Houlihan Lokey (HLI): Assessing Valuation After Strong Revenue Growth and Upbeat Corporate Finance Results

Houlihan Lokey (HLI) just delivered a quarterly update that has investors taking a closer look. Revenues grew by 17.9% year over year, coming in above consensus, with the Corporate Finance segment pulling much of the weight. CEO Scott Adelson struck a balance between celebrating the results and acknowledging the unpredictable environment but made clear that he sees reasons for continued momentum as fiscal 2026 approaches.

This upbeat tone is echoed across much of the investment banking sector, which has generally managed to outperform expectations in recent quarters. For Houlihan Lokey, strong year-on-year share price gains—up 35% over the past year, and nearly tripling over five years—suggest that the market recognizes this operational strength. A series of recent hires expanding capabilities across Europe and further client wins point to the company making the most of its current standing, adding to investor enthusiasm for the stock’s growth trajectory.

But after such a strong run, the question is front and center: is Houlihan Lokey trading at an attractive entry point, or is the market simply pricing in even more future growth?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Houlihan Lokey shares are considered fairly valued, with the market price closely aligned to future profit and growth assumptions given an 8.1% discount rate.

Ongoing global expansion, sector diversification, and talent recruitment position Houlihan Lokey for sustained revenue growth and increased market share. Strong pipelines from succession planning, resilient restructuring activity, and enhanced client engagement are stabilizing fee income and supporting earnings despite macroeconomic shifts.

Want to know the narrative driving this fair value? It is built on rising profit margins and ambitious revenue growth, underpinned by major hiring bets and a bold assumption about future earnings multiples. Curious which projections carry the most weight? Just how high is the bar set? Dive deeper to uncover the core financial forecasts behind this valuation call.

Result: Fair Value of $207.80 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, Houlihan Lokey’s reliance on US deal volumes and its high cost structure could quickly challenge current growth expectations if market dynamics shift.

Find out about the key risks to this Houlihan Lokey narrative.Another View: A Different Valuation Lens

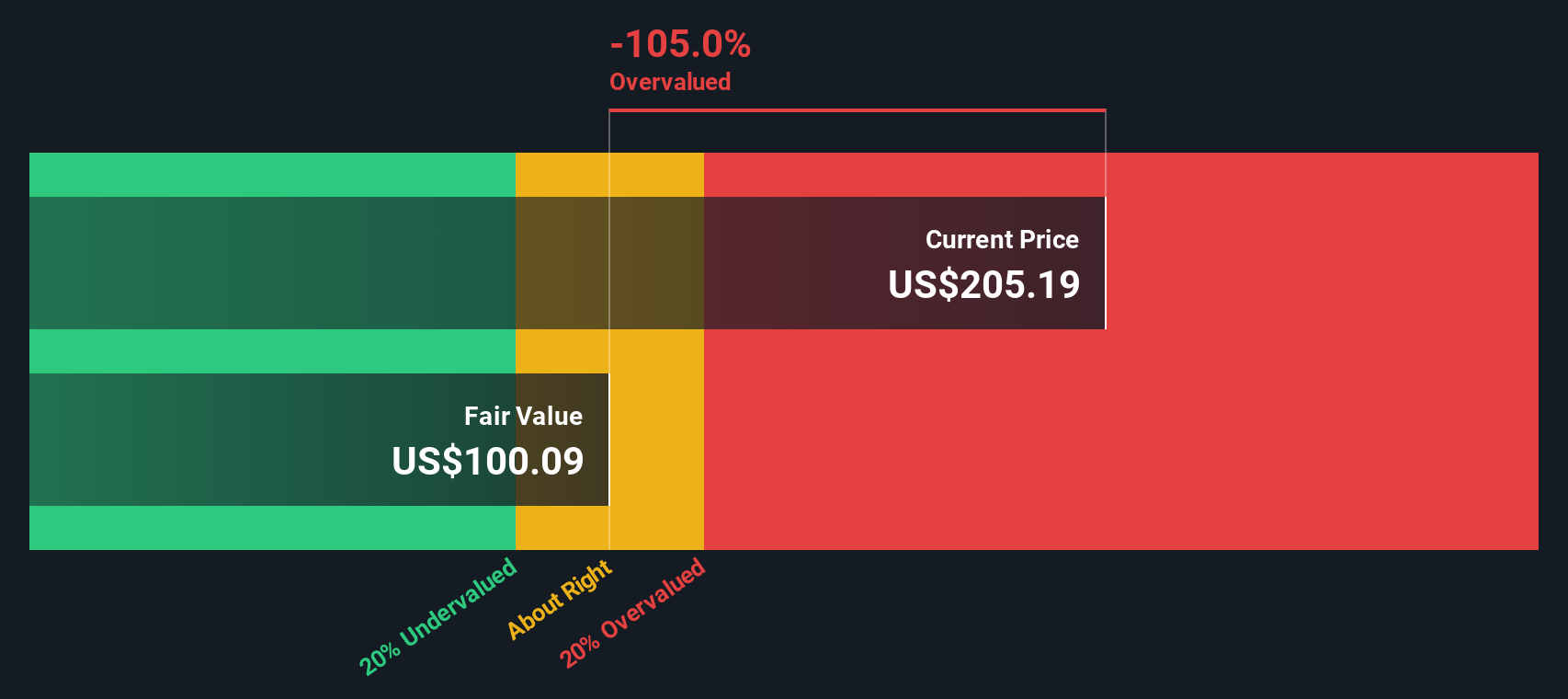

While consensus sees Houlihan Lokey close to fair value using analyst targets, our DCF model tells a different story. It suggests current prices may be higher than their estimated worth. Which perspective will prove more accurate as conditions change?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Houlihan Lokey Narrative

Readers who want to reach their own conclusions or dig into the numbers further can easily shape a personalized outlook of Houlihan Lokey in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Houlihan Lokey.

Looking for More Smart Investment Opportunities?

Serious investors never limit themselves to just one stock. Unlock the potential for outperformance and future-proof your portfolio by acting on fresh ideas now. Missing out could cost you.

- Uncover resilient income streams and earn steady returns by tapping into dividend stocks with yields > 3%.

- Capitalize on the booming intersection of medicine and technology with a focused look at healthcare AI stocks.

- Catch the next wave of tech evolution by evaluating game-changers in quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English