Rubrik (RBRK) Lifts 2026 Outlook but Can Profitability Catch Up With Ambitious Growth Targets?

- Earlier this week, Rubrik reported second quarter results showing US$309.86 million in revenue and a narrowed net loss of US$95.93 million, with management raising guidance for both the next quarter and full fiscal year 2026.

- Although the company’s financial improvements surpassed analyst expectations, the interplay between forward guidance and market expectations highlighted how investors are closely scrutinizing Rubrik's ability to sustain robust growth versus its current valuation.

- We’ll explore how Rubrik’s raised full-year outlook and ongoing revenue growth refine its investment narrative and future expectations.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Rubrik Investment Narrative Recap

To be a Rubrik shareholder, you have to believe in the company’s ability to maintain strong revenue growth and capitalize on the growing demand for data security and cyber resilience, while effectively executing on cost discipline until profitability improves. The recent raised guidance demonstrates management optimism, but the sharp reaction in the share price highlighted that the most important short-term catalyst, sustained revenue growth outpacing expectations, remains closely tied to investor confidence in valuation. The biggest risk continues to be the company’s ability to meet high growth assumptions in a competitive market, and this news did not materially shift that balance.

Among recent company developments, Rubrik’s updated revenue outlook for fiscal year 2026 (US$1,227 million to US$1,237 million) stands out. This announcement directly reinforces the main catalyst for the stock as seen by the market: confidence in ongoing revenue growth built on the company’s core strengths in data security, partnership expansion, and cloud innovation. However, near-term reactions suggest investor sensitivity to any indication that growth could moderate.

Yet despite strong topline momentum, investors should be aware that...

Read the full narrative on Rubrik (it's free!)

Rubrik's outlook forecasts $2.0 billion in revenue and $257.3 million in earnings by 2028. This scenario assumes a 26.2% annual revenue growth rate and a $782.1 million increase in earnings from current earnings of $-524.8 million.

Uncover how Rubrik's forecasts yield a $115.20 fair value, a 55% upside to its current price.

Exploring Other Perspectives

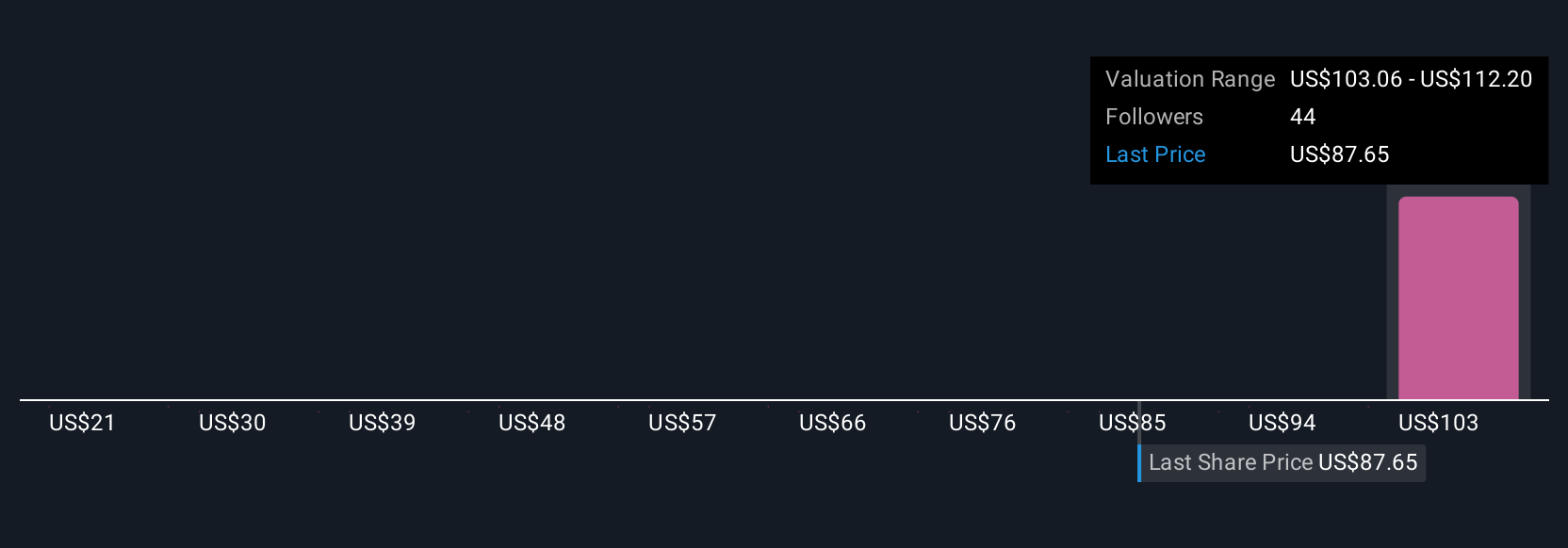

Fair value estimates from the Simply Wall St Community range widely from US$20.21 to US$115.20 across 9 unique analyses. While many are focused on growth projections, competitive risks remain a central concern for Rubrik’s path forward, inviting you to compare a variety of viewpoints on the company’s prospects.

Explore 9 other fair value estimates on Rubrik - why the stock might be worth less than half the current price!

Build Your Own Rubrik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rubrik's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English