Did Alleged Price-Fixing Probe Just Shift Atkore's (ATKR) Investment Narrative?

- In the past week, Bragar Eagel & Squire, P.C. announced an investigation into Atkore Inc. following a class action complaint alleging breaches of fiduciary duties by the board of directors, centered on claims of an anticompetitive price-fixing scheme in PVC Pipes.

- This development raises questions about the sustainability of previous financial benefits and the accuracy of Atkore's positive statements regarding its business outlook.

- Next, we'll examine how the investigation into alleged price-fixing and board conduct could affect Atkore's investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Atkore Investment Narrative Recap

To believe in Atkore as a shareholder, you have to rely on the company's ability to maintain margins and recapture market share from diminished import competition, particularly in steel and PVC conduit. However, the recent investigation into allegations of price-fixing and board conduct directly challenges the credibility of Atkore's previous financial reporting and outlook, and may quickly shift the biggest short-term risk toward regulatory and reputational fallout rather than just margin pressures from input costs or weak market demand.

Among recent announcements, the CEO's retirement, disclosed just after the investigation surfaced, carries heightened significance. Leadership changes during periods of legal and operational uncertainty can create added volatility and may complicate Atkore’s near-term response to both existing margin headwinds and new regulatory scrutiny.

In contrast, shareholders should be keenly aware that legal and governance risks can have...

Read the full narrative on Atkore (it's free!)

Atkore's narrative projects $2.9 billion revenue and $217.1 million earnings by 2028. This requires a 0.5% yearly revenue decline and a $105.7 million earnings increase from $111.4 million currently.

Uncover how Atkore's forecasts yield a $63.60 fair value, a 4% upside to its current price.

Exploring Other Perspectives

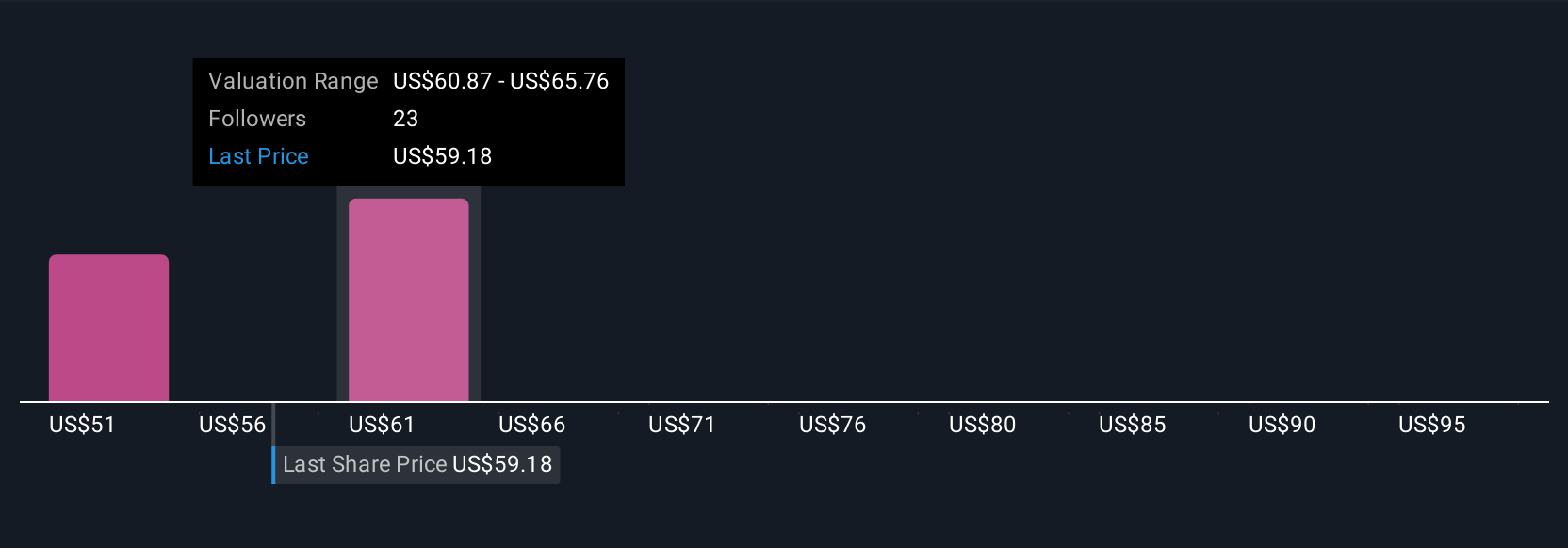

Simply Wall St Community participants offered five fair value estimates between US$51.50 and US$100 per share, showing wide-ranging expectations. With regulatory uncertainty now in focus, these divergent views underscore just how differently participants assess business risks and future prospects.

Explore 5 other fair value estimates on Atkore - why the stock might be worth 16% less than the current price!

Build Your Own Atkore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atkore research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atkore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atkore's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English