Choice Hotels International (CHH) Declares US$0.29 Per Share Dividend

Choice Hotels International (CHH) recently declared a dividend of $0.29 per share, to be paid on October 16, 2025, which supports its commitment to returning value to shareholders. However, despite these positive signals, the company's stock experienced a 4% decline over the last week. This move comes amid a market environment where major indexes climbed, driven by hopes of potential interest rate cuts and inflation data in line with expectations. The opening of a new property in Argentina evidently did not counter broader market moves, suggesting the stock's performance was weighed down more significantly by other factors.

Be aware that Choice Hotels International is showing 1 possible red flag in our investment analysis.

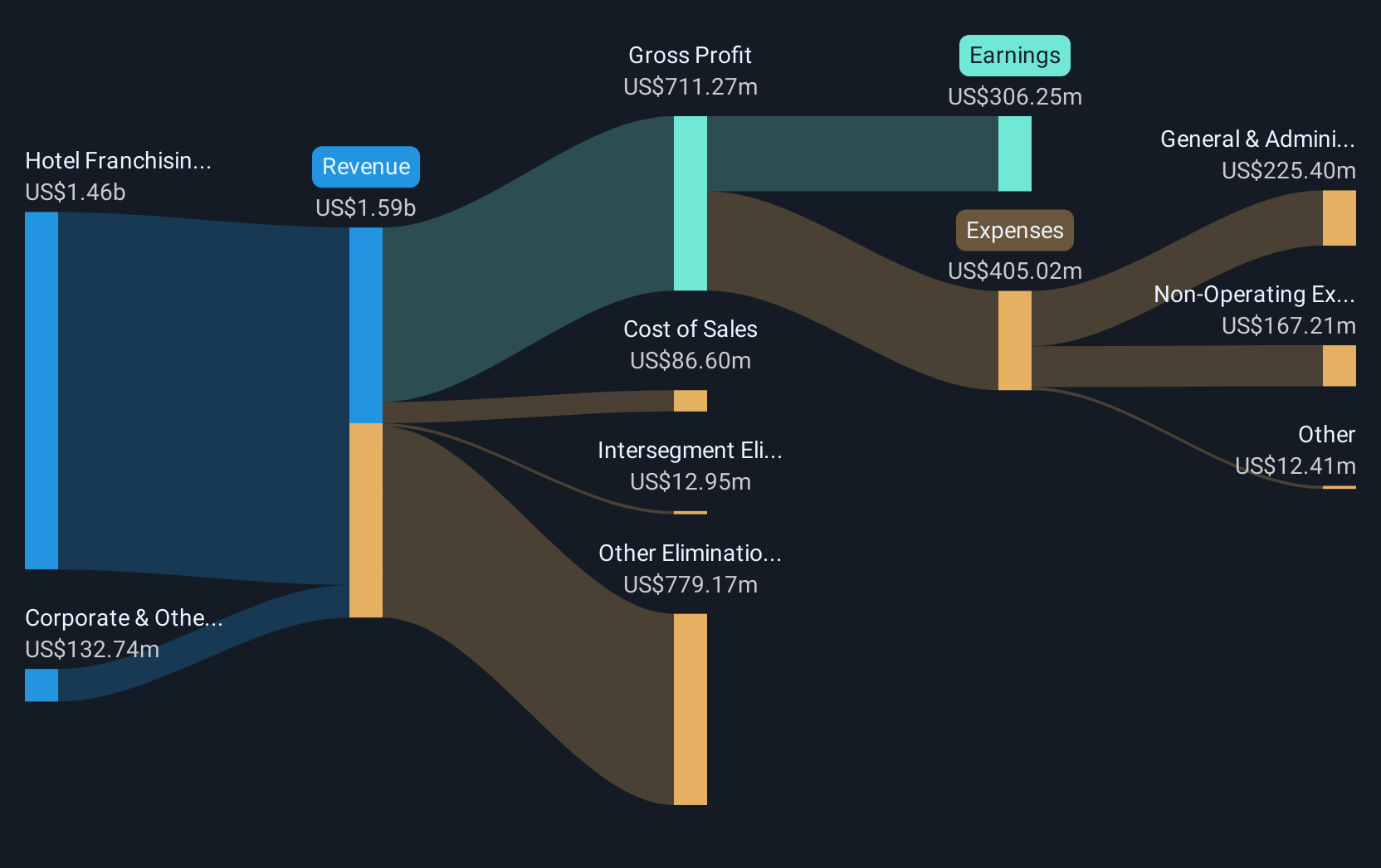

The recent declaration of a US$0.29 dividend by Choice Hotels International showcases the company's ongoing dedication to shareholder returns, contrasting its recent 4% decline in share price. Over the longer term, however, Choice Hotels' shares have delivered a total return of 18.16% over a five-year period, indicating a generally positive trajectory despite short-term fluctuations. This long-term performance reflects the company's broader strategy of expanding its international franchising and enhancing digital platforms to boost revenue and earnings. Over the past year, the company underperformed the U.S. Hospitality industry, which achieved better overall returns.

The latest developments, including the dividend announcement and stock performance, might influence future revenue and earnings forecasts. The company's focus on international growth and digital investments could potentially underpin these projections, especially if market conditions stabilize. However, analysts have set a price target of US$132.93, which is approximately 18% higher than the current share price of US$112.49. This indicates that analysts remain optimistic about Choice Hotels' potential value increase. For the company to meet these expectations, it would need to execute its growth strategy effectively and navigate market challenges, ensuring continued improvements in profitability and revenue growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English