Is Five Below’s (FIVE) Latest Expansion Enough to Offset Broader Retail Spending Challenges?

- Earlier this month, Five Below opened a new store in Peru, Illinois, featuring a Party Shop and special grand opening promotions for early guests.

- Despite recent expansion and solid operational performance, broader pressures in the retail sector have shaped the conversation around discount retailers like Five Below.

- We'll now examine how concerns over sector-wide consumer spending weigh on Five Below's investment narrative in light of its continued growth initiatives.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

Five Below Investment Narrative Recap

To be a shareholder in Five Below, you need confidence in the company’s ability to maintain robust sales and traffic growth as it expands into new markets, capitalizes on value-driven consumer behavior, and delivers operational improvements, even when sector-wide concerns about consumer spending and tariff risks persist. The recent news of a new Peru, Illinois store opening, combined with store expansion announcements, does not meaningfully alter the immediate catalyst of sustained comparable sales growth or the predominant risk of persistent margin pressure from tariffs and higher costs.

Among recent updates, the management’s raised full-year sales and earnings guidance after exceeding Q2 expectations stands out for investors focusing on near-term growth drivers. This outlook is supported by new store openings and the continued rollout of differentiated in-store experiences like the Party Shop concept, which aim to broaden Five Below’s appeal during key shopping periods without materially changing its exposure to margin risks.

Yet, in contrast to this operational momentum, investors should not overlook the persistent risk posed by elevated tariff costs and how ...

Read the full narrative on Five Below (it's free!)

Five Below's outlook projects $5.7 billion in revenue and $352.1 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 10.6% and a $79 million increase in earnings from the current $273.1 million.

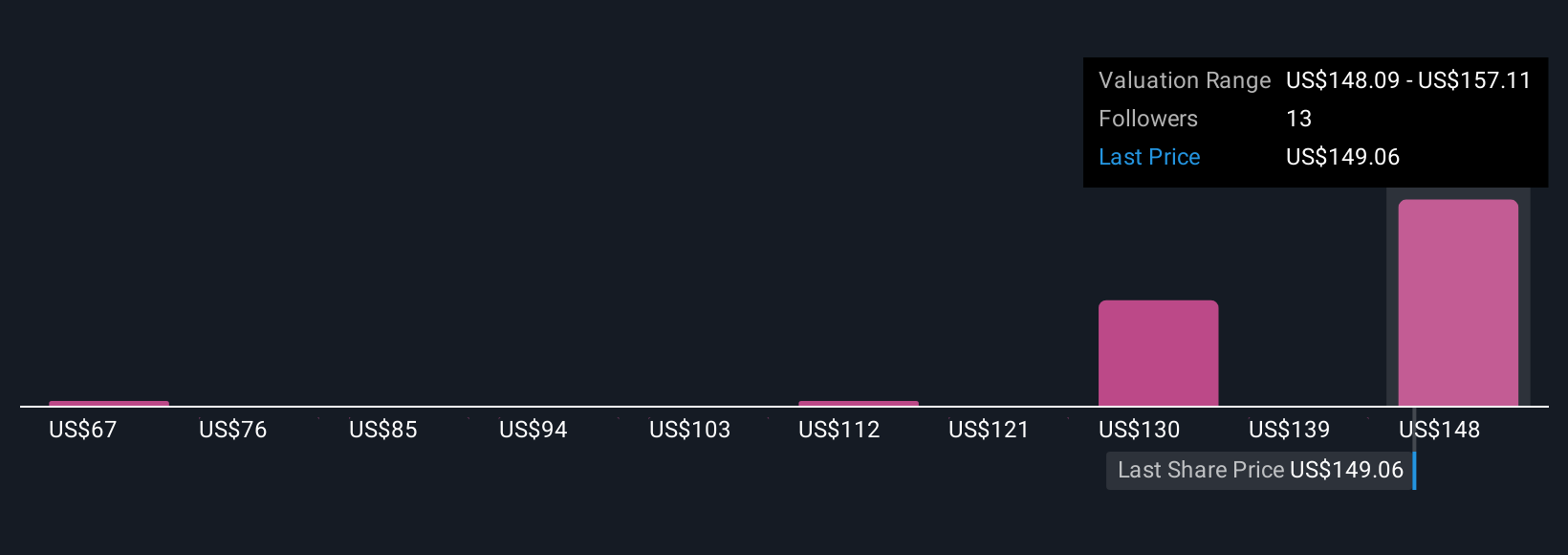

Uncover how Five Below's forecasts yield a $157.11 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set their fair value estimates for Five Below anywhere from US$67 to US$157, with four views reflecting wide divergence. Margin pressure from tariffs, highlighted in recent discussions, remains a key concern for overall profitability and outlook, be sure to compare these differing perspectives before deciding your next steps.

Explore 4 other fair value estimates on Five Below - why the stock might be worth less than half the current price!

Build Your Own Five Below Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Five Below research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Five Below research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Five Below's overall financial health at a glance.

No Opportunity In Five Below?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English