2 Boatmaker Stocks That Are Set For A Lift-Off: Big Surge In Growth Metrics

Two boat designers and manufacturers are turning heads in Benzinga’s Edge Stock Rankings, with big spikes in their Growth scores.

Two Boatmakers That Are Now ‘Growth’ Stocks

In Benzinga’s Edge rankings, scores are assigned to stocks based on Value, Momentum, Growth and Quality. The Growth metric is calculated primarily using the pace at which revenue and earnings have grown, with equal importance given to both long-term trends as well as the immediate performance.

See Also: 3 Real Estate Stocks Flash Strong Momentum Signals As Fed Is Expected To Cut Rates

The sector is largely immune to the tariffs, rising interest rates and cost pressures resulting from the same, given the demand inelasticity of its primary clientele.

1. MasterCraft Boat Holdings

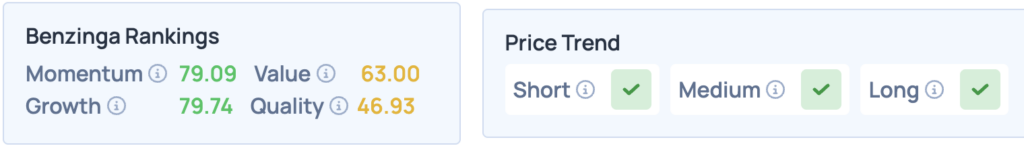

The Tennessee-headquartered designer, manufacturer and marketer of recreational powerboats, Mastercraft Holdings Inc. (NASDAQ:MCFT), is seeing a sharp spike in its Growth metrics in Benzinga’s Edge Rankings, rising from 14.06 to 79.7 within just a week.

This can primarily be attributed to its recent fourth-quarter results, with net sales up 46% year-over-year, alongside no debt and a robust balance sheet.

According to Benzinga’s Edge Stock Rankings, the stock scores high on Momentum and Growth, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

2. Malibu Boats Inc.

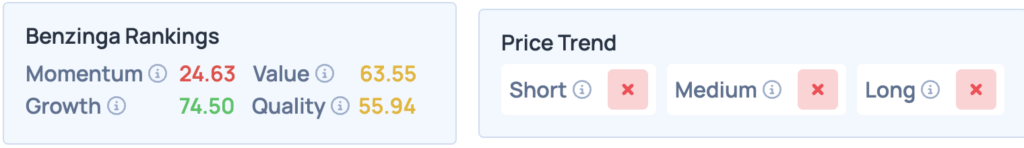

Malibu Boats Inc. (NASDAQ:MBUU) makes recreational boats based in Loudon, Tennessee, and the stock witnessed a sharp increase in its Growth metrics over the past week, rising 47.96 points from 26.49 to 74.45.

Here again, the primary driving factor is the company’s robust fourth quarter performance, with sales up 30.4% year-over-year. The company swung from a net loss of $19.6 million last year to a profit of $4.8 million this quarter, leading to increased optimism in the markets.

The stock scores high on Growth in Edge Rankings, but does poorly elsewhere, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English