Mobileye (NasdaqGS:MBLY) Valuation in Focus After EU Trade Decision Raises New Uncertainties

Mobileye Global (MBLY) is making headlines after the European Union moved to partially pause its free trade agreement with Israel in response to ongoing tensions in the region. This matters for investors because Mobileye, an Israel-based innovator supplying advanced driver-assistance systems, counts major European automakers like Volkswagen, BMW, and Stellantis among its key clients. The prospect of new tariffs or changing trade conditions introduces additional risk to Mobileye’s revenue streams and, more importantly, its future margin profile.

Shares dropped 6.85% on the news, reflecting market concern over these uncertainties. Over the past year, however, Mobileye’s stock has delivered a 25% total return, outpacing many peers, even as momentum has wavered in recent months. This latest move follows a period of more muted near-term returns and increased volatility as investors weigh the implications of shifting European policy and ongoing conflict for the company’s long-term prospects.

With all eyes on European trade developments and the stock price seeing a sharp move lower, the question is whether this pullback signals an undervalued opportunity or if the market is already factoring in everything Mobileye might face next.

Most Popular Narrative: 31% Undervalued

The most widely followed narrative suggests Mobileye Global is trading at a deep discount to fair value, offering a potentially attractive entry point for investors. This perspective reflects analyst consensus on future earnings, margin expansion, and market opportunities that could shift the company’s valuation higher if realized.

Mobileye's success in rapidly achieving design wins in Q1 showcases robust forward demand for single-chip front camera systems and future volume expansion, indicating potential revenue growth. There is strategic alignment with OEMs to integrate Mobileye's advanced technology and software for future safety features, forecasting enhanced long-term earnings given the sustained demand for multi-camera setups and highway hands-free driving systems.

Curious how Mobileye’s ambitious OEM partnerships and bold product rollouts could fuel dramatic shifts in profits and valuation? The narrative’s fair value hinges on major leaps in earnings speed, unprecedented revenue growth, and tight margin targets. Want to discover which forecasting leaps underpin this 31% undervaluation call? There are some aggressive financial assumptions baked in; you’ll have to dig deeper to see them unfold.

Result: Fair Value of $19.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as trade frictions or slower-than-expected adoption by automakers could quickly challenge the results analysts are currently betting on.

Find out about the key risks to this Mobileye Global narrative.Another View: Industry Comparison Tells a Different Story

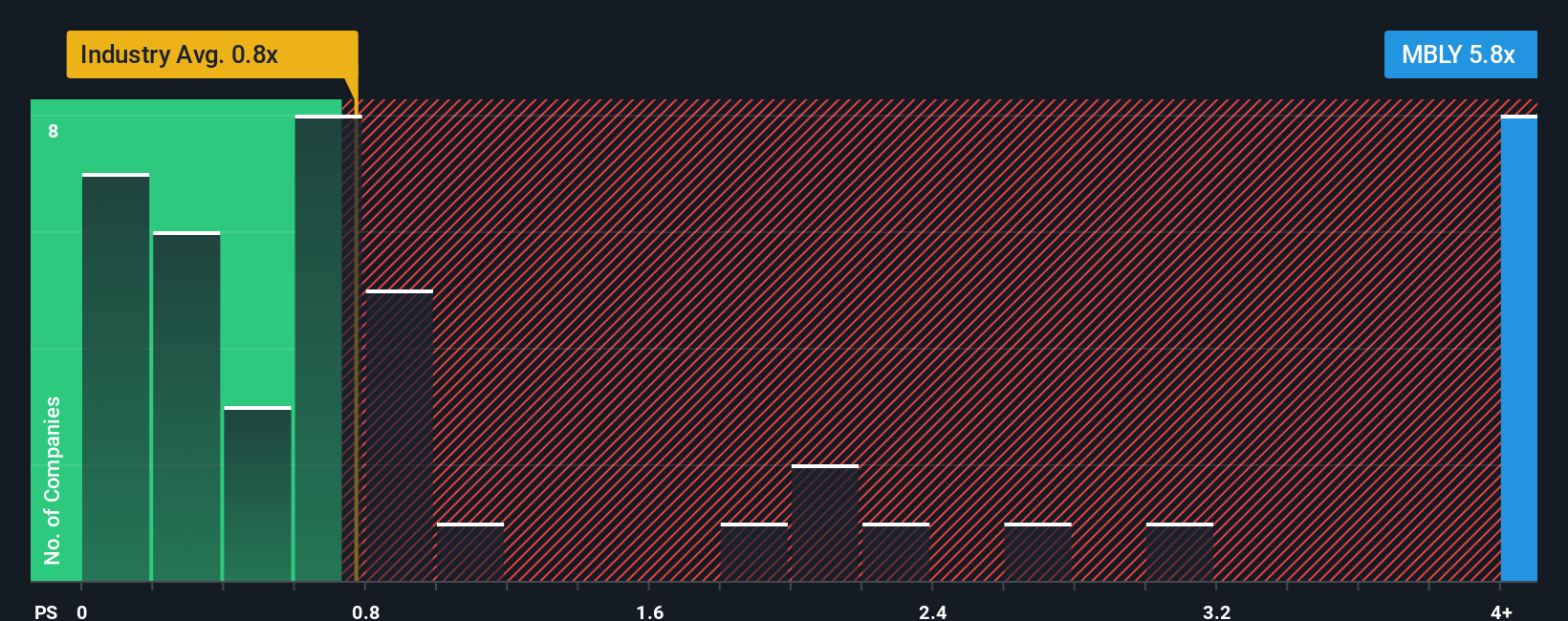

Looking at how Mobileye trades compared to the industry average, the shares appear expensive by this metric. This raises the question: is the current discount to fair value truly as appealing as it first looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If you’d rather chart your own conclusions or want to explore the numbers firsthand, you can quickly build a custom narrative based on your research, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Looking for More Investment Opportunities?

Serious about your portfolio? Don’t miss the chance to get ahead with new trends. Tap into our curated stock screens for untapped ideas that others might overlook.

- Uncover growth with small-cap contenders by checking out penny stocks with strong financials and see which agile businesses are built to break out.

- Earn more from your holdings by jumping into dividend stocks with yields > 3% to spot companies rewarding investors with yields above 3%.

- Get ahead of the tech curve and seize opportunities among innovators in artificial intelligence through AI penny stocks today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English