How Class Action Lawsuits Over IPO Disclosures Will Impact Lineage (LINE) Investors

- In the past week, several law firms have initiated class action lawsuits against Lineage, Inc., alleging the company made false or misleading statements in its IPO registration materials about customer demand, pricing practices, and business outlook.

- The lawsuits come after disclosures of disappointing financial results and operational challenges, bringing added scrutiny to Lineage’s disclosures surrounding its 2024 IPO.

- We’ll examine how these legal challenges over alleged IPO misrepresentations may reshape Lineage’s investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Lineage's Investment Narrative?

To be a shareholder in Lineage, Inc. right now, it's essential to believe in the company's capacity to recover from recent setbacks and capitalize on its scale and market footprint in temperature-controlled logistics. The big picture has traditionally looked forward to gradual improvements in profitability, stronger dividend stability, and commercial expansion like the certified bonded warehouse partnership. But the wave of class action lawsuits alleging serious IPO misrepresentations, including on customer demand and pricing, shifts the narrative. This legal cloud now stands alongside other established risks, such as Lineage’s ongoing losses, new board turnover, and a dividend not fully covered by earnings. For the short term, market focus may pivot away from operational progress or value metrics and toward the outcomes of these legal disclosures. Recent price declines point to the materiality of the risk, with catalysts such as leadership changes or facility expansions now overshadowed by uncertainty around litigation and governance. On the flip side, the risk of further legal and reputational setbacks is tough to ignore right now.

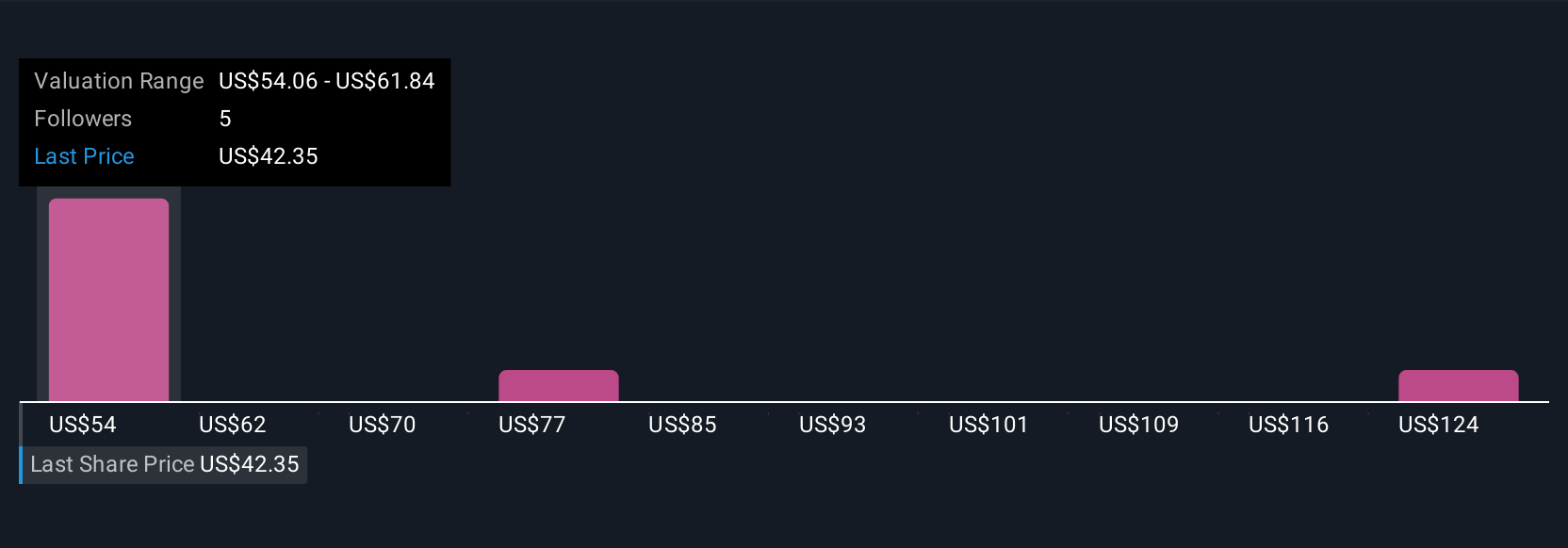

Lineage's shares have been on the rise but are still potentially undervalued by 41%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Lineage - why the stock might be worth just $49.00!

Build Your Own Lineage Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lineage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lineage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lineage's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English