The Bull Case For TJX Companies (TJX) Could Change Following Upbeat Guidance and $1B Shareholder Return

- TJX Companies reported its second-quarter earnings in August, highlighted by raised full-year guidance and a US$1 billion return to shareholders through dividends and buybacks.

- The updated outlook and continued shareholder returns reflect management’s confidence in consumer demand and TJX’s ability to capitalize on favorable inventory trends.

- We’ll explore how TJX’s guidance boost and shareholder returns might impact its outlook for continued growth and market share gains.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

TJX Companies Investment Narrative Recap

To own TJX Companies stock, you need to believe its off-price retail model can consistently drive traffic and sales through economic cycles, even as shopping trends shift. The recent guidance boost and US$1 billion shareholder return are welcomed short-term positives that back up this confidence, but these moves do not meaningfully address the ongoing risk that rising digital competition could slowly erode physical store traffic and revenue growth potential.

Among TJX’s latest announcements, its new full-year guidance forecasting around 3% comparable sales growth and higher EPS stands out. This ties directly to a key catalyst: stronger-than-expected customer transaction growth across divisions, suggesting shoppers remain drawn to value-focused retail, the lifeblood of TJX’s comp sales momentum and market share performance.

By contrast, investors should not overlook...

Read the full narrative on TJX Companies (it's free!)

TJX Companies' outlook anticipates $68.6 billion in revenue and $6.3 billion in earnings by 2028. This scenario is based on a projected 5.8% annual revenue growth and a $1.3 billion earnings increase from current earnings of $5.0 billion.

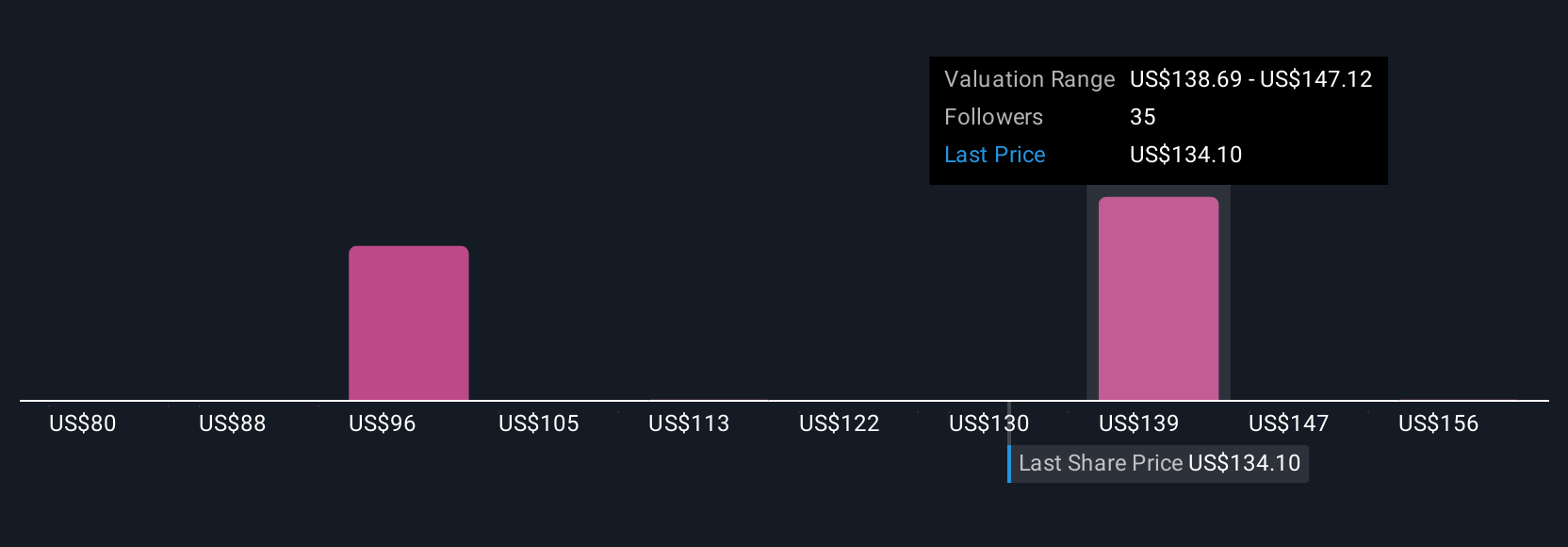

Uncover how TJX Companies' forecasts yield a $149.44 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Some analysts take a notably more optimistic view, projecting TJX’s revenue to climb toward US$71 billion and earnings reaching US$6.6 billion by 2028. If you’re weighing these bullish forecasts, consider that risk views and growth expectations vary widely, and fresh company developments like this quarter’s results could shift those assumptions in important ways.

Explore 7 other fair value estimates on TJX Companies - why the stock might be worth as much as 17% more than the current price!

Build Your Own TJX Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TJX Companies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free TJX Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TJX Companies' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English