Why Sarepta Therapeutics (SRPT) Is Down 7.1% After ELEVIDYS Gene Therapy Disclosure Probe Announced And What’s Next

- An investigation was announced for long-term shareholders of Sarepta Therapeutics following allegations of securities law violations related to disclosures about the ELEVIDYS gene therapy’s safety and trial procedures.

- This development introduces questions about corporate governance and transparency, which are especially significant given the company's ongoing communications around its flagship therapeutic platform.

- We’ll explore how new legal scrutiny over ELEVIDYS safety disclosures could impact Sarepta Therapeutics’ investment outlook and risk profile.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sarepta Therapeutics Investment Narrative Recap

For Sarepta Therapeutics, belief in the future of gene therapy, especially the success and adoption of ELEVIDYS, remains central for shareholders. The recent investigation into disclosure practices around ELEVIDYS’ safety raises new questions, but does not appear to materially change the most important short term catalyst: regulatory clarity and resumptions of product shipments. However, it directly amplifies the biggest current risk, which is further regulatory or market reaction to adverse safety events.

Among Sarepta’s many announcements, the voluntary pause on ELEVIDYS shipments pending FDA review stands out as most relevant. This pause, tied to safety and regulatory concerns, aligns closely with the investigation news and is particularly impactful to the catalysts tied to product uptake, revenue timing, and market confidence.

Yet, there is a substantial risk that, beyond the headline investigation, further developments could limit patient access or slow adoption, something investors should be watching for as...

Read the full narrative on Sarepta Therapeutics (it's free!)

Sarepta Therapeutics' narrative projects $1.4 billion revenue and $171.6 million earnings by 2028. This requires a 17.0% yearly revenue decline and an earnings increase of $229.6 million from -$58.0 million today.

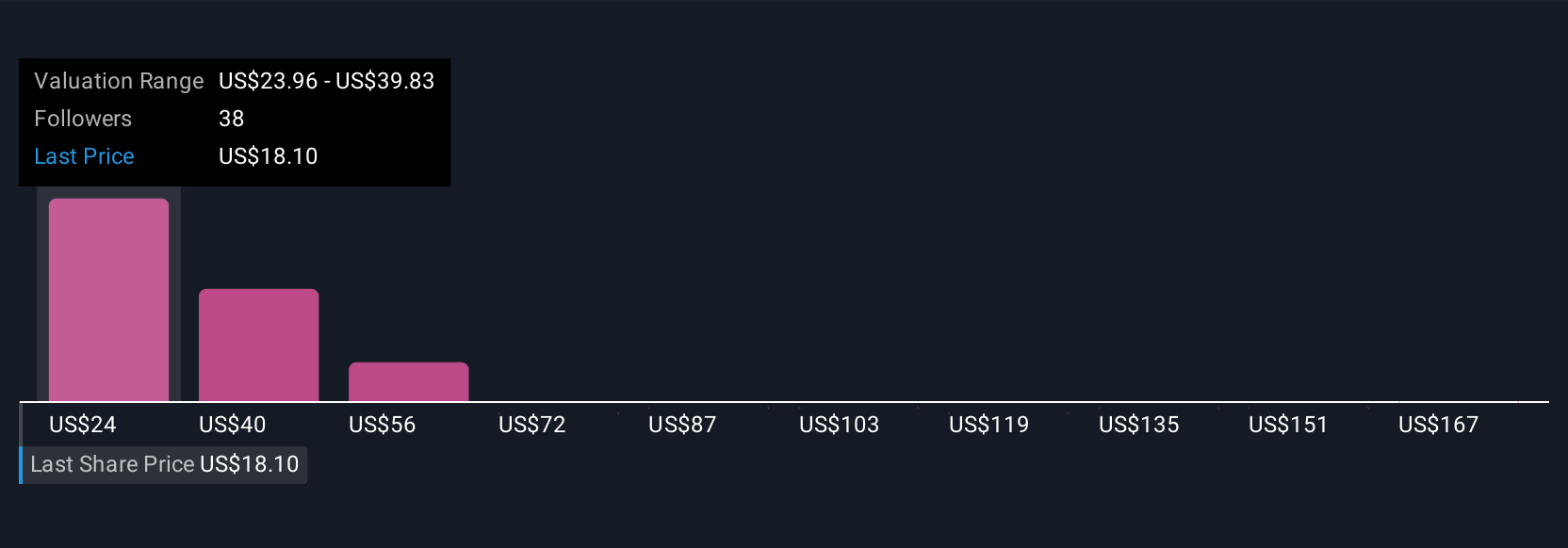

Uncover how Sarepta Therapeutics' forecasts yield a $23.96 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Eleven individual fair value estimates from the Simply Wall St Community range from US$23.96 to US$182.67 per share. With this wide variance, your view on potential regulatory risks may weigh heavily on how you interpret Sarepta's current position and long-term prospects.

Explore 11 other fair value estimates on Sarepta Therapeutics - why the stock might be worth over 10x more than the current price!

Build Your Own Sarepta Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sarepta Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sarepta Therapeutics' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English