Will Houlihan Lokey’s (HLI) DACH Expansion Redefine Its International Advisory Strategy?

- Earlier this month, Nano Dimension Ltd. announced that its Board of Directors has engaged Houlihan Lokey and Guggenheim Partners as exclusive financial advisors to explore strategic alternatives aimed at maximizing shareholder value.

- This move aligns with a period of significant growth for Houlihan Lokey, highlighted by recent senior hires expanding its Financial Sponsors Group’s presence across EMEA.

- We'll explore how Houlihan Lokey’s expanded DACH leadership signals deepening commitment to international advisory growth and long-term strategy.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Houlihan Lokey Investment Narrative Recap

Being a Houlihan Lokey shareholder means believing in the global demand for independent advisory expertise and the firm’s ability to deepen international client relationships. The recent engagement by Nano Dimension as an exclusive advisor may increase exposure to high-profile mandates, but it doesn’t alter the most immediate catalyst: accelerating EMEA deal growth, nor does it materially reduce the key risk of M&A volume dependence outside the US.

The appointment of Martin Rezaie to lead the DACH Financial Sponsors Group is particularly relevant in this context. His addition supports Houlihan Lokey’s push to capture more mid-cap advisory business in Europe, directly tied to ambitions for broader, more resilient non-US revenue streams amid fluctuating regional deal activity.

By contrast, investors should also be aware of the ongoing risk posed by cost containment and wage inflation if EMEA deal growth remains subdued...

Read the full narrative on Houlihan Lokey (it's free!)

Houlihan Lokey's outlook anticipates $3.5 billion in revenue and $654.6 million in earnings by 2028. This projection implies a 12.3% annual revenue growth rate and a $246.3 million earnings increase from the current earnings of $408.3 million.

Uncover how Houlihan Lokey's forecasts yield a $207.80 fair value, a 6% upside to its current price.

Exploring Other Perspectives

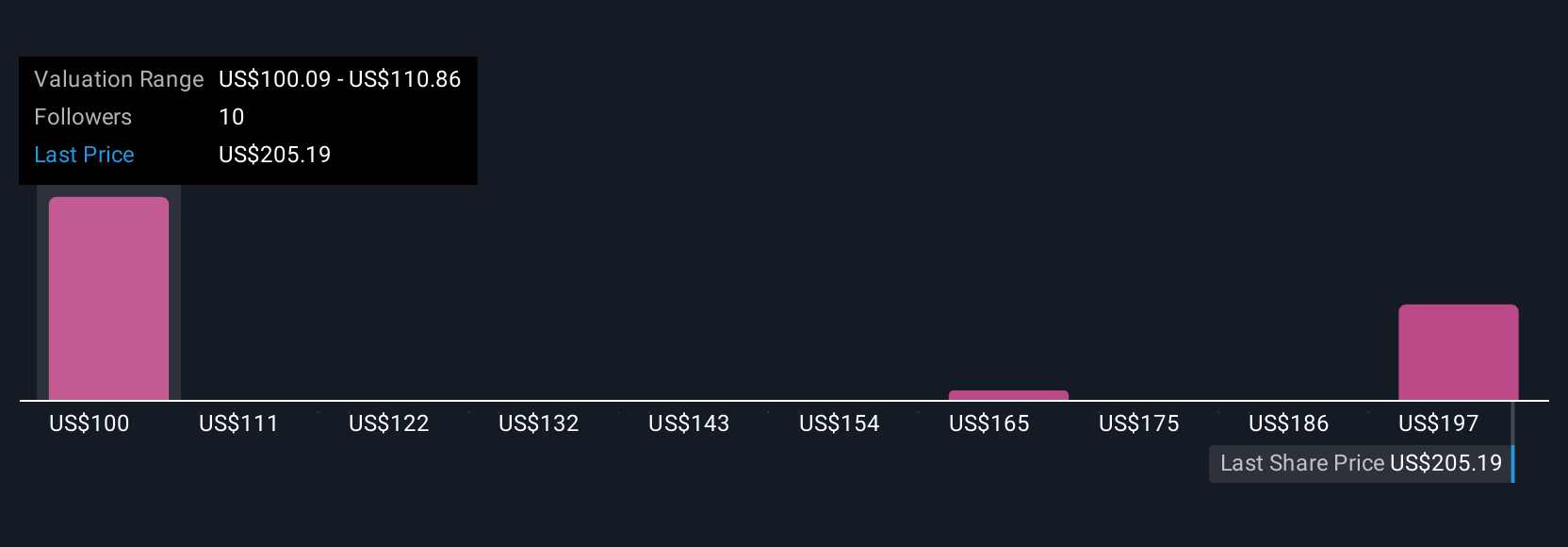

Three recent fair value estimates from the Simply Wall St Community span US$100 to US$208 per share. With EMEA deal growth as a primary catalyst, community opinions vary widely on Houlihan Lokey's future potential, explore several perspectives for a complete view.

Explore 3 other fair value estimates on Houlihan Lokey - why the stock might be worth 49% less than the current price!

Build Your Own Houlihan Lokey Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Houlihan Lokey research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Houlihan Lokey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Houlihan Lokey's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English