Will Analyst Optimism on SITE Signal a Turning Point for Its Long-Term Earnings Narrative?

- In recent months, SiteOne Landscape Supply experienced a shift in analyst sentiment, with expectations for improved earnings growth rates despite ongoing operational challenges and below-industry financial metrics.

- This optimism among analysts has emerged even as SiteOne continues to report a lower return on equity and declining earnings compared to broader industry trends.

- We'll examine how renewed confidence in SiteOne's earnings outlook may influence its broader investment narrative and near-term opportunities.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SiteOne Landscape Supply Investment Narrative Recap

To own shares of SiteOne Landscape Supply today, you need to have conviction in its ability to turn around earnings growth despite a history of declining profits, below-average return on equity, and significant price appreciation in the face of inconsistent financial results. The recent news of a planned CFO succession, executed via internal promotion and a thoughtful transition period, does not materially affect the most important short-term catalyst for the stock, which remains any tangible improvement in profitability and organic growth. Among the recent developments, the company's full-year guidance for low single-digit organic daily sales growth stands out as most relevant. This outlook highlights management’s measured approach in a market awaiting stronger signs of demand improvement and margin recovery, which is critical for reinforcing renewed analyst optimism and supporting current share price levels. In contrast, investors should be aware of how input cost volatility and limited pricing power could still present meaningful headwinds if...

Read the full narrative on SiteOne Landscape Supply (it's free!)

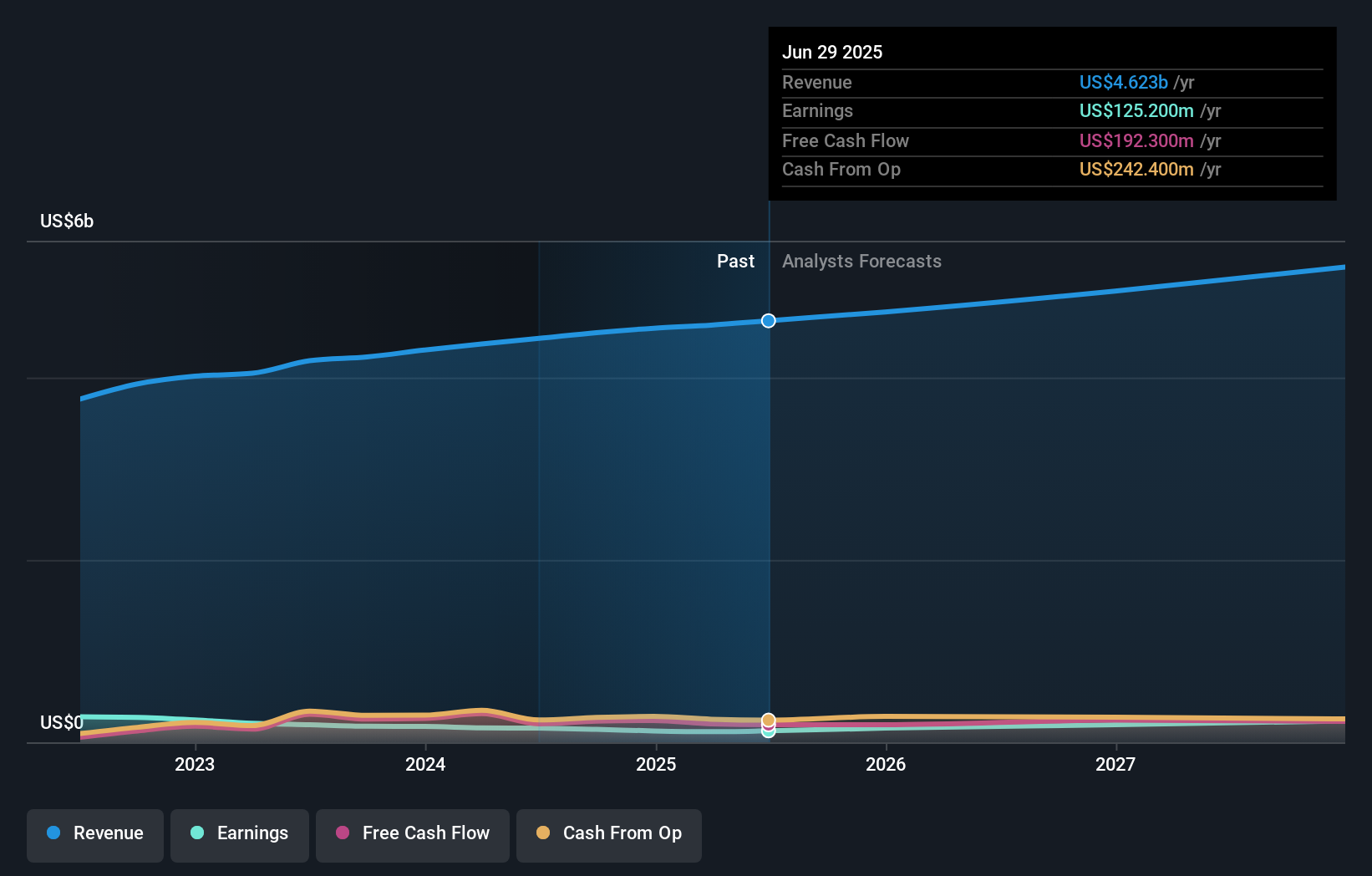

SiteOne Landscape Supply's narrative projects $5.3 billion in revenue and $263.9 million in earnings by 2028. This requires 4.8% yearly revenue growth and a $138.7 million increase in earnings from the current $125.2 million.

Uncover how SiteOne Landscape Supply's forecasts yield a $153.90 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for SiteOne range from US$83.01 to US$153.90, reflecting varied expectations across just two unique perspectives. While many hope for earnings growth to accelerate as analysts project, ongoing margin pressures remain an important consideration for anyone assessing where value may lie.

Explore 2 other fair value estimates on SiteOne Landscape Supply - why the stock might be worth 42% less than the current price!

Build Your Own SiteOne Landscape Supply Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiteOne Landscape Supply research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free SiteOne Landscape Supply research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiteOne Landscape Supply's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English