Transocean (RIG): Evaluating Valuation After Petrobras Renewal, Fleet Sale, and Analyst Optimism

Transocean (NYSE:RIG) is once again catching the market’s eye, this time following a wave of upbeat news. The renewed contract with Petrobras, a ramp-up in operational contracts such as the one with Equinor in the Norwegian Sea, and a strategic fleet sale all signal meaningful changes for the company’s future direction. Investors tuned in as Transocean’s shares moved up 3% in a single day, which could be an early sign that the market is recalibrating its outlook on this offshore drilling specialist.

This recent surge comes after a mixed stretch for Transocean. Despite pockets of optimism, the stock remains down considerably over the past year. Momentum, however, appears to be picking up, thanks to a swelling contract backlog of $7.2 billion and a sharper focus on high-specification assets through fleet refinement. The decision to offload five rigs and absorb a $1.9 billion non-cash charge this quarter underscores management’s efforts to optimize for long-term profitability. These changes are significant in a sector where operational discipline is paramount.

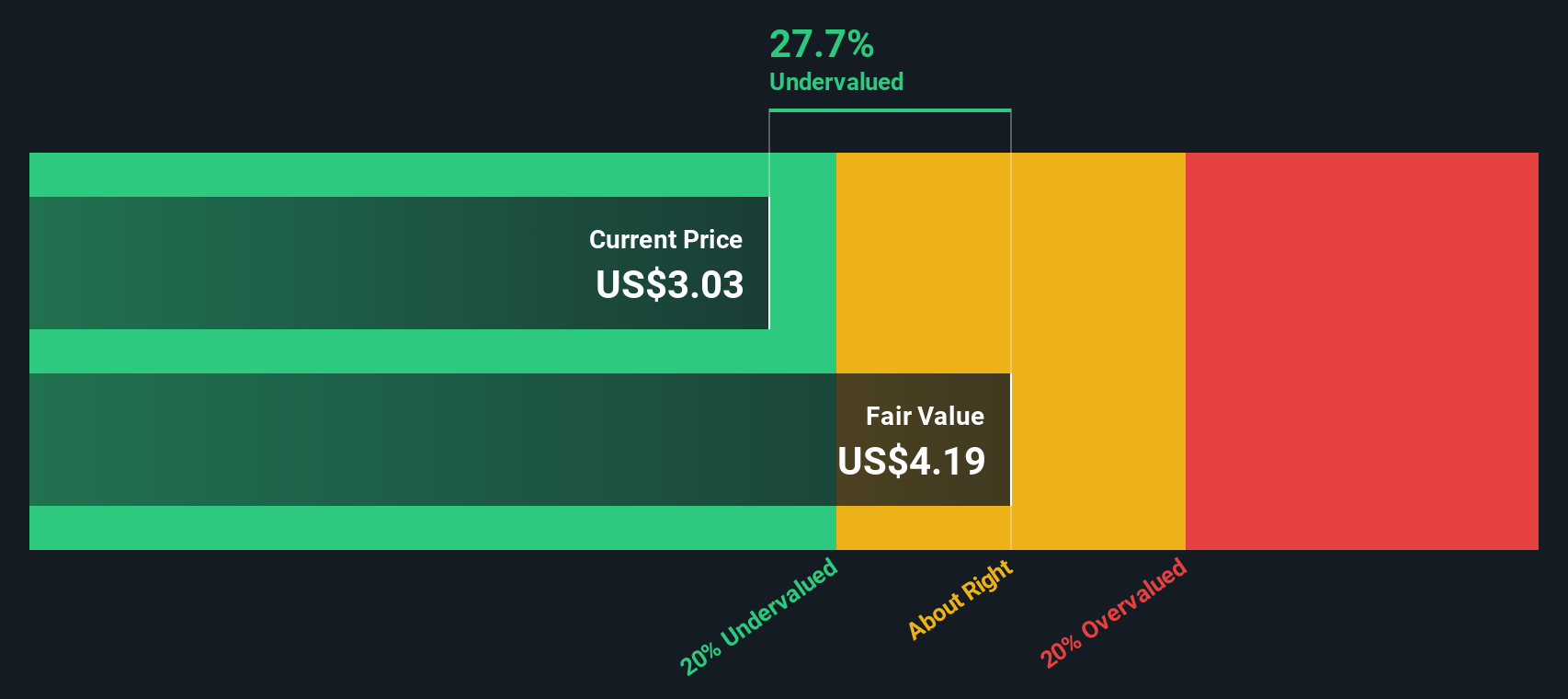

With shares still well below last year’s levels, the question is whether Transocean is now undervalued, or if the market is already factoring in all these future growth prospects. Which side of the fence do you find yourself on?

Most Popular Narrative: 16% Undervalued

According to the most popular narrative, Transocean is currently undervalued by a notable margin. Analysts believe the company's shares have yet to fully reflect a range of future catalysts and improvements.

Rising global energy demand and the ongoing depletion of easily accessible onshore oil reserves are driving sustained investment in offshore and ultra-deepwater exploration. This has led to a tightening rig market and rising dayrates, which are poised to boost Transocean's revenue and EBITDA as utilization approaches or exceeds 90% in late 2026 and 2027.

Thinking Transocean’s shares have room to run? There is one crucial pivot in this forecast, and the scale of the projected turnaround is significant. This narrative depends on aggressive profitability milestones and a market valuation multiple more typical of growth stocks. Curious about what bold moves and numbers drive this price target? You may want to review the analysts’ full scenario for yourself.

Result: Fair Value of $3.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy debt and unpredictable offshore dayrates remain significant hurdles. These factors could challenge Transocean’s turnaround and disrupt the bullish expectations.

Find out about the key risks to this Transocean narrative.Another View: Our DCF Model’s Perspective

Taking a step back from analyst price targets, the SWS DCF model offers its own analysis. According to this method, Transocean currently trades below its estimated intrinsic value. Could this signal opportunity, or is there more to consider?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Transocean Narrative

If you see things differently or want to dig into the details yourself, it takes just a few minutes to craft your own outlook on Transocean. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Transocean.

Looking for More Investment Ideas?

Don’t miss your chance to uncover even more unique opportunities. Use the screens below to spot hidden gems and keep your investing momentum going strong.

- Spot undervalued companies with solid financial fundamentals by starting with our list of undervalued stocks based on cash flows. This could offer the value edge you want for your portfolio.

- Capture the potential of early-stage growth stories by reviewing penny stocks with strong financials positioned for powerful comebacks and surprising success.

- Catch the next breakthrough in medicine and tech by seeing which healthcare AI stocks are leading advancements in smarter healthcare solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English