Civitas Resources (CIVI) Up 7% Over Last Month As Nasdaq Hits New Highs

Civitas Resources (CIVI) experienced a 7% price increase over the past month, influenced by recent market dynamics. While no specific company news directly impacted Civitas's share performance, the stock's movement aligned with broader market trends, including the S&P 500 and Nasdaq reaching new highs. The decline in the Producer Price Index (PPI) suggested easing inflation pressure, adding to market optimism. Meanwhile, the buzz surrounding AI demand and the surge in Oracle’s stock captured investor attention. These developments collectively provided a positive backdrop for Civitas, which mirrored the market's buoyant sentiment over the period.

Be aware that Civitas Resources is showing 2 risks in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent uptick in Civitas Resources's share price aligns well with broader market trends, potentially amplifying optimism about its operational efficiency and capital returns. Over the past five years, the company delivered a total shareholder return of 138.17%, showcasing strong long-term performance. However, in the past year, Civitas underperformed the US Oil and Gas industry, which saw a 4.5% return, indicating some challenges in maintaining pace with its peers.

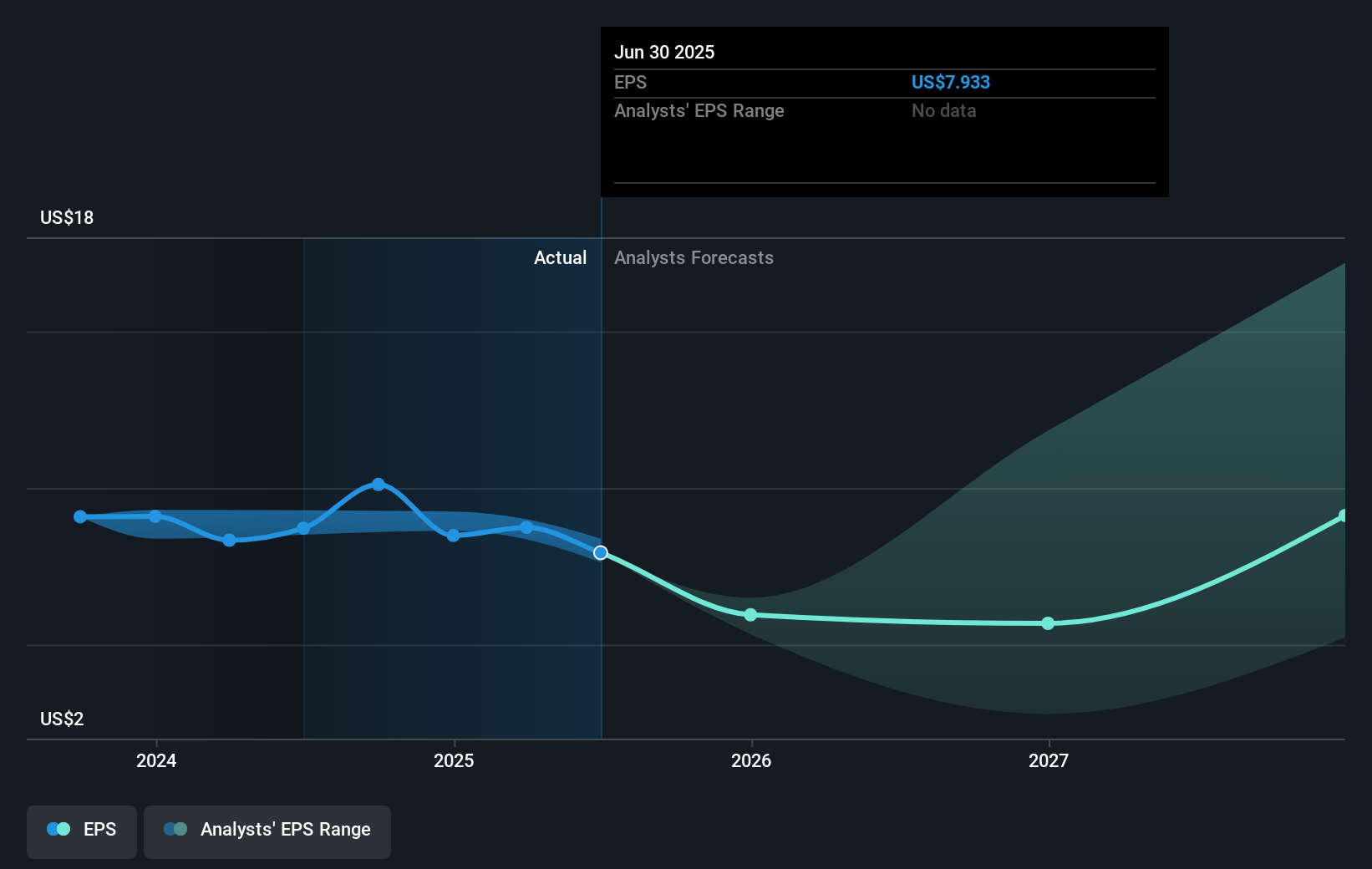

With share prices currently at $32.52, displays breadth in its price dynamics considering the analyst consensus price target of $42.13. The market's current optimism, driven by easing inflation and excitement around AI and tech stocks, could impact Civitas's revenue and earnings forecasts. Improved operational efficiency and anticipated production increases in key oil basins might support revenue stability. However, analysts forecast a slight annual revenue decline of 0.6%, with earnings expected to rise modestly over the next few years. This backdrop can influence market perception of Civitas's valuation. As of today, the share price reflects a substantial discount to the estimated fair value, underscoring the market's cautious approach in pricing future profitability and margin improvements.

Our valuation report unveils the possibility Civitas Resources' shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English