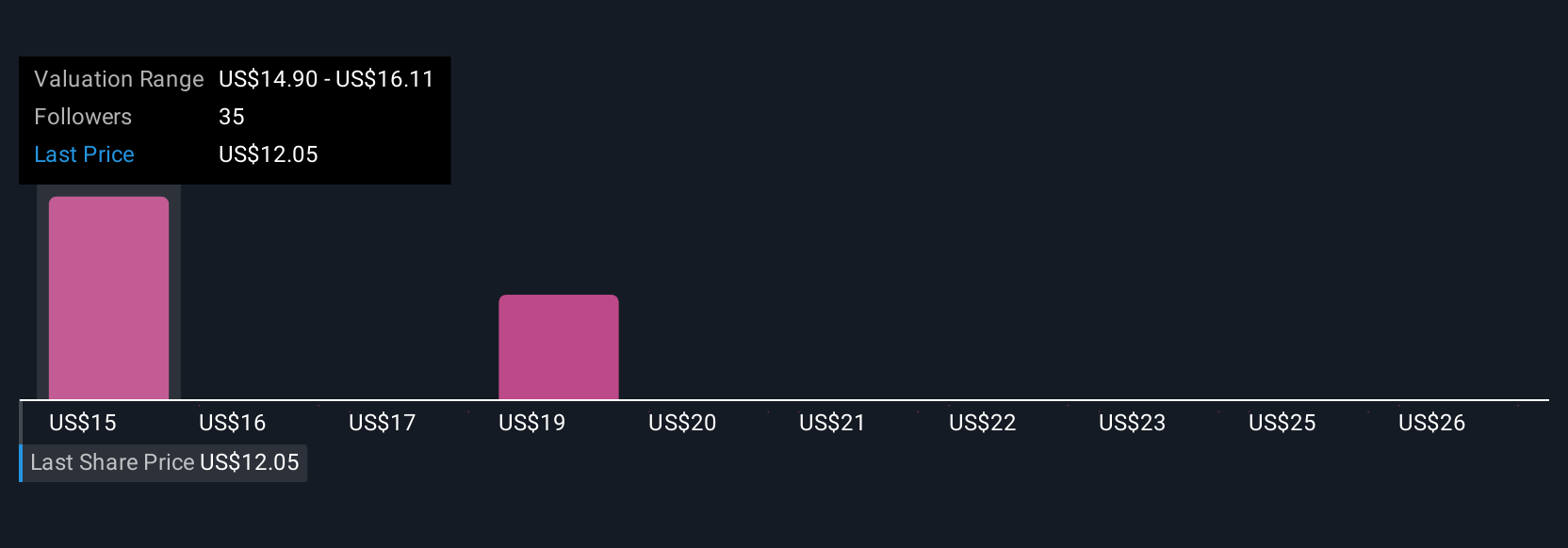

Eight members of the Simply Wall St Community estimate fair value for V.F. Corporation shares between US$10 and US$27.59. With persistent revenue declines at Vans still weighing heavily on expectations, consider how your view aligns or contrasts with these varied investor perspectives.

Explore 8 other fair value estimates on V.F - why the stock might be worth as much as 81% more than the current price!

Build Your Own V.F Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free V.F research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V.F's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English