XtalPi Holdings (SEHK:2228) Advances AI-Driven Cancer Therapy With Regulatory Clearance

XtalPi Holdings (SEHK:2228) recently announced a significant milestone as its next-generation PRMT5 inhibitor, PEP08, received regulatory approvals to begin Phase 1 clinical trials for solid tumors. This development underscores the company's advanced capabilities in drug discovery, likely contributing to the impressive 65% rise in its stock price over the last quarter. Alongside broader tech market gains, highlighted by the S&P 500 and Nasdaq reaching new highs, XtalPi's earnings reports showing substantial revenue growth, coupled with strategic partnerships, likely bolstered investor confidence, reinforcing the positive price movement.

Be aware that XtalPi Holdings is showing 2 risks in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past year, XtalPi Holdings' shares experienced a total return of 28.15% decline. This longer-term performance contrasts significantly with the company's impressive quarterly stock price growth of 65%, suggesting some volatility and fluctuations in investor sentiment. Despite these higher short-term gains, the company has underperformed the broader Hong Kong market, which returned 50.8%, and its own industry, the Life Sciences sector, which saw a 101.2% increase over the same period.

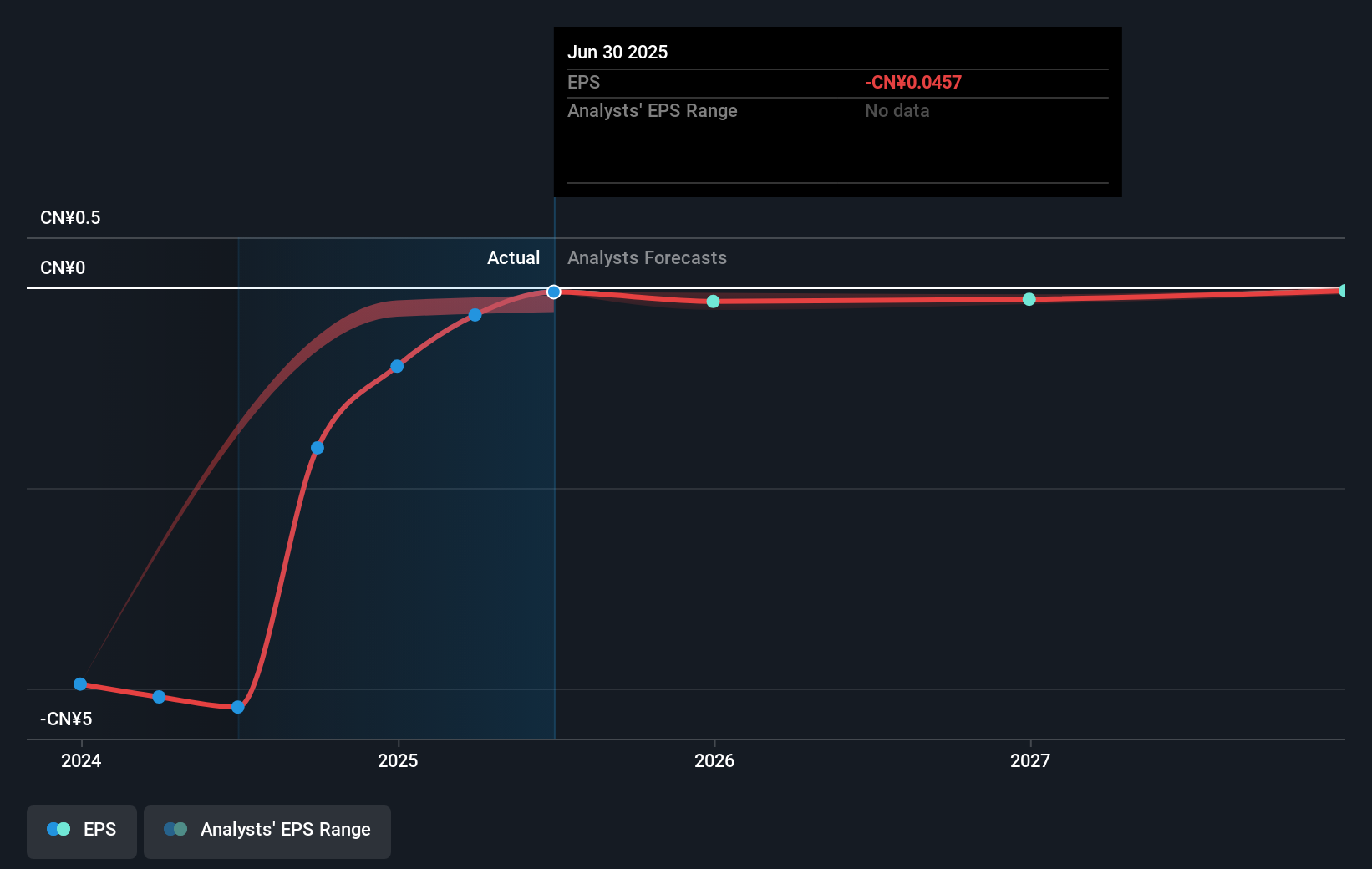

The developments outlined in the introduction, such as regulatory approvals for PEP08 and strategic partnerships, may influence future revenue and earnings. XtalPi's revenue is forecasted to grow at a rate of 27.5% per year, indicating potential positive impacts from ongoing collaborations and technological innovations. However, with current unprofitability and a CEO compensation above market averages, some uncertainties remain. Furthermore, the stock trades at HK$10.03, closely aligning with the analyst consensus price target of HK$10.12, suggesting market expectations are already reflective of the company's future growth prospects, assuming no significant market disruptions or unforeseen challenges.

Review our growth performance report to gain insights into XtalPi Holdings' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English