Is Albemarle’s Drop After Sluggish Lithium Demand a Key Opportunity in 2025?

Thinking about Albemarle for your portfolio right now? You are not alone. Whether you are considering holding, buying, or just watching from the sidelines, Albemarle has been on a remarkable ride that is capturing plenty of attention and debate. The stock price has slipped sharply, down 7.3% in the last week and 7.6% over the past month. Widen the lens and you will see Albemarle is down 13.1% from a year ago, tumbling an eye-opening 73.3% over three years. Even the five-year return is slightly negative, sitting at -15.3%. There is no denying the market’s attitude has shifted, and it is not just short-term nerves at play here.

Much of this turbulence can be traced to changing sentiment about demand for lithium, which is crucial for electric vehicle batteries. Headlines around global lithium supply expansions, shifting electric vehicle sales forecasts, and broader market caution have all played their part, prompting investors to rethink both growth and risk for Albemarle’s future.

But here is where things get interesting. Despite the price struggles, Albemarle’s valuation score comes in at 3 out of 6, based on key metrics that suggest the stock is undervalued in half the checks. Does that mean the market is being too harsh, or are there issues under the surface? The answer is not a simple one, so let us walk through each of the major valuation approaches next, and then dig into what might be an even smarter way to get the full picture.

Why Albemarle is lagging behind its peersApproach 1: Albemarle Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those projections back to today’s value. This method helps investors gauge what a stock should be worth based on expectations for how much cash the company can generate over time.

For Albemarle, the current Free Cash Flow (FCF) sits at -$330.5 Million, reflecting recent challenges in operations and market demand. Looking forward, analysts expect FCF to recover, forecasting $301.5 Million in 2027. Ten-year projections, which extend beyond analyst estimates and use extrapolated trends, show FCF rising steadily to just over $1 Billion by 2035. All of these figures are in USD.

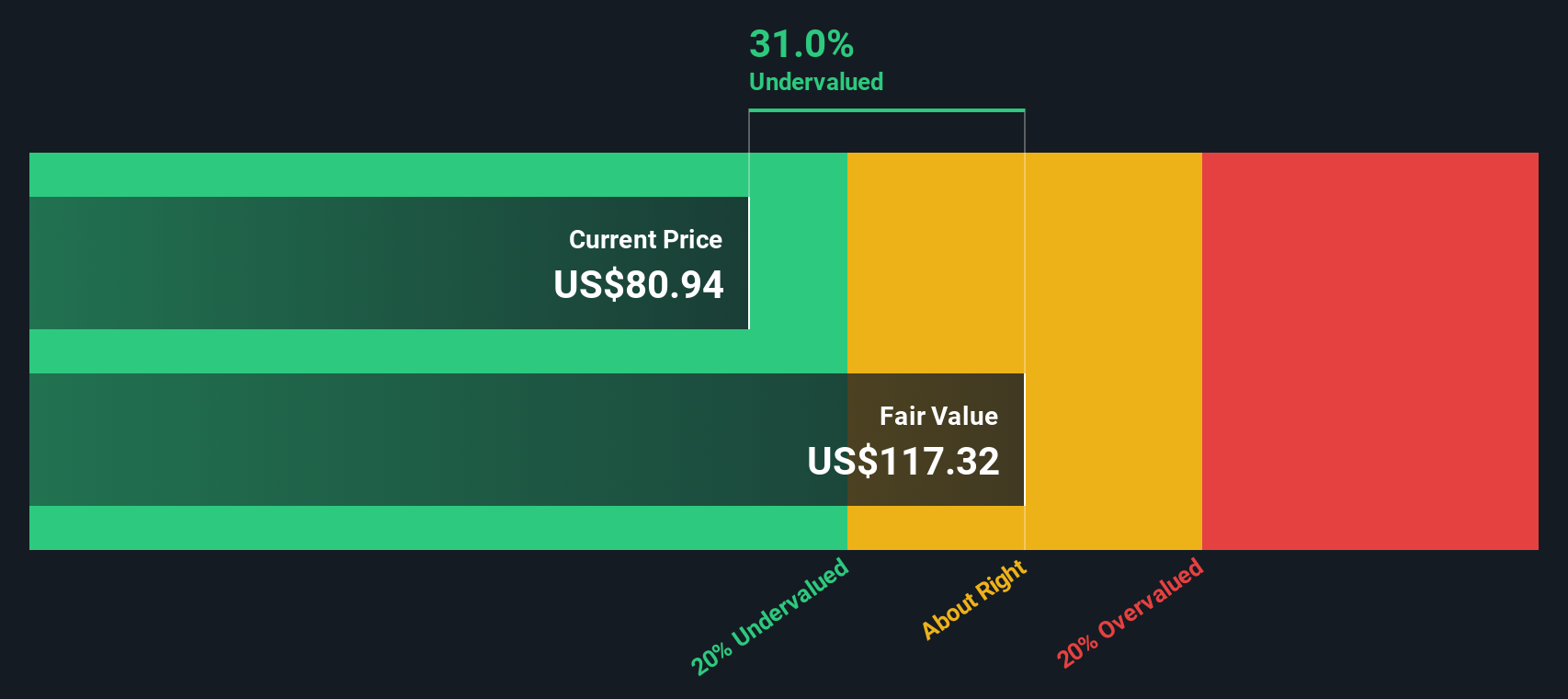

Based on the cash flow projections and the DCF methodology, Albemarle’s intrinsic value is estimated at $116 per share. This marks the stock as about 34.5% undervalued compared to the current market price. This suggests that the market may be pricing in more pessimism than the company’s long-run cash flow potential would indicate.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Albemarle.

Approach 2: Albemarle Price vs Sales

For many profitable companies, the price-to-sales (P/S) ratio is a widely-used valuation metric. It is especially useful when earnings are volatile or negative, as it offers a straightforward view of how the market values every dollar of sales generated by the company. A “normal” or “fair” P/S multiple depends not only on the company’s recent sales, but also on growth expectations, risk profile, and how those compare to the wider industry.

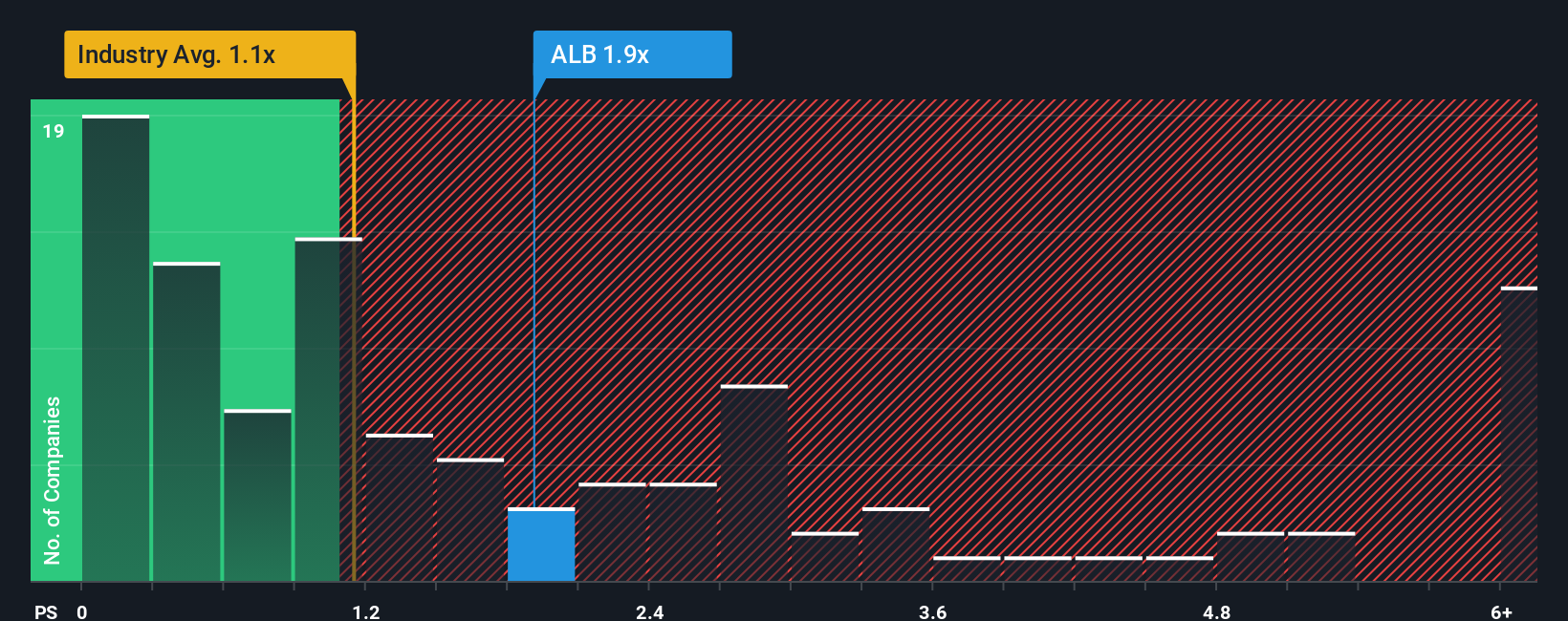

Currently, Albemarle trades at a P/S ratio of 1.79x. This places it slightly above the industry average for Chemicals (1.15x) and just under its peer group average of 1.88x. At first glance, this suggests the market is pricing Albemarle at a modest premium to the sector, possibly reflecting its distinct position or growth prospects within the industry.

However, Simply Wall St’s “Fair Ratio” gives a more tailored assessment. The Fair Ratio for Albemarle stands at 1.20x, calculated using a proprietary approach that incorporates the company’s future growth, profit margins, industry environment, market cap, and company-specific risks. Unlike simple comparisons to peers or industry averages, the Fair Ratio takes into account a broader and more nuanced dataset, offering a sharper benchmark for valuation.

In Albemarle’s case, the actual P/S multiple is substantially above the Fair Ratio. This indicates the stock is currently trading at a premium compared to what its fundamentals would suggest.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Albemarle Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your personalized story or perspective on a company, your reasoning for what makes a stock attractive or risky, and what you believe its future sales, earnings, and margins could look like. Narratives uniquely link a company’s story to a forward-looking financial forecast and, ultimately, a fair value. This makes it easier to connect real-world trends and company events directly to your investment decision.

This approach is not just for the pros. Narratives are easily created and shared on Simply Wall St’s platform, inside the Community page, used every day by millions of investors. They help you decide when to buy or sell by explicitly pairing your own Fair Value calculation with the current share price, so you can see if the market matches your expectations. Plus, Narratives update automatically as new information such as news, earnings, or company announcements comes in, so your view stays current.

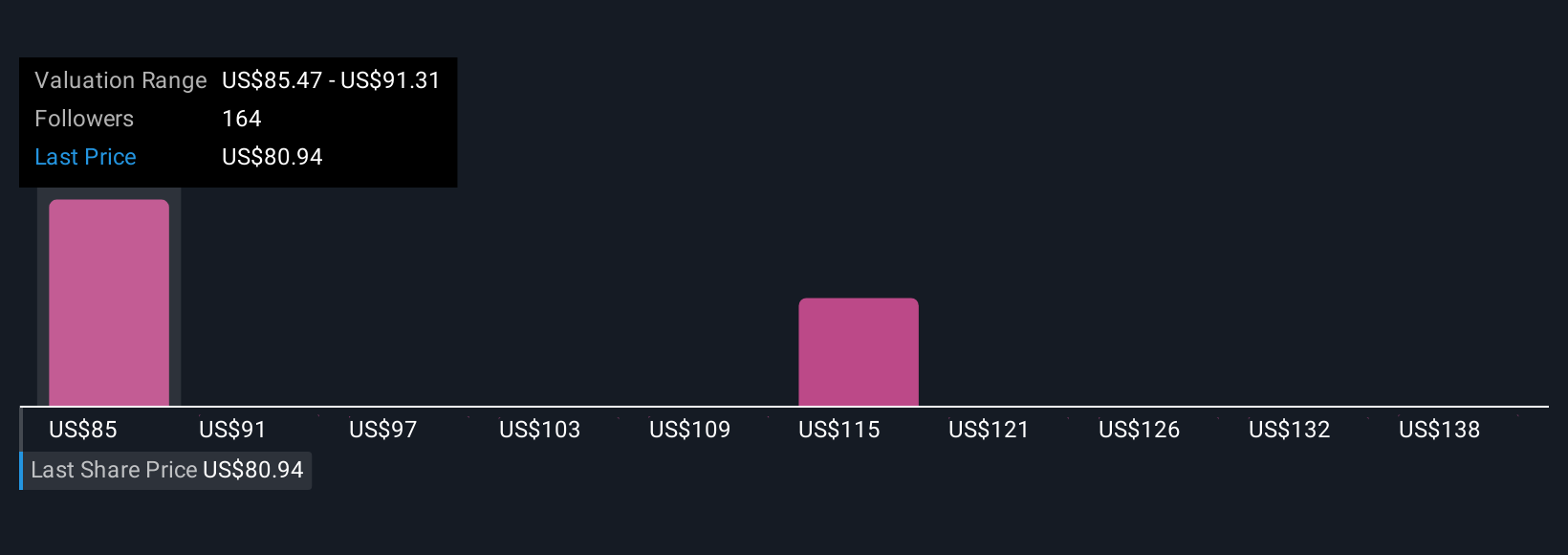

For example, some investors see policy tailwinds and Albemarle’s cost cuts as unlocking big long-term value, supporting bullish price targets near $200. Others focus on lithium price uncertainty and operational risks, with more cautious views and price targets as low as $58. Narratives empower you to clearly see and act on your unique outlook, backed by numbers and real-time updates.

Do you think there's more to the story for Albemarle? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English