Synaptics (SYNA): Assessing Valuation After Astra AI Processor Reveal for IBC 2025

Most Popular Narrative: 14% Undervalued

According to the most widely followed narrative, Synaptics is trading meaningfully below its estimated fair value. The consensus is that the market may be overlooking key forward drivers.

The company's strategy to bundle highly integrated solutions combining wireless connectivity, low-power mixed-signal processing, and embedded AI/software content is expected to increase silicon content per device and drive higher gross margins as more revenue is captured per customer design win.

Want to know what’s fueling this predicted upside? The fair value hinges on bold assumptions about turnarounds in growth and margins that could surprise even seasoned investors. What if Synaptics achieved profitability levels once reserved for the industry’s elite? Curious about which numbers truly set this story apart? The full narrative breaks down the exact projections driving this “undervalued” thesis.

Result: Fair Value of $82.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as ramping up new sales channels and maintaining pricing power in a competitive landscape could undermine Synaptics’ projected turnaround.

Find out about the key risks to this Synaptics narrative.Another View: DCF Model Perspective

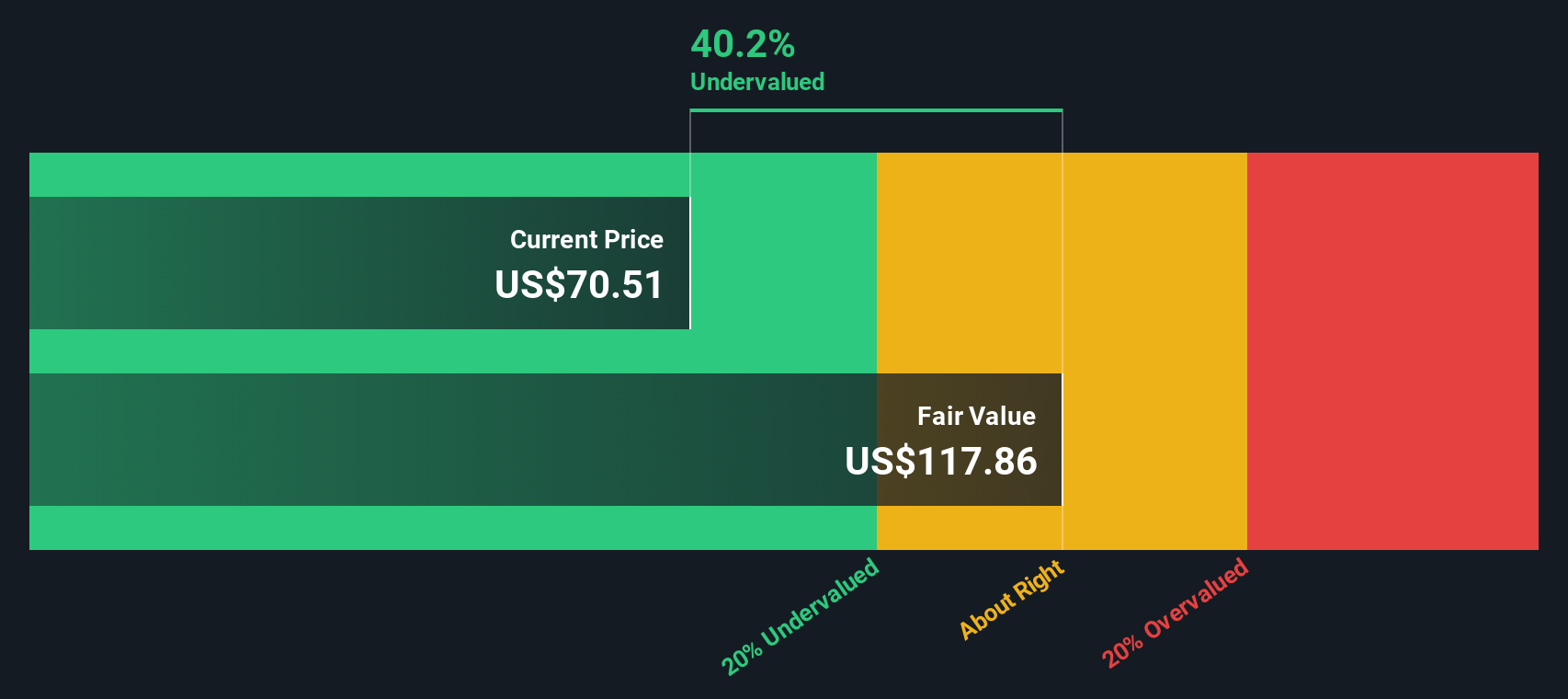

While many focus on Synaptics' valuation by comparing it to industry pricing, our DCF model takes a different approach. This model currently signals that the shares are trading below their fair value. Could this model be overlooking key industry challenges, or is it revealing a hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Synaptics Narrative

If you see the story unfolding differently or want to examine the data yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Synaptics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next investing move count by checking out these unique opportunities. Don’t let great investments slip by while the market evolves right under your nose.

- Uncover high-growth opportunities in artificial intelligence by tapping into companies shaping tomorrow’s breakthroughs with AI penny stocks.

- Secure your income stream and get peace of mind with stocks offering strong yields, all handpicked in our dividend stocks with yields > 3%.

- Ride the wave of future finance innovation by targeting businesses pioneering blockchain disruption and digital assets through cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English