Hecla Mining (HL) Declares Modest Cash Dividend With Q2 2025 Earnings

Hecla Mining (HL) declared a modest cash dividend and delivered strong earnings in Q2 2025, with sales increasing to $304 million and net income reaching approximately $58 million. The operational success was further highlighted by a production increase in both gold and silver, as well as revised production guidance. These developments occurred as the broader market hit record highs, with the S&P 500 and Nasdaq responding favorably to lower inflation data and potential rate cuts. This robust market environment was generally supportive of Hecla's notable 68% price jump last quarter, reflecting both company-specific gains and broader market trends.

Buy, Hold or Sell Hecla Mining? View our complete analysis and fair value estimate and you decide.

The announcement of Hecla Mining's Q2 earnings growth and increased production heralds a promising period for the company, potentially bolstering its revenue growth and reinforcing its appeal amidst growing silver demand driven by electrification and safe-haven investment trends. However, while the robust quarter contributed to a recent 68% surge in Hecla’s share price, the company's current share price of $10.18 still finds it trading above some analyst expectations, with a consensus price target set at $8.36. This suggests that the market may currently price Hecla with optimism towards its strategic initiatives and silver market positioning.

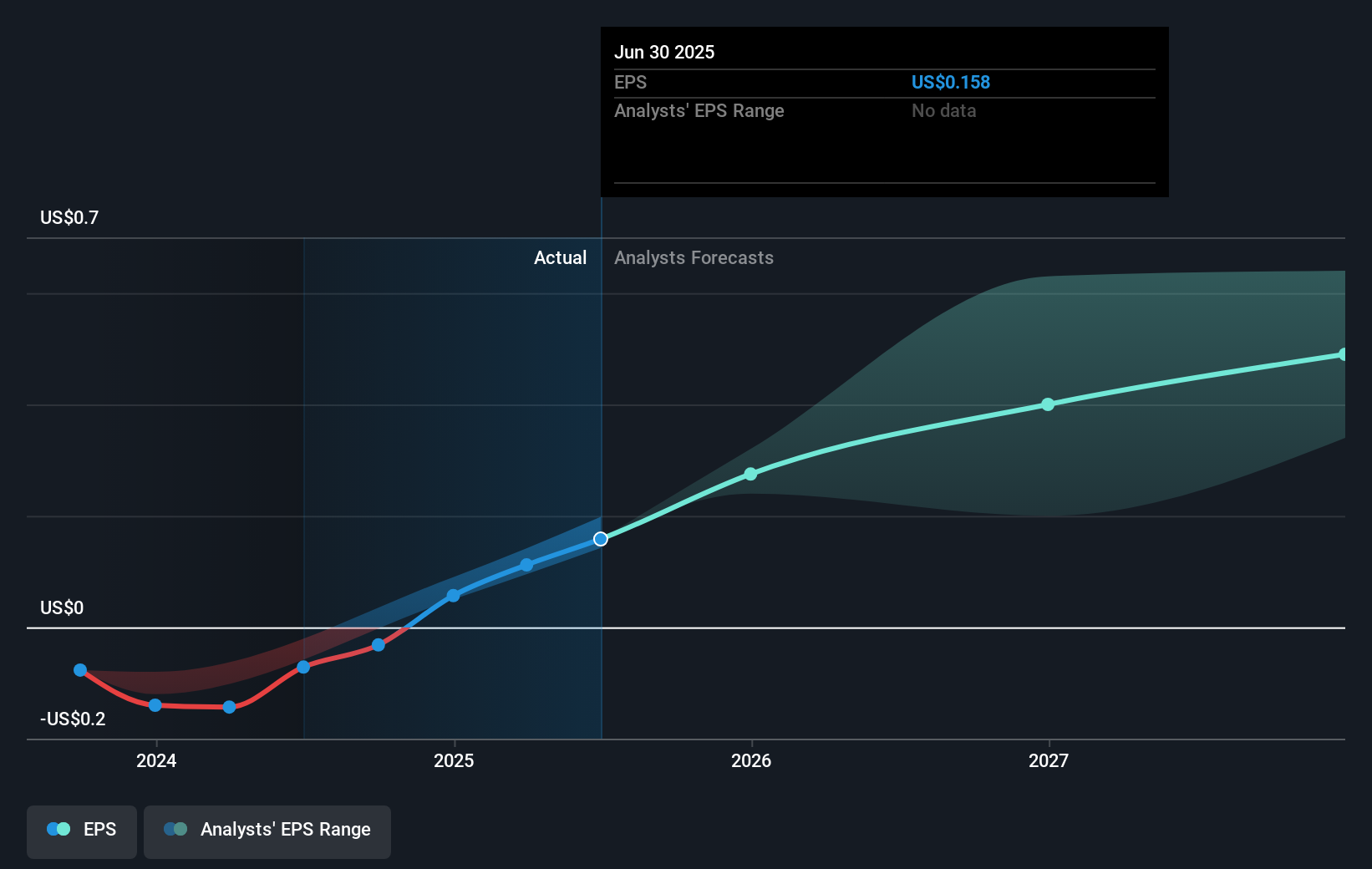

Over the longer three-year period, Hecla showcased a total shareholder return of 159.69%, underscoring sustained growth momentum compared to its peers. Notably, within the past year, Hecla also surpassed the broader US Metals and Mining industry, which returned 34.6%, highlighting a robust outperformance. Such important milestones could enhance Hecla's prospect for achieving ambitious forecasts, including expected earnings growth of 17.3% annually despite anticipated revenue contraction of 3% per year. Nonetheless, macroeconomic factors, alongside internal challenges such as potential regulatory pressures and cost escalation, may influence future performance.

Examine Hecla Mining's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English