A Fresh Look at Harley-Davidson’s Valuation After Artie Starrs Takes Over as CEO

Harley-Davidson (NYSE:HOG) is back in the spotlight after the company named Artie Starrs as its new CEO, a move that is turning heads across the investment community. Even before the official announcement, Starrs made waves by purchasing a 2025 Heritage Classic motorcycle, signaling his personal stake in the company’s legacy and direction. For current and prospective shareholders, this leadership transition feels like more than just a change of title. It suggests a renewed push for brand alignment starting at the top.

The market responded with cautious optimism. While Harley-Davidson’s stock ticked up nearly 9% over the past month, the broader picture is mixed. The past year has been tough, with shares down 18%, and even looking out three years, the stock is still lagging compared to where it was. However, the past three months have shown a 24% bump, suggesting momentum is shifting as investors digest the implications of new leadership and consider whether recent strategic moves signal a new chapter.

So, is this the moment to snap up Harley-Davidson at an attractive valuation, or does the current price already reflect expectations for growth under Starrs’ leadership?

Most Popular Narrative: 1.9% Overvalued

According to the most watched narrative, Harley-Davidson appears slightly overvalued, trading just above its calculated fair value when using a 12.32% discount rate and detailed analyst projections.

The new partnership in HDFS unlocks significant cash ($1.25B) and reduces leverage, enabling accelerated share buybacks and freeing up $300M for growth investments. This can directly bolster EPS and future revenue streams through both financial engineering and new business initiatives.

Wondering what has led analysts to call Harley-Davidson’s value so closely? A big part comes down to fast-moving strategic deals, ambitious profitability targets, and a drastic reshaping of their market approach. This narrative’s calculation blends impressive operational shifts with bold growth forecasts, but the specific levers driving that fair value might surprise you. Want to see which assumptions are pushing that price from ‘value’ into ‘overvalued’? Explore the details to uncover the full valuation story.

Result: Fair Value of $29.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak demand and ongoing macroeconomic uncertainties could disrupt Harley-Davidson’s expected recovery. This situation puts projected growth and profitability at risk.

Find out about the key risks to this Harley-Davidson narrative.Another View: What Does the Market Multiple Say?

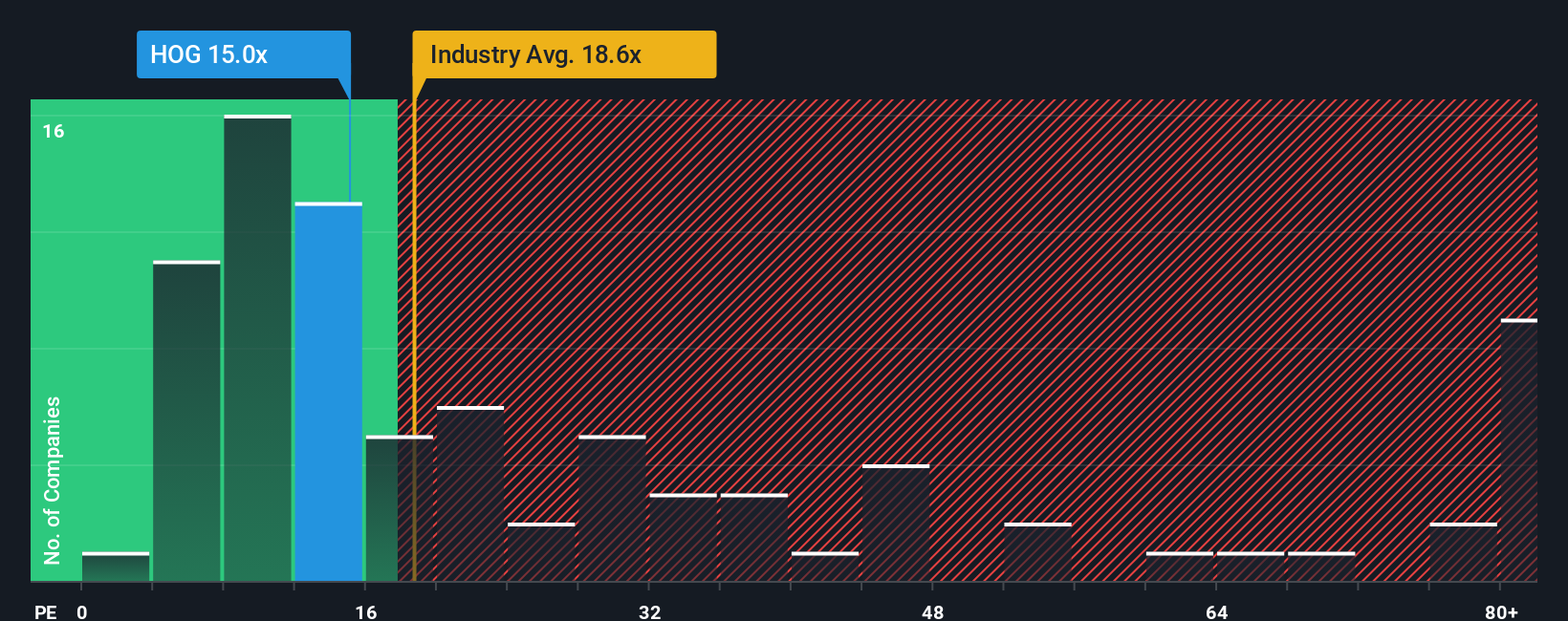

Looking at a different method, our market comparison shows Harley-Davidson is actually priced below the industry’s average, which may suggest possible value is being overlooked. However, can this relative bargain remain if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Harley-Davidson Narrative

If these insights don’t quite fit your perspective, or if you’d rather investigate the details on your own terms, you can craft your own analysis in just a few minutes. Do it your way

A great starting point for your Harley-Davidson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why focus on just one opportunity when you can enhance your strategy? Make sure you’re not missing out on other fast-moving stocks with strong upside potential.

- Tap into rapid tech transformation by searching for breakthroughs in machine learning, automation, and robotics with AI penny stocks.

- Unlock consistent income potential by looking for companies offering robust yields and a track record of rewarding shareholders through dividend stocks with yields > 3%.

- Get ahead of the crowd by identifying standout businesses trading below their cash flow value using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English