Why Argan (AGX) Is Up 8.9% After Dividend Hike and Share Buyback Completion

- Argan, Inc. recently declared a 33% increase in its quarterly cash dividend to US$0.50 per share, payable on October 31, 2025, following strong second-quarter financial results and the completion of a substantial multiyear share buyback program.

- The significant dividend hike and robust earnings performance reflect the company’s ongoing focus on shareholder returns and highlight improved operational performance amid growth in project backlog.

- We’ll explore how the recent dividend increase might influence Argan’s investment outlook and expectations for long-term profitability.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Argan Investment Narrative Recap

To be a shareholder in Argan, you need to be confident in the company’s ability to capitalize on strong demand for power infrastructure, particularly natural gas-fired projects, and maintain consistent execution on large, complex EPC contracts. The recent dividend increase confirms strong cash flows and a focus on shareholder returns but does not materially change the most important short-term catalyst: sustained momentum in project backlog and contract wins. The biggest risk remains high project concentration and potential delays, which could introduce volatility in future earnings.

Among the latest company announcements, second-quarter results stand out: Argan reported strong sales and net income growth year-on-year, supporting its higher dividend and suggesting continued successful project execution. This is relevant as it underpins near-term shareholder returns and signals Argan is performing well in what remains a cyclical and competitive sector. But against these positives, investors should also be aware that success depends on ...

Read the full narrative on Argan (it's free!)

Argan's narrative projects $1.5 billion revenue and $142.0 million earnings by 2028. This requires 18.1% yearly revenue growth and a $24.8 million increase in earnings from $117.2 million today.

Uncover how Argan's forecasts yield a $230.33 fair value, in line with its current price.

Exploring Other Perspectives

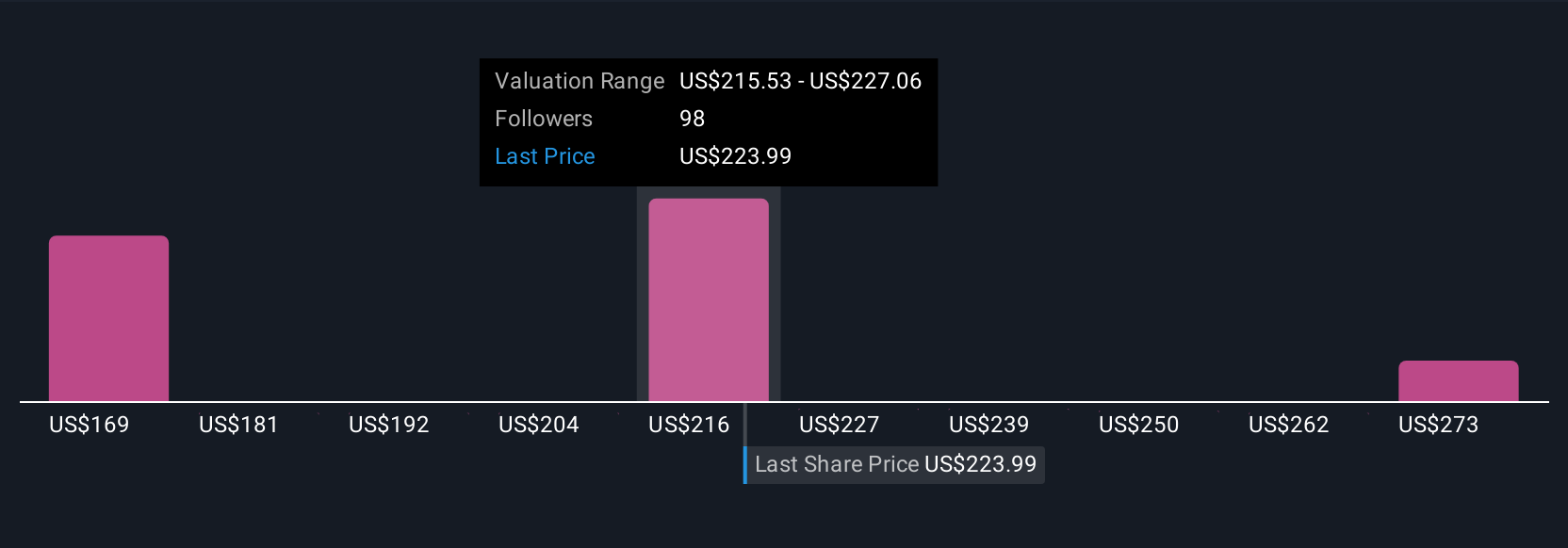

Nine fair value estimates from the Simply Wall St Community span US$171.99 to US$284.68 per share. While opinions differ widely, remember that Argan’s earnings depend on securing and safely executing a limited number of large projects, which could affect returns.

Explore 9 other fair value estimates on Argan - why the stock might be worth as much as 24% more than the current price!

Build Your Own Argan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Argan research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Argan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Argan's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English