Crescent Energy (CRGY) Is Down 7.7% After Sharp Drop in Earnings Estimates - Has The Bull Case Changed?

- Recently, Crescent Energy faced projections of a 23.08% year-over-year decline in earnings per share for its upcoming quarterly report, even as revenue is expected to rise.

- An unusually sharp 19.36% drop in consensus earnings estimates over the past month suggests mounting analyst caution ahead of the company's earnings release.

- Next, we'll examine how declining earnings expectations might reshape Crescent Energy's investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Crescent Energy Investment Narrative Recap

Staying invested in Crescent Energy often means believing in the company's ability to grow through acquisitions in established U.S. oil and gas basins while maintaining operational efficiency and capital discipline. The forecasted 23.08% decline in earnings per share, alongside falling consensus estimates, may cast a short-term shadow but is unlikely to materially affect the company’s most immediate catalyst of operational improvements. The main risk heightened by this news is whether Crescent can convert higher revenue into bottom-line growth as capital costs and integration challenges persist.

Among recent company announcements, Crescent's $500 million note tender and concurrent debt reduction stand out as most relevant. This effort to lower interest expenses could help support margins at a time when earnings outlooks are under pressure, tying directly into Crescent’s need to improve financial flexibility so it can withstand commodity and acquisition-related volatility. Yet, despite debt management, investors should still weigh what happens if...

Read the full narrative on Crescent Energy (it's free!)

Crescent Energy's narrative projects $5.2 billion in revenue and $672.6 million in earnings by 2028. This requires 14.8% yearly revenue growth and a $649.5 million earnings increase from $23.1 million today.

Uncover how Crescent Energy's forecasts yield a $14.78 fair value, a 70% upside to its current price.

Exploring Other Perspectives

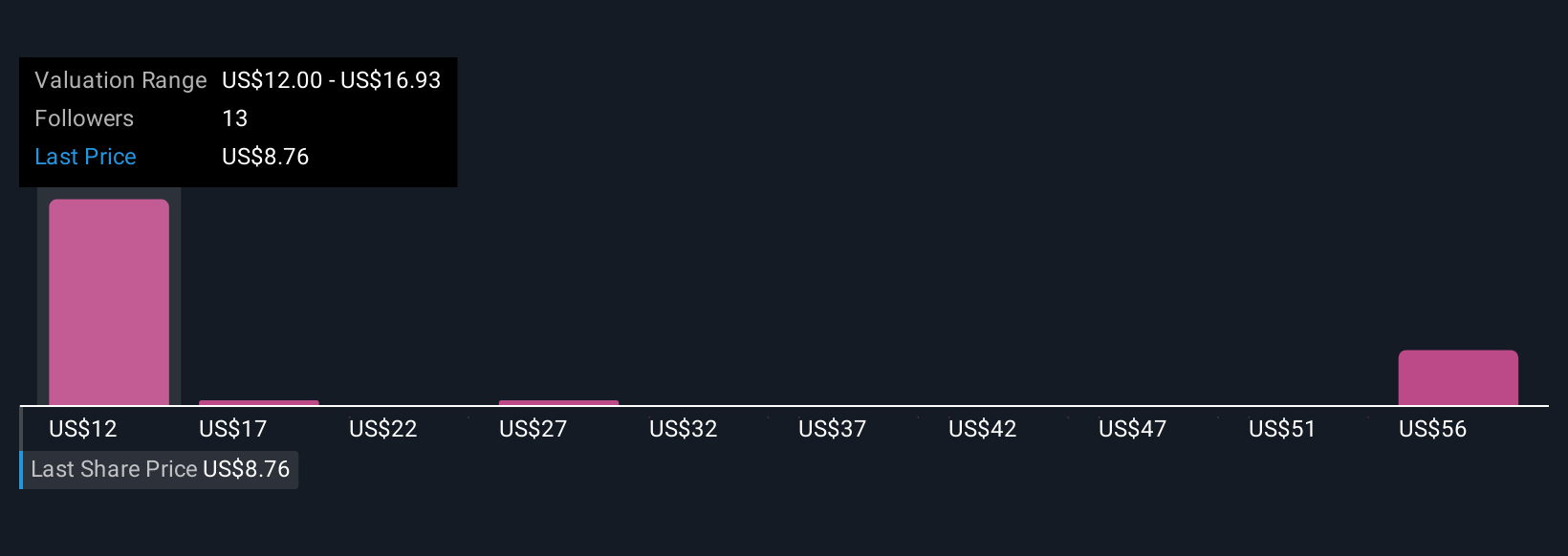

Five Simply Wall St Community members estimate Crescent’s fair value from US$12 up to US$53.62 per share. This wide spectrum of views underscores how concerns about rising integration and debt costs can shape widely varying expectations for future returns.

Explore 5 other fair value estimates on Crescent Energy - why the stock might be worth over 6x more than the current price!

Build Your Own Crescent Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crescent Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crescent Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crescent Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English