Brilliance China Automotive (SEHK:1114): Exploring Valuation After Last Year’s Dramatic Share Price Surge

What’s Moving Brilliance China Automotive Holdings Stock?

Brilliance China Automotive Holdings (SEHK:1114) has started catching more investor attention lately, though there’s no dramatic headline catalyzing the shift. Sometimes these quieter moves, without headline-grabbing events, raise interesting questions about what the numbers are telling us underneath the surface. Is there something in the data that long-term investors should pay closer attention to?

Taking a broader look, the past year has seen Brilliance China Automotive Holdings’s stock climb an eye-watering 140%, which easily eclipses what most of its peers have managed. Momentum, however, has started to cool a bit over recent months. After a rapid run-up, performance so far this year is slightly negative, with the last quarter showing a moderate rebound. The numbers show the company isn’t just treading water, but the pace has shifted multiple times as sentiment and outlook evolve.

So, after such a huge jump last year and some mixed signals since, is Brilliance China Automotive Holdings a bargain or is the market simply building in expectations the business will keep growing in years to come?

Price-to-Earnings of 5x: Is it justified?

Brilliance China Automotive Holdings is trading at a Price-to-Earnings (P/E) ratio of 5x, which is significantly lower than both its industry peers and the broader market. This suggests that the stock appears undervalued relative to the typical benchmarks used for car makers on the Hong Kong exchange and across Asia.

The P/E ratio is a widely used metric that compares a company’s current share price to its per-share earnings. For auto companies, it helps investors judge whether current earnings sufficiently reflect potential future growth or if the market is being overly cautious about risks.

Given Brilliance China Automotive’s earnings outlook and present profitability, this low P/E may indicate that investors are pricing in relatively modest near-term growth or perhaps expressing doubts about the ability to sustain past performance. However, the discount compared to peer averages could offer long-term investors an attractive entry point, especially if the company can deliver on growth forecasts.

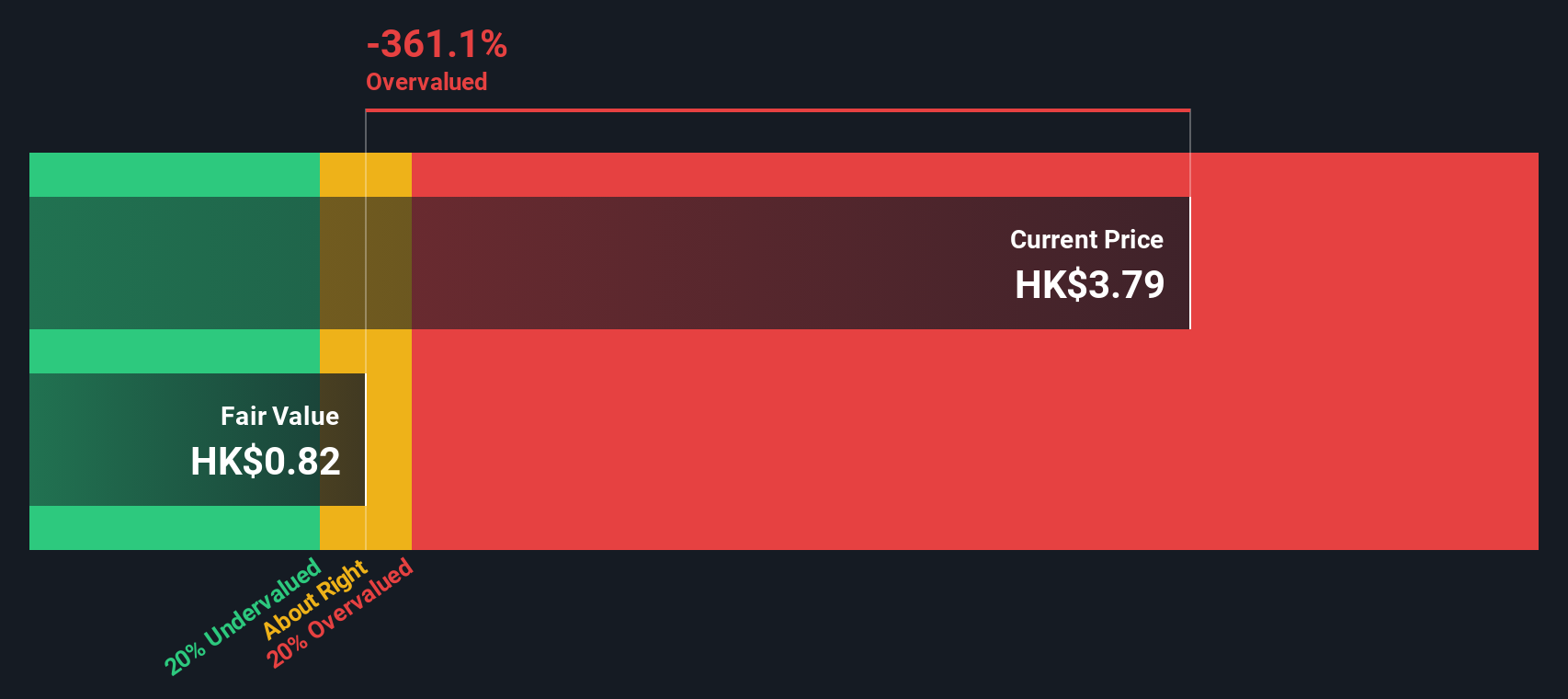

Result: Fair Value of $2.21 (OVERVALUED)

See our latest analysis for Brilliance China Automotive Holdings.However, revenue and net income growth remain modest. This signals that weaker fundamentals or unmet growth expectations could change investor sentiment quickly.

Find out about the key risks to this Brilliance China Automotive Holdings narrative.Another View: Discounted Cash Flow Tells a Different Story

Beyond what the low earnings ratio suggests, our DCF model looks at Brilliance China Automotive Holdings differently. The conclusion is that the shares might not be trading at a bargain after all. Could this method be highlighting risks the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brilliance China Automotive Holdings Narrative

If you want a different perspective or like diving into the numbers yourself, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your Brilliance China Automotive Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next move with confidence by uncovering standout stock opportunities. The Simply Wall Street screener puts specialized, high-potential picks right at your fingertips. Don’t let the best opportunities pass you by.

- Supercharge your portfolio with fresh income streams and check out dividend stocks with yields > 3%, delivering yields above 3%.

- Ride the AI revolution by spotting tomorrow’s leaders in technology innovation through our AI penny stocks.

- Snap up shares that the market has overlooked for their growth potential by starting with our curated set of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English