Valero Energy (VLO): Exploring Current Valuation with Shares Treading Water

Most Popular Narrative: 1% Undervalued

According to the most widely followed narrative, Valero Energy is trading just below its estimated fair value, offering a potential opening for investors looking for value in the energy sector.

A strong balance sheet and $5.3 billion of available liquidity provide Valero with operational and financial flexibility to invest in growth and optimization projects. This could potentially improve future earnings. The potential for higher D4 RIN prices and an increase in the RIN obligation could positively impact the renewable diesel segment's earnings by improving margins.

Curious what’s driving Valero’s surprising valuation? The most popular narrative hints at ambitious profit targets, shifting market dynamics, and a controversial growth roadmap. Major upgrades, future cash flow, and the sector’s hottest debates are all considered in this number. Want to see what’s behind the analysts’ big call?

Result: Fair Value of $158.33 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. Asset impairments or ongoing struggles in the renewable segment could quickly undermine these optimistic forecasts.

Find out about the key risks to this Valero Energy narrative.Another View: SWS DCF Model Says Shares Look Cheap

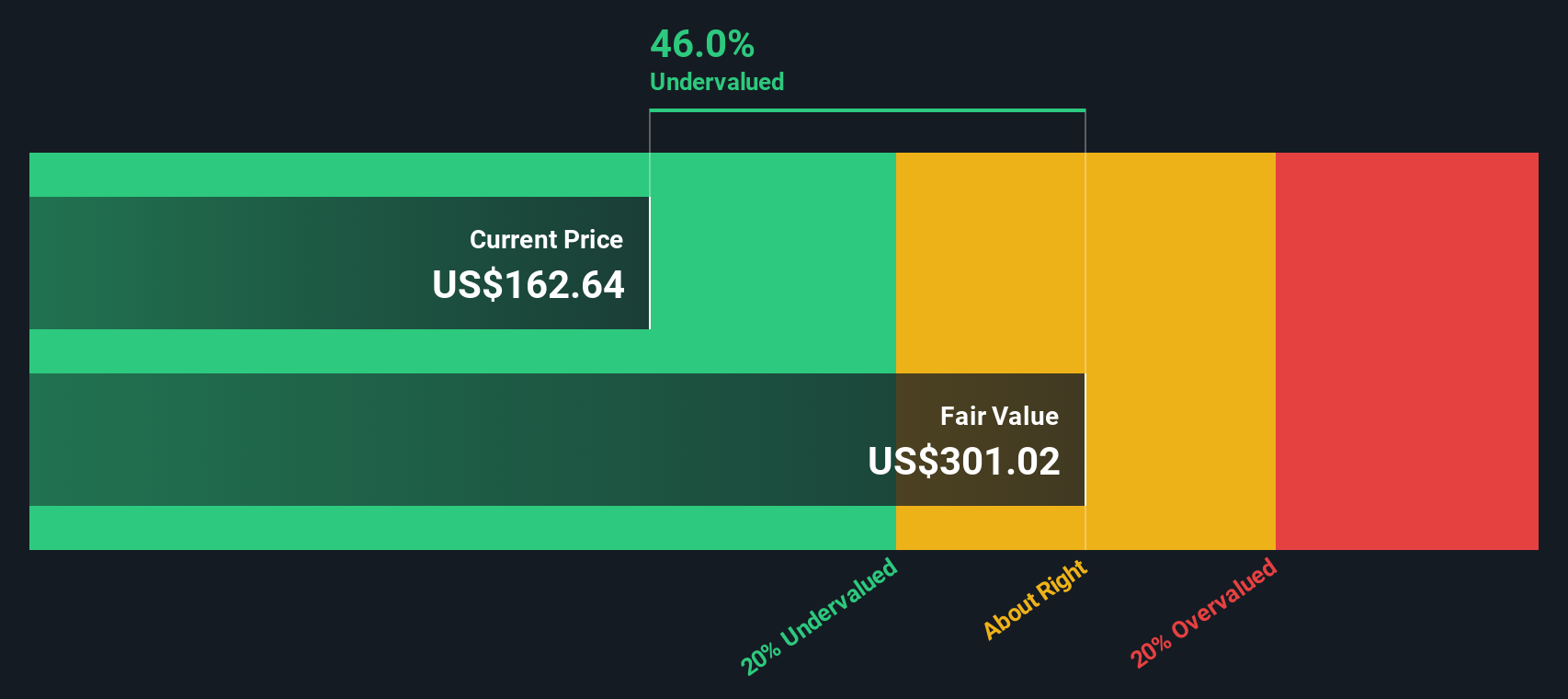

While traditional valuation looks at earnings compared to industry averages and suggests Valero might be priced steeply, our DCF model tells a different story. This approach points to shares trading below what long-term cash flows could justify. Could the real value be hiding in the numbers others overlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valero Energy Narrative

If these views do not match your outlook, or you want to see the numbers for yourself, you can dive in and form your own perspective in just a few minutes. Do it your way

A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment angles?

Don’t let your portfolio get stuck on repeat. Unlock possibilities by zeroing in on the markets’ most promising trends and untapped potential today.

- Jump on the latest shifts in financial technology and payments by scanning standout companies, all with just a tap on cryptocurrency and blockchain stocks.

- Spot tomorrow’s innovations in healthcare by browsing firms leveraging artificial intelligence for breakthroughs in diagnostics, treatment, and patient care with healthcare AI stocks.

- Seize undervalued gems before the crowd using data-driven insights via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English