How Dollar Tree’s Raised Guidance and Leadership Changes Could Impact DLTR’s Investment Outlook

- Earlier this month, Dollar Tree reported second quarter results showing growth in both sales and net income, raised its earnings guidance for the full year 2025, and announced a leadership transition as Brent Beebe is set to become Chief Merchandising Officer in 2026.

- Share repurchases totaling US$567.68 million this quarter reflect ongoing capital returns, while higher projected sales suggest management’s confidence in Dollar Tree’s operational strategy and expanded market reach.

- We’ll now explore how raising full-year guidance and recent executive changes could influence the company’s forward-looking investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dollar Tree Investment Narrative Recap

To own Dollar Tree shares today, you need confidence in its ability to capture more value-focused shoppers while managing rising costs and competitive pressures. The Q2 earnings beat and higher full-year guidance support optimism around near-term sales momentum, but the leadership transition and ongoing cost risks, especially labor and tariffs, mean that the key short-term catalyst remains sales leverage, while sustained cost control is still the largest challenge. These news items do not appear to meaningfully change the risk profile or main catalyst at this time.

Among recent announcements, the executive transition, with Brent Beebe set to become Chief Merchandising Officer in 2026, stands out for its potential to shape Dollar Tree’s merchandising, product assortment, and supplier relationships. As merchandising leadership is a significant driver behind sales growth and gross margin performance, a successful handover could help reinforce the company’s ability to respond to evolving consumer trends and operational challenges.

However, in contrast, investors should remain mindful of risks surrounding margin pressure from persistent tariff volatility and labor cost inflation...

Read the full narrative on Dollar Tree (it's free!)

Dollar Tree's narrative projects $22.1 billion revenue and $1.4 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.3 billion earnings increase from $1.1 billion.

Uncover how Dollar Tree's forecasts yield a $112.30 fair value, a 15% upside to its current price.

Exploring Other Perspectives

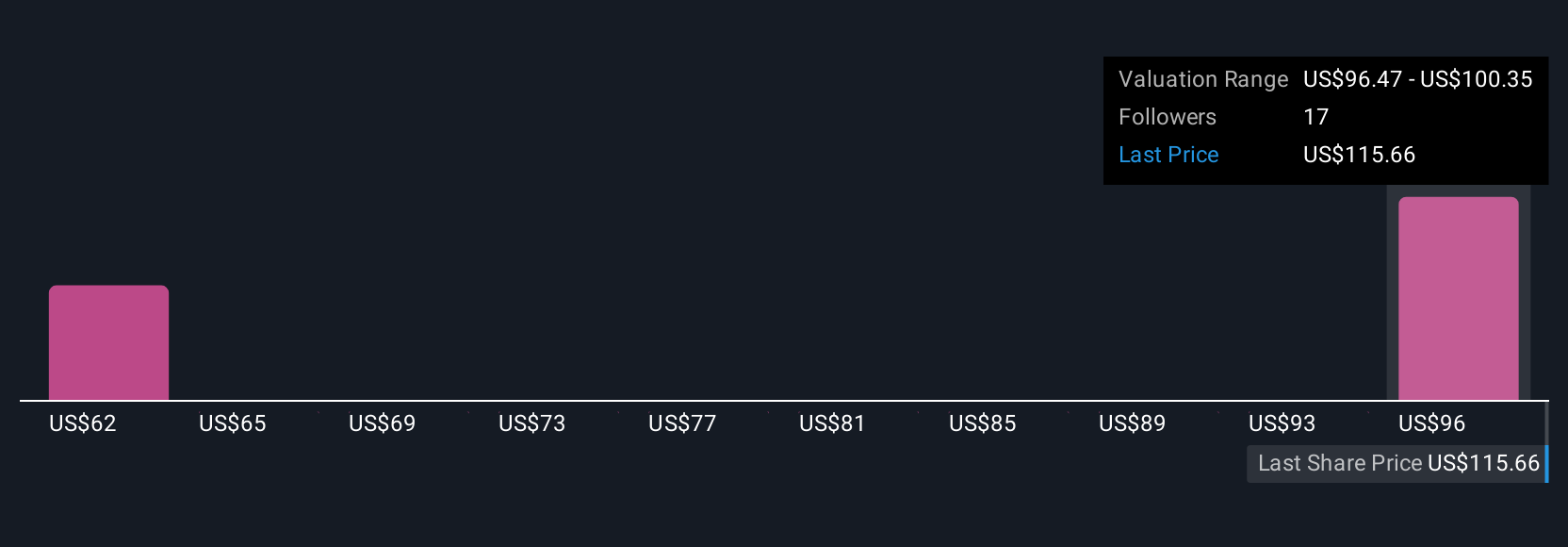

Community fair value estimates for Dollar Tree span from US$58.51 to US$112.30, based on three independent Simply Wall St Community perspectives. While views are wide ranging, ongoing cost pressures from tariffs and labor still loom large for future performance, reminding you that investor opinions can widely differ and encouraging you to compare alternative viewpoints.

Explore 3 other fair value estimates on Dollar Tree - why the stock might be worth as much as 15% more than the current price!

Build Your Own Dollar Tree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar Tree research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dollar Tree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar Tree's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English