The Bull Case For BJ's (BJ) Could Change Following Surge in Digital Sales and Membership Fee Revenue

- BJ's Wholesale Club Holdings recently reported strong growth in digital sales and record-high membership fee income, driven by a focus on digital integration and value for shoppers.

- An interesting insight is that digitally engaged members are twice as valuable as those who shop only in-club, significantly boosting recurring revenue and customer retention.

- We'll explore how accelerating digital sales and rising membership renewals are shaping the future investment narrative for BJ's Wholesale Club Holdings.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

BJ's Wholesale Club Holdings Investment Narrative Recap

For investors considering BJ's Wholesale Club Holdings, the key narrative centers on the company's ability to leverage digital integration and membership-driven growth as shopping patterns shift. The latest report of record digital sales and high membership renewals underpins the catalyst of accelerating recurring revenues, though it does not materially change the near-term risk tied to ongoing volatility in consumer demand for general merchandise and potential tariff impacts on profitability.

One announcement particularly relevant now is the company's continued expansion of its physical footprint, including the upcoming club opening in Georgia and the long-awaited return to Massachusetts. These developments add to BJ's growth catalysts by widening its addressable market and reinforcing its value proposition, especially as digital and in-store offerings increasingly connect to customer retention and revenue diversification.

However, as growth in digitally engaged members gains headlines, investors should also be aware that, in contrast, the struggle to revive performance in discretionary general merchandise categories could...

Read the full narrative on BJ's Wholesale Club Holdings (it's free!)

BJ's Wholesale Club Holdings is expected to reach $25.2 billion in revenue and $683.1 million in earnings by 2028. This outlook is based on a projected annual revenue growth rate of 6.5% and a $104.2 million earnings increase from current earnings of $578.9 million.

Uncover how BJ's Wholesale Club Holdings' forecasts yield a $115.63 fair value, a 17% upside to its current price.

Exploring Other Perspectives

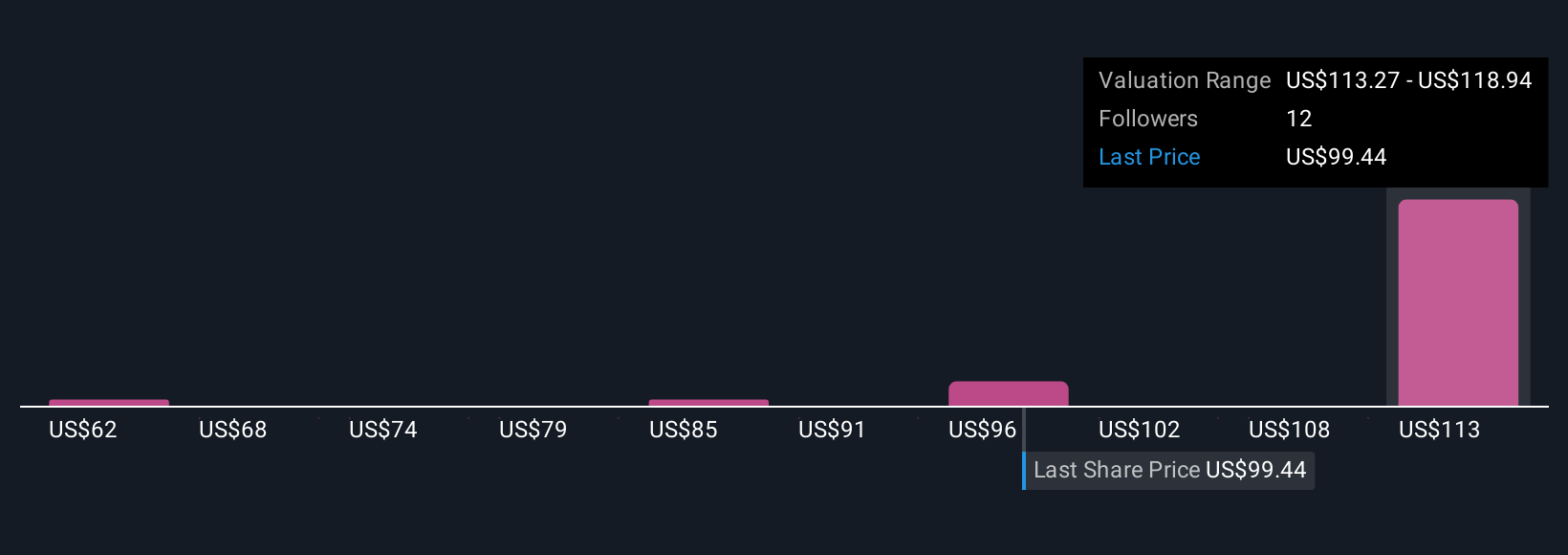

Seven recent fair value estimates from the Simply Wall St Community put BJ's shares in a wide US$62.28 to US$118.94 range. While many see upside on membership-driven growth, keep in mind ongoing margin pressures present real challenges for future profitability, highlighting just how differently individual investors view the stock’s prospects.

Explore 7 other fair value estimates on BJ's Wholesale Club Holdings - why the stock might be worth 37% less than the current price!

Build Your Own BJ's Wholesale Club Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BJ's Wholesale Club Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BJ's Wholesale Club Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BJ's Wholesale Club Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English