Is Cummins Stock Outperforming the Dow?

With a market cap of $55.8 billion, Cummins Inc. (CMI) is a global leader in designing, manufacturing, and distributing engines and power solutions. The company operates through five segments: Engine; Distribution; Components; Power Systems; and Accelera, offering products that range from diesel and natural gas engines to electrified power systems and hydrogen technologies.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Cummins fits this criterion perfectly. Serving OEMs, distributors, and dealers worldwide, Cummins delivers innovative solutions across transportation, industrial, and energy markets.

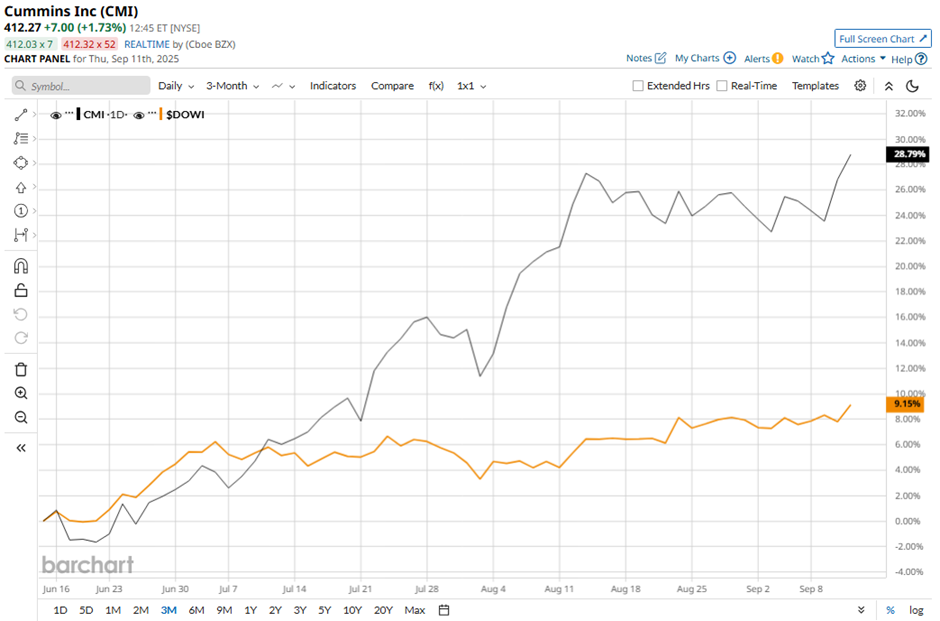

Shares of the Columbus, Indiana-based company have decreased marginally from its 52-week high of $413.52. Over the past three months, its shares have surged 27.2%, outperforming the broader Dow Jones Industrials Average's ($DOWI) 7.5% gain during the same period.

Longer term, CMI stock is up 18.1% on a YTD basis, outpacing DOWI's 8.3% return. Moreover, shares of the company have climbed 40.3% over the past 52 weeks, compared to DOWI’s 12.7% increase over the same time frame.

The stock has been trading above its 50-day moving average since early May and has remained above its 200-day moving average since early July.

Shares of Cummins rose 3.2% on Aug. 5 after the company reported Q2 2025 earnings of $6.43 per share and revenue of $8.6 billion, beating the analyst estimates. Growth was driven by a 19% increase in its Power Systems segment to $1.89 billion, fueled by strong demand for power generation products, particularly from AI-driven data center investments.

Additionally, CMI stock has performed better than its rival, AMETEK, Inc. (AME). AME stock has increased 5.5% YTD and 15.1% over the past 52 weeks.

Despite Cummins’s outperformance, analysts remain cautiously optimistic about its prospects. CMI stock has a consensus rating of “Moderate Buy” from 21 analysts in coverage, and the mean price target of $415.06 is a slight premium to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English