5 Stocks Investors Couldn't Stop Talking About This Week— Here's How They Fared: ORCL, OPEN, NBIS, UNH, AAPL

Benzinga·09/13/2025 12:30:07

Listen to the news

Retail investors buzzed about five stocks this week, from Sept. 8 to 12, on platforms like X and Reddit's r/WallStreetBets, amid market volatility and enthusiasm for AI.

The stocks, Oracle Corp. (NYSE:ORCL), Opendoor Technologies Inc. (NASDAQ:OPEN), Nebius Group NV (NASDAQ:NBIS), UnitedHealth Group Inc. (NYSE:UNH), and Apple Inc. (NASDAQ:AAPL) spanned tech, realty, and insurance, reflecting diverse retail interests.

Oracle Corp

- ORCL was trending after its first quarter report, which missed expectations but still saw a lot of chatter around its massive new backlog of $455 billion, up by 359%.

- Retail traders were seen questioning ORCL’s backlog and OpenAI’s massive deal pipeline with the company.

- The stock had a 52-week range of $118.86 to $345.72, trading around $307 to $310 per share, as of the publication of this article. It was up 85.42% year-to-date and 90.77% over the year.

- Benzinga's Edge Stock Rankings showed that the stock had a stronger price trend in the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

Opendoor Technologies

- Retail favorite OPEN was in focus this week as the company named a new CEO and co-founders returned to the board.

- The retail conviction in OPEN was soaring as many believed that investing in the stock might help them buy a house in reality.

- The stock had a 52-week range of $0.51 to $10.70, trading around $8 to $10 per share, as of the publication of this article. It was up 561.64% year-to-date and 380.37% over the year.

- The stock had a stronger price trend in the short, medium, and long terms, as per Benzinga's Edge Stock Rankings. Additionally, its growth ranking was quite poor. Other performance details are available here.

Nebius Group

- NBIS made headlines as it unveiled a $17.4 billion contract with Microsoft Corp. (NASDAQ:MSFT) and priced $1 billion stock offering and $2.75 billion convertible notes, raising nearly $3.7 billion for expansion.

- Investors felt that NBIS was undervalued and had the potential to rally.

- The stock had a 52-week range of $14.09 to $100.51, trading around $90 per share, as of the publication of this article. It was up 192.33% year-to-date and 345.95% over the year.

- According to Benzinga's Edge Stock Rankings, it had a moderate growth ranking while maintaining a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

UnitedHealth Group

- UNH was in focus this week as institutions and so-called “smart money” moved into the stock after flashing a critical technical signal on Wednesday.

- Retailers placed their bets on UNH as they believed the insured were unlikely to swap their insurance from the company.

- The stock had a 52-week range of $234.60 to $630.73, trading around $353 to $355 per share, as of the publication of this article. It was down 29.91% year-to-date and 39.91% over the year.

- It maintains a weaker price trend over the long term but a strong trend over the short and medium terms, as per Benzinga's Edge Stock Rankings. However, it had a moderate quality ranking. Additional performance details are available here.

Apple

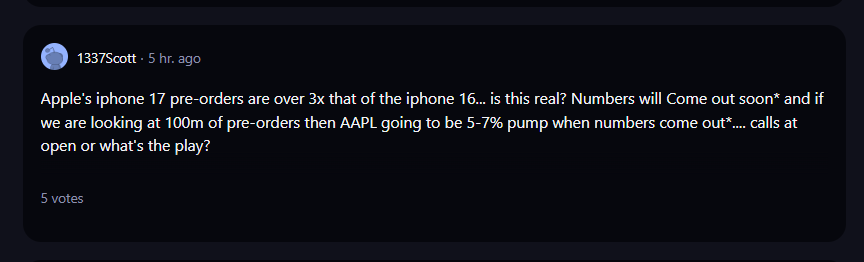

- AAPL was on the retail watchlist after its “Awe Dropping” event this week, the tech giant launched its iPhone 17 lineup, which CEO Tim Cook described as “unlike anything we’ve ever created.”

- Retail investors cited iPhone 17 pre-orders, showing conviction in AAPL’s stock.

- The stock had a 52-week range of $169.21 to $260.10, trading around $228 to $230 per share, as of the publication of this article. It was down 5.67% year-to-date and up 3.26% over the year.

- While this stock had a poor value ranking, Benzinga's Edge Stock Rankings showed that it had a strong price trend in the short, medium, and long terms. Additional performance details are available here.

Retail focus blended meme-driven optimism with future outlook and earnings narratives, as the S&P 500, Dow Jones, and Nasdaq scaled fresh highs during the week.

Read Next:

Photo: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkRisk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.