Exploring Flowers Foods (FLO) Valuation Following Its Update at the Barclays Global Consumer Staples Conference

Flowers Foods (FLO) just took the stage at the Barclays 18th Annual Global Consumer Staples Conference, offering a fresh look at its strategy and direction. For those following the stock, conference appearances like this tend to shine a spotlight on management’s agenda and sometimes reveal plans that could shift opinions in the investment community. Investors are now weighing whether the extra visibility and any new details shared at the event will move the needle for Flowers Foods in the months ahead.

This renewed attention comes during a stretch where Flowers Foods’ stock performance has been challenging, with shares declining over the past year and losses stretching back across longer periods. Even as the company delivered modest annual growth in both revenue and net income, the stock has underperformed market benchmarks. This suggests that momentum remains soft and that investors are looking for a reason to re-engage. Events like prominent conference appearances can help reposition a company’s story, but the market’s cautious stance is still visible in recent price trends.

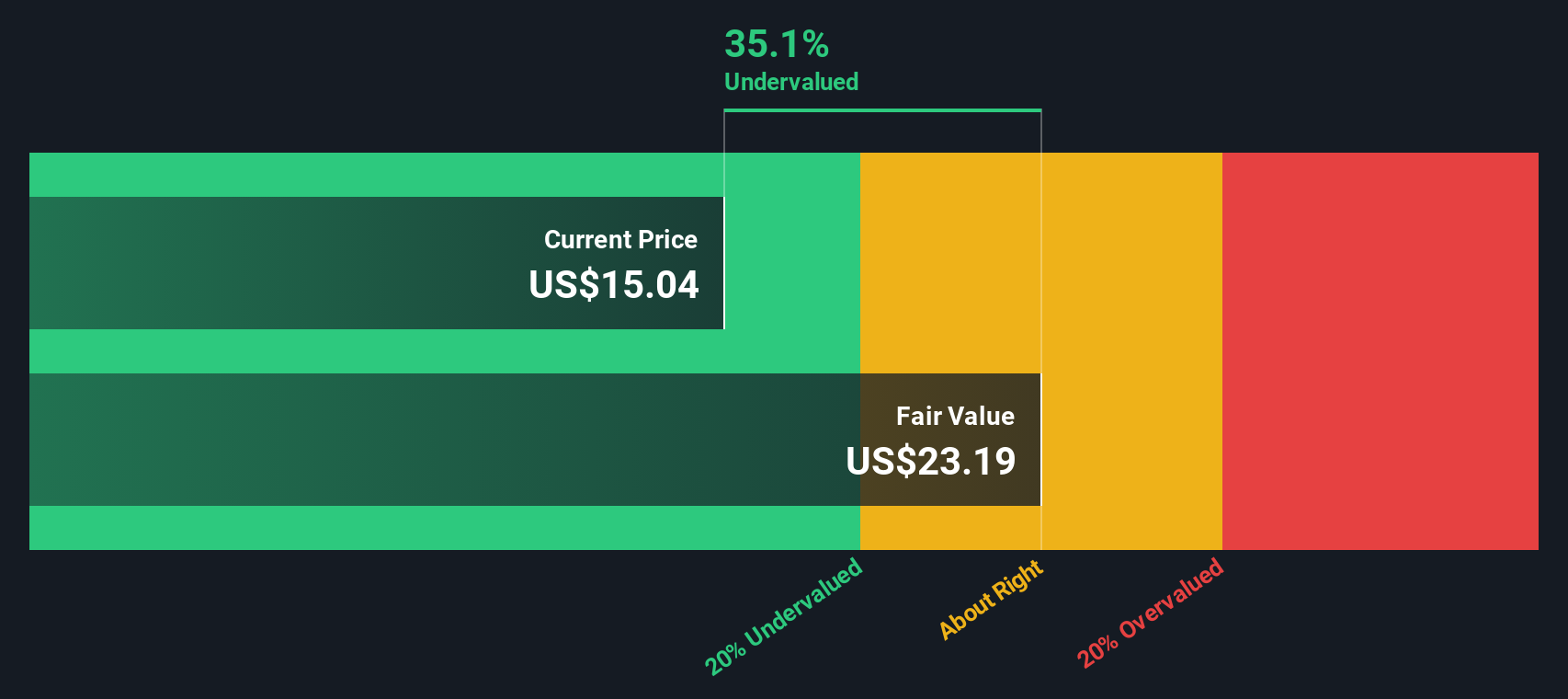

So, after another year of muted returns, is Flowers Foods now flying under the radar or potentially undervalued? Or are investors right to remain skeptical, and has the market already priced in everything it knows?

Most Popular Narrative: 12.5% Undervalued

The most widely followed narrative views Flowers Foods as undervalued, factoring in a cautious outlook driven by changing consumer tastes and increased industry pressures.

The accelerating shift away from traditional bread, driven by increased adoption of low-carb, keto, and fresh, minimally processed foods, is expected to shrink Flowers Foods' core markets. This puts persistent downward pressure on long-term revenue growth and hinders the company's ability to fully offset volume declines with innovation.

Curious how this narrative justifies a higher fair value even as traditional bread loses ground? Hidden behind the undervaluation claim are key projections tied to the company’s future growth rates, innovation plans, and margin expectations. Want to see how analysts balance slow sales growth with ambitious assumptions about profitability? Dive in to uncover the full story behind the numbers.

Result: Fair Value of $15.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, strong consumer demand for premium health-oriented brands and successful innovation rollouts could help Flowers Foods outperform these bearish assumptions.

Find out about the key risks to this Flowers Foods narrative.Another View: What Does the SWS DCF Model Say?

While the analyst consensus values Flowers Foods as close to fairly priced, our DCF model paints a different picture and suggests shares may be priced below their actual worth. Could this model be highlighting an overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Flowers Foods Narrative

Of course, if you have a different perspective or want to analyze the figures firsthand, you can easily craft your own narrative in just a few minutes using Do it your way.

A great starting point for your Flowers Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more ways to invest smarter?

Why limit your strategy to just one stock? Use the Simply Wall Street Screener to act on promising ideas and stay ahead of market trends.

- Unlock high potential by grabbing opportunities in companies delivering robust yields thanks to dividend stocks with yields > 3%.

- Find hidden value by discovering stocks trading below their intrinsic worth and start with undervalued stocks based on cash flows.

- Take advantage of momentum in breakthrough healthcare technology by targeting pioneers with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English