UnitedHealth Group (UNH) Is Up 11.8% After Medicare Advantage Star Rating Confirmation Has the Bull Case Changed?

- Earlier this week, UnitedHealth Group reaffirmed its 2025 adjusted earnings forecast and disclosed that 78% of its Medicare Advantage members are expected to be enrolled in plans rated 4 stars or higher by the Centers for Medicare & Medicaid Services, making these plans eligible for quality bonus payments.

- This confirmation eased investor concerns about regulatory ratings and signaled ongoing access to crucial federal reimbursement streams for UnitedHealth's Medicare operations.

- We’ll explore how these positive Medicare quality ratings may strengthen UnitedHealth’s investment narrative and future profitability outlook.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

UnitedHealth Group Investment Narrative Recap

To be a UnitedHealth Group shareholder, you need confidence in its ability to deliver steady long-term earnings and withstand changing healthcare regulations, especially regarding Medicare Advantage. The company’s reaffirmation of its 2025 outlook and confirmation that 78% of Medicare Advantage members remain in 4-star or better plans has reduced concerns about near-term disruptions to federal bonus payments, a top short-term catalyst, though regulatory and reimbursement risks persist.

Among recent announcements, UnitedHealth’s quarterly dividend of US$2.21 per share stands out. This supports the company’s record of delivering shareholder returns and reinforces the narrative that steady income remains a draw, even as operational and regulatory factors evolve.

However, behind these strengths are ongoing Department of Justice investigations that could have material consequences for UnitedHealth investors if...

Read the full narrative on UnitedHealth Group (it's free!)

UnitedHealth Group's outlook anticipates $501.1 billion in revenue and $20.0 billion in earnings by 2028. This requires 5.8% annual revenue growth but a $1.3 billion decrease in earnings from the current $21.3 billion.

Uncover how UnitedHealth Group's forecasts yield a $333.42 fair value, a 5% downside to its current price.

Exploring Other Perspectives

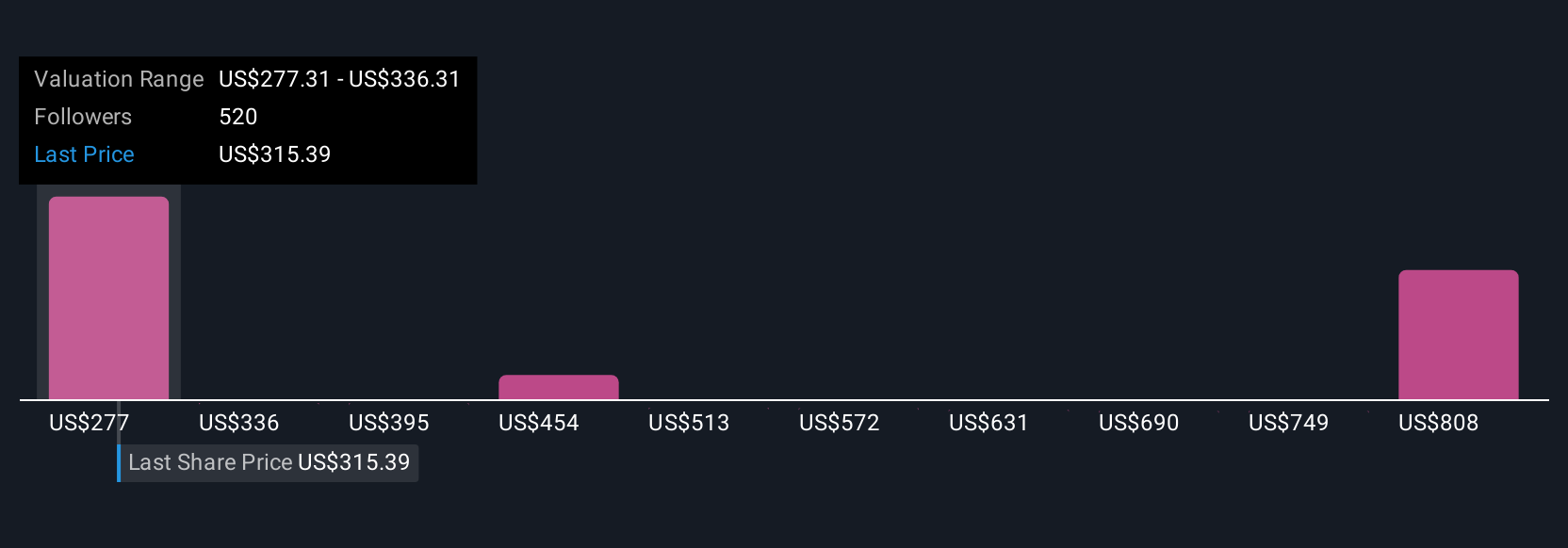

Simply Wall St Community members estimate UnitedHealth Group’s fair value from US$306.24 to US$867.30, drawing from 82 viewpoints. While opinions differ, the company’s ability to secure high Medicare Advantage quality ratings remains a pivotal factor affecting near-term performance and market perception.

Explore 82 other fair value estimates on UnitedHealth Group - why the stock might be worth 13% less than the current price!

Build Your Own UnitedHealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UnitedHealth Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UnitedHealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UnitedHealth Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English