Assessing Crescent Energy's (CRGY) Valuation After Share Surge and Uncertain Earnings Outlook

Thinking about what to do with Crescent Energy (CRGY) after its recent surge? Investors have taken notice as shares jumped 5.8%, powered by strong commodity prices and Crescent’s established foothold in major U.S. basins like Eagle Ford and Uinta. While its mix of low-cost production assets looks like a winning formula for profitability, the story has gotten more complicated lately as downward revisions to expected earnings per share have clouded the outlook just as momentum seemed to be building.

Taking a step back, Crescent Energy’s stock has had a tough year, down more than 14% over the past twelve months. While the company continues to post healthy revenue growth and benefit from its multi-basin strategy, expectations for the coming quarters have softened as analysts took a sharp 37% cut to earnings estimates this month. That shift has unsettled some investors, tempering the enthusiasm around Crescent’s operational strengths and recent price upticks.

After these swings, the big question is whether the market is undervaluing Crescent Energy’s future potential or if these risks are already priced in. Could this be a buying window, or is the market simply bracing for slower growth ahead?

Most Popular Narrative: 41% Undervalued

According to the most widely followed narrative, Crescent Energy shares are considered substantially undervalued, with the current price trading at a steep discount to fair value based on forward earnings and growth assumptions.

Persistent growth in global energy demand, alongside heightened energy security concerns among major economies, is likely to support stable or higher commodity prices and underpin ongoing demand for Crescent Energy's oil and gas production. This dynamic could provide a tailwind to future revenue and cash flow.

Ever wondered what is powering such a bullish narrative? The math behind this valuation comes from a daring blend of aggressive future profit margins and a shrinking valuation multiple, typically reserved for industry giants during periods of strong market performance. If you want to see which bold assumptions about revenue growth, earnings, and sector strategy are fueling this price target, the full narrative breaks it all down.

Result: Fair Value of $14.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on acquisitions and regional regulatory shifts could undermine Crescent Energy’s ambitious outlook, potentially keeping investor sentiment restrained in the near term.

Find out about the key risks to this Crescent Energy narrative.Another View: Market-Based Comparison Tells a Different Story

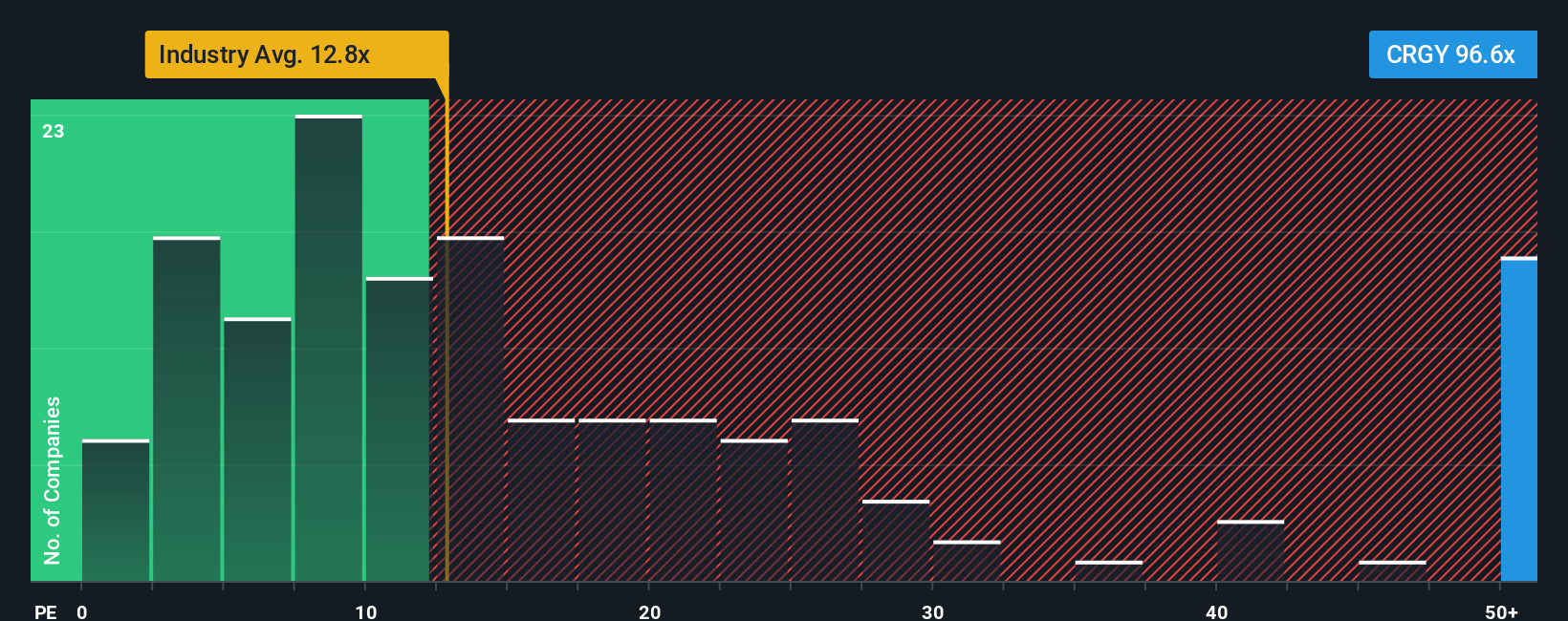

Taking a closer look at Crescent Energy’s current valuation against industry standards reveals a different perspective. This method suggests the stock appears more expensive than its sector peers, which challenges the idea of a clear bargain. Which perspective best matches reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crescent Energy Narrative

If you see things differently, or want to dig into the numbers yourself, you can craft your own story for Crescent Energy in just a few minutes: Do it your way.

A great starting point for your Crescent Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment moves?

Don’t let these opportunities slip away. Expand your possibilities and get ahead of the crowd by checking out powerful stock ideas outside the usual headlines.

- Target strong returns with lesser-known companies boasting robust fundamentals by browsing penny stocks with strong financials that are making waves beneath the radar.

- Unlock potential growth in intelligent automation and emerging innovation. See which next-generation firms are shaping the future with AI penny stocks.

- Position yourself for value gains by reviewing companies trading below intrinsic value using our expert picks for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English