Will Harley-Davidson’s New CEO’s Brand Loyalty Shape Management Credibility for HOG Investors?

- Harley-Davidson recently announced the appointment of Artie Starrs as its new CEO, with Starrs having purchased a 2025 Heritage Classic motorcycle shortly before the news was made public.

- This personal investment in the brand by the incoming CEO highlights a strong alignment with Harley-Davidson's culture and values, potentially boosting stakeholder confidence.

- We'll look at how Artie Starrs' visible commitment to the brand may influence Harley-Davidson's investment narrative and strategic direction.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Harley-Davidson Investment Narrative Recap

To be a Harley-Davidson shareholder today, you need to believe in the company’s ability to reignite growth despite weak global motorcycle sales and ongoing macroeconomic headwinds. The appointment of Artie Starrs as CEO, highlighted by his purchase of a new motorcycle, is unlikely to materially shift the immediate catalyst, accelerating growth in new markets, or the biggest risk of falling core demand and negative sales trends.

Among recent announcements, the approved Q3 2025 cash dividend of US$0.18 per share stands out. While this signals ongoing shareholder returns, it is especially relevant as investors consider management’s ability to sustain payouts in the face of earning pressures and industry challenges.

However, despite Artie Starrs’ personal commitment, investors should be aware that weakening North American and Asia-Pacific retail sales could weigh on results in coming quarters as...

Read the full narrative on Harley-Davidson (it's free!)

Harley-Davidson's outlook foresees revenue of $3.9 billion and earnings of $390.5 million by 2028. This assumes a 4.4% annual revenue decline and an earnings increase of $147.7 million from current earnings of $242.8 million.

Uncover how Harley-Davidson's forecasts yield a $29.33 fair value, in line with its current price.

Exploring Other Perspectives

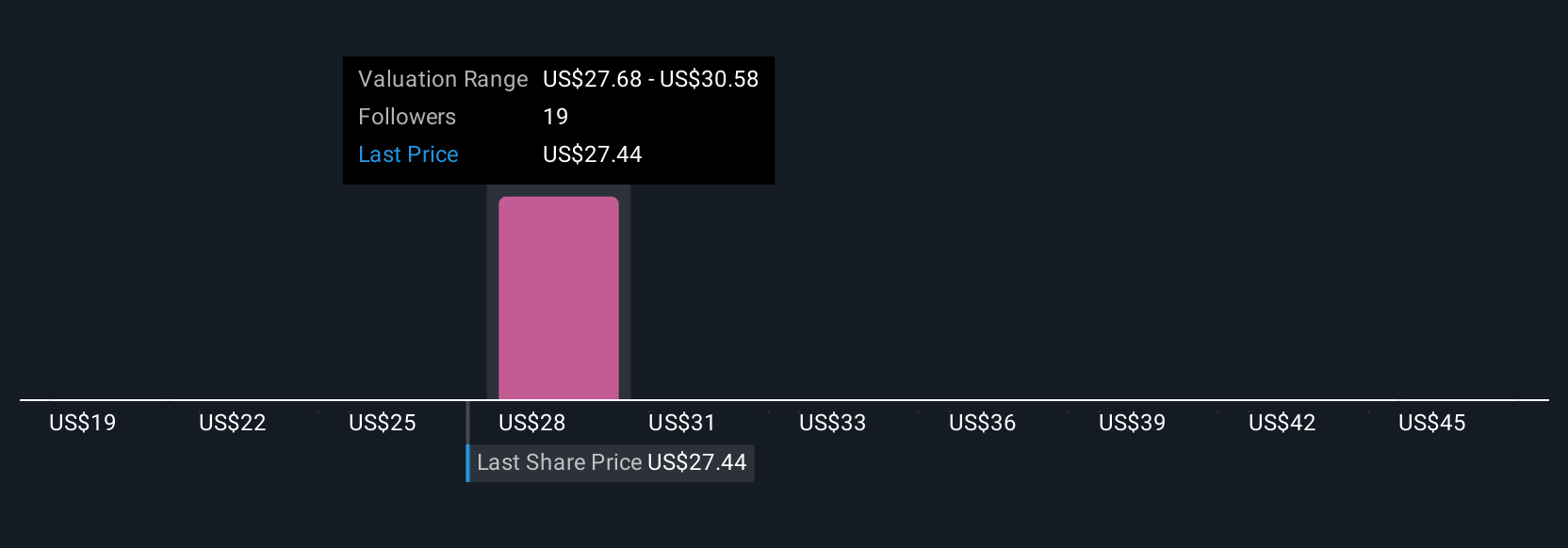

Four community members estimate Harley-Davidson’s fair value between US$19 and US$47.94 per share, reflecting contrasting views on its prospects. Weakening retail sales trends remain a key concern for the company’s performance, so consider a range of perspectives before deciding your next move.

Explore 4 other fair value estimates on Harley-Davidson - why the stock might be worth 37% less than the current price!

Build Your Own Harley-Davidson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harley-Davidson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Harley-Davidson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harley-Davidson's overall financial health at a glance.

No Opportunity In Harley-Davidson?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English