NetEase (SEHK:9999) Posts 12% Stock Price Rise Over Last Month

NetEase (SEHK:9999) recently announced a lower dividend, alongside its notable Q2 financial performance showing increased sales and net income. With a new independent director appointed to its board and ongoing share repurchase activity, the company's strategic maneuverings continue to shape investor perception. Over the last month, NetEase's share price rose by 12.52%, an increase that aligns with broader market trends, as U.S. stock indices also experienced gains thanks to cooling inflation data and potential interest rate cuts. Despite these developments, NetEase's specific events would have enhanced the positive sentiment rather than countered the overall market trajectory.

Buy, Hold or Sell NetEase? View our complete analysis and fair value estimate and you decide.

Recent developments at NetEase, including a lower dividend, notable Q2 financial performance, and board changes, appear poised to influence the company's long-term trajectory focusing on digital entertainment and gaming, fostering global expansion and diversifying revenue streams. These strategic moves could enhance investor confidence by strengthening the company's position in an increasingly competitive industry. The ongoing share repurchase activity signals management's belief in the company's value, potentially impacting shareholder returns.

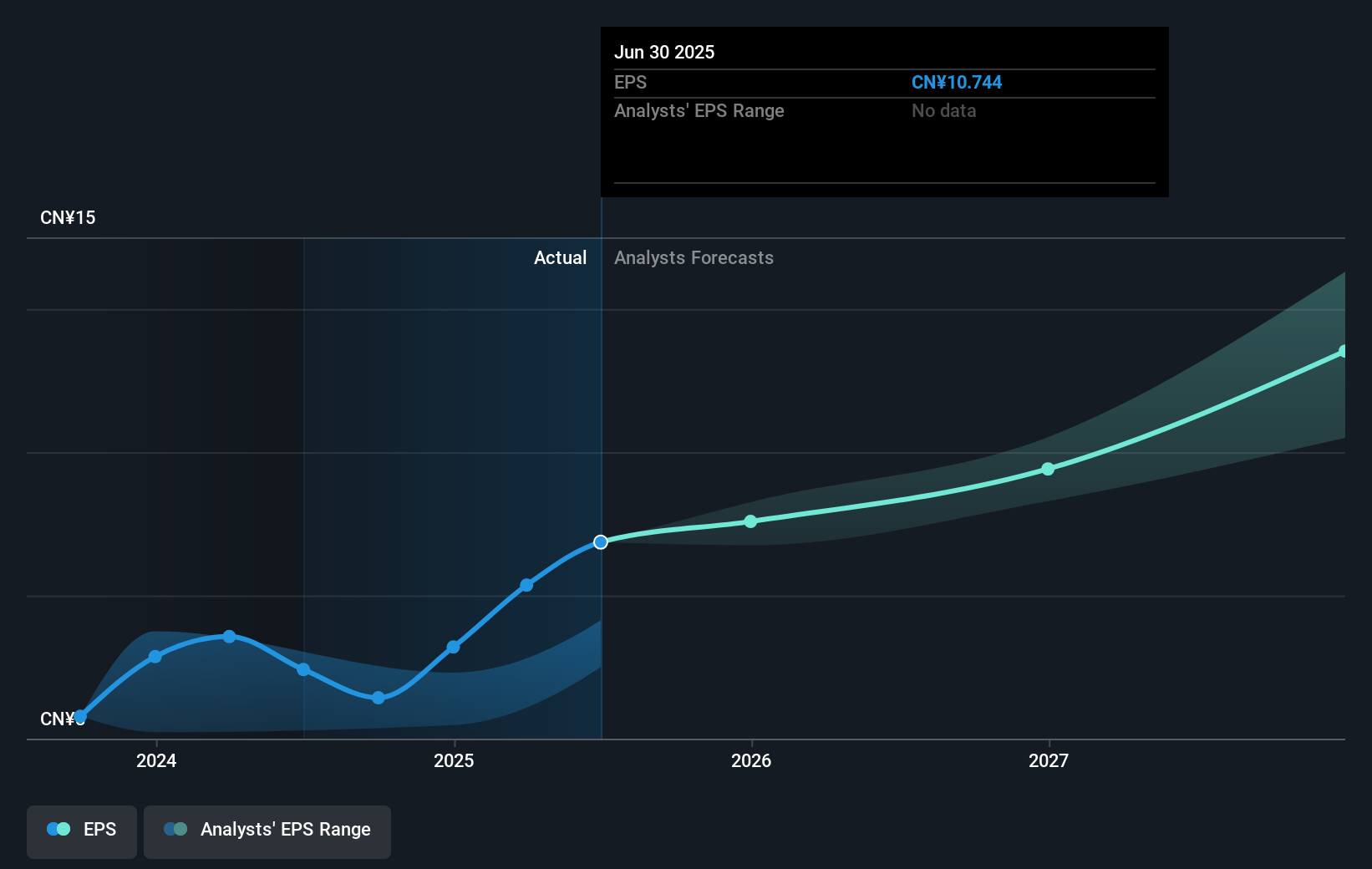

Over the past year, NetEase delivered a substantial total return of 95.06%, highlighting strong performance dynamics. However, compared to the Hong Kong Entertainment industry, which saw a higher return of 91.5% over the same period, NetEase's growth in the past year shows some underperformance relative to industry benchmarks. Meanwhile, analysts' forecasts, which include an 8.5% annual revenue growth and slight profit margin decline, might be positively influenced by these strategic initiatives designed to project revenue growth and earnings stability.

Currently trading at HK$230.00, the shares are close to the consensus price target of HK$234.08. The recent positive price movement, including a 12.52% increase over the last month, suggests that these company-specific actions have bolstered market sentiment, moving the shares closer to consensus analyst predictions. However, achieving the price target assumes continued strong operational performance and successful execution of strategic expansion plans.

Examine NetEase's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English