Is Fresh Leadership and New Strategy at Autohome (ATHM) Reshaping Its Investment Case?

- Autohome Inc. recently underwent significant leadership changes, with Mr. Chi Liu named Chief Executive Officer and Chairman, alongside multiple new board appointments and the formation of a Compliance Management Committee.

- This reshaping of Autohome’s executive team brings an influx of management talent from Haier Group, marking a shift in leadership expertise and potential company direction.

- We’ll explore how the appointment of a new CEO with a background in automotive innovation could influence Autohome’s investment narrative moving forward.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Autohome Investment Narrative Recap

To be a shareholder in Autohome right now, you’d need to believe that the recent leadership overhaul and infusion of experienced talent from Haier Group can address margin compression and unlock growth from new digital channels or partnerships. The CEO transition appears aligned with broader Haier integration but may not quickly resolve Autohome’s primary near-term catalyst, improving online engagement and ad revenue, or its most immediate risk: deepening competition and margin pressure in China’s auto sector.

One announcement that stands out in connection with these developments is Haier Group’s acquisition of a 43% controlling stake in Autohome on August 27, 2025. This move formalizes the operational and strategic alignment between the two companies and could reshape how Autohome captures digital innovation or platform partnerships, especially as both seek greater traction with AI-powered tools and O2O services.

By contrast, investors should be alert to the risk that growing direct-to-consumer digital channels...

Read the full narrative on Autohome (it's free!)

Autohome's outlook anticipates CN¥7.5 billion in revenue and CN¥1.8 billion in earnings by 2028. This scenario assumes a 3.7% annual revenue growth rate and an increase in earnings of about CN¥0.3 billion from the current CN¥1.5 billion.

Uncover how Autohome's forecasts yield a $28.87 fair value, in line with its current price.

Exploring Other Perspectives

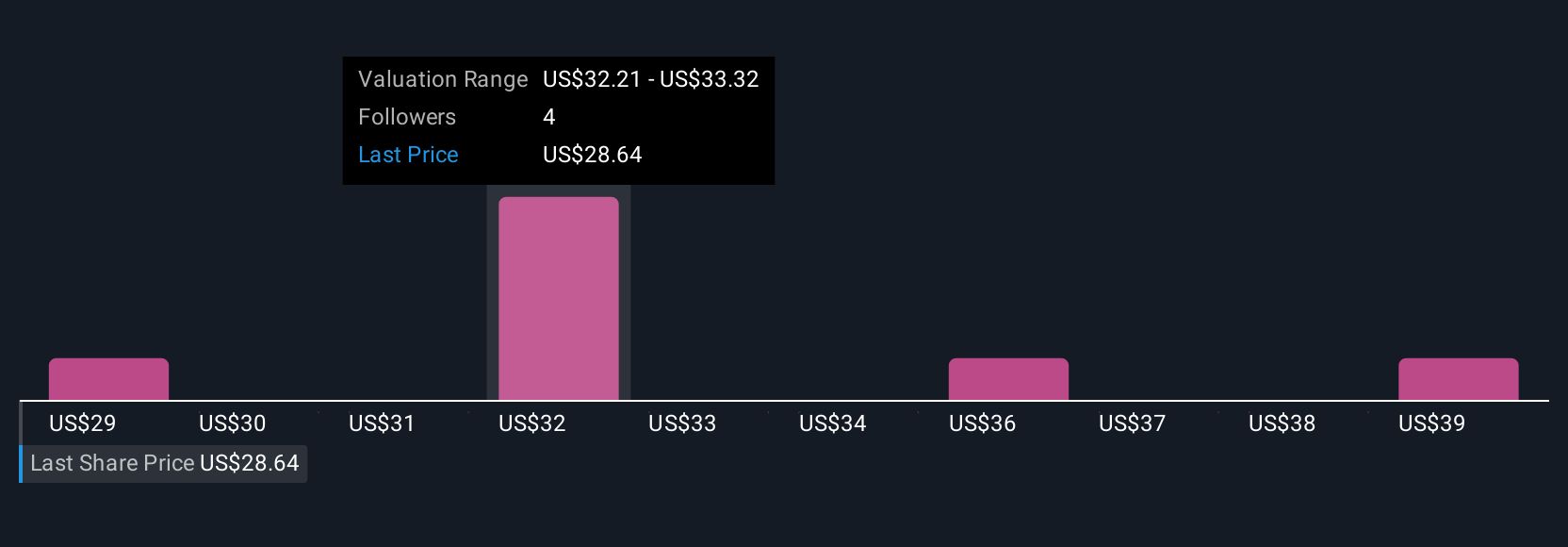

Four members of the Simply Wall St Community have estimated Autohome’s fair value between CN¥28.87 and CN¥40 per share. While these differing views help illuminate possible opportunities, heightened competition across auto platforms could quickly affect growth and earnings, so it is worth comparing several viewpoints before making your own call.

Explore 4 other fair value estimates on Autohome - why the stock might be worth as much as 36% more than the current price!

Build Your Own Autohome Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autohome research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autohome research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autohome's overall financial health at a glance.

No Opportunity In Autohome?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English