Defense Tech Partnership Could Be a Game Changer for Gentex (GNTX)

- On September 9, 2025, Gentex Corporation announced its role as a key partner in the U.S. Army's Soldier Borne Mission Command (SBMC) program, providing advanced helmet and communications integration for next-generation Heads Up Displays under a contract awarded to Anduril Industries.

- This major defense collaboration leverages Gentex's established Ops-Core helmet and AMP communication technologies, reinforcing its position at the forefront of modular soldier-vision systems and military technology integration.

- We'll explore how Gentex's participation in the SBMC program could impact its investment narrative, particularly through expanded defense sector opportunities.

Find companies with promising cash flow potential yet trading below their fair value.

Gentex Investment Narrative Recap

For shareholders in Gentex, the core belief is that the company can successfully broaden its business from automotive components into advanced defense and safety systems, while navigating ongoing pressures in its traditional product lines. The new U.S. Army partnership meaningfully boosts Gentex’s exposure to defense sector opportunities, but it does not change the fact that the continued trend of decontenting in China’s auto market remains the most important risk over the next year.

Of Gentex’s recent company updates, the launch of the next-generation Ops-Core FAST® SF Helmet System (June 30, 2025) stands out as most relevant, reinforcing its investment in modular soldier systems ahead of the SBMC announcement. This product development directly connects to the company’s biggest near-term catalyst: expanding into higher-margin defense and mission-critical applications using its proven helmet and communication platform technology.

However, investors should also be aware that despite these moves into defense markets, persistent decontenting by Chinese automotive OEMs could still have a material impact on future revenue if automakers continue scaling back advanced features...

Read the full narrative on Gentex (it's free!)

Gentex's outlook anticipates $3.0 billion in revenue and $529.5 million in earnings by 2028. This scenario assumes a 7.4% annual revenue growth rate and a $134.7 million increase in earnings from the current $394.8 million.

Uncover how Gentex's forecasts yield a $30.56 fair value, a 7% upside to its current price.

Exploring Other Perspectives

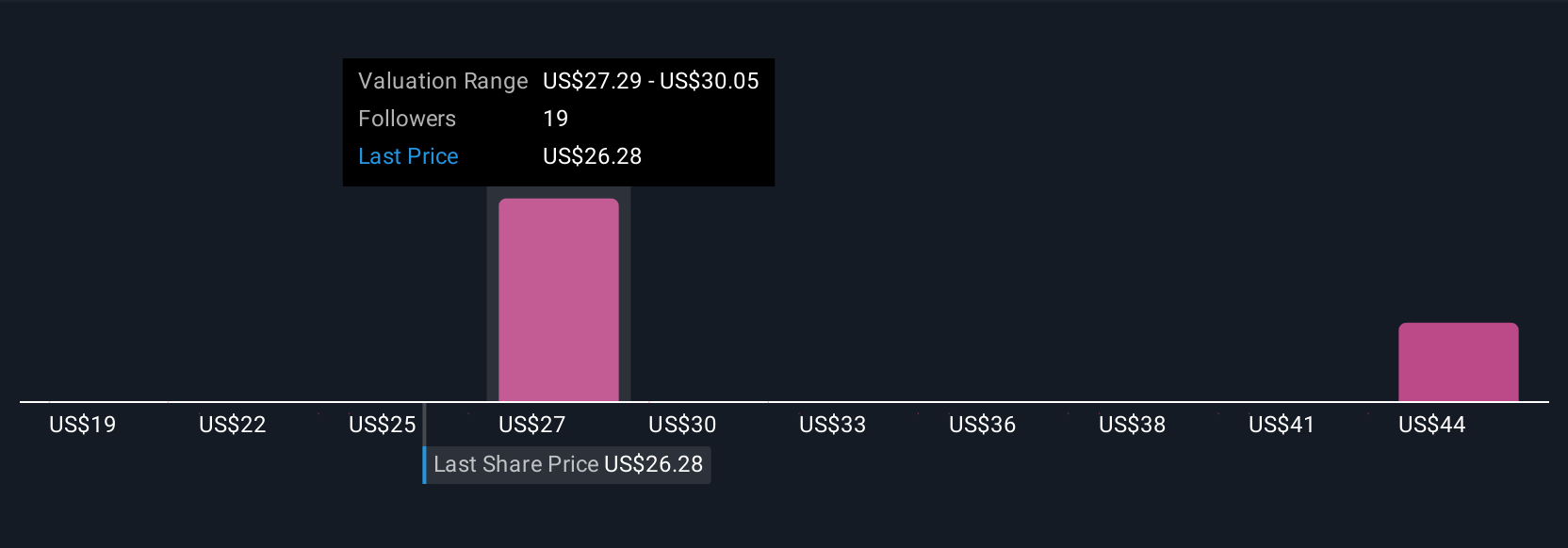

Five members of the Simply Wall St Community set Gentex’s fair value between US$19 and US$40.24 per share. Opinions remain divided as robust defense contracts are weighed against ongoing margin pressures and concentration risks, explore these perspectives for a fuller view.

Explore 5 other fair value estimates on Gentex - why the stock might be worth as much as 41% more than the current price!

Build Your Own Gentex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gentex research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Gentex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gentex's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English