Discover Asian Penny Stocks To Watch In September 2025

As global markets navigate the anticipation of interest rate cuts and the ongoing AI boom, Asian markets have been experiencing their own shifts, with notable movements in China and Japan. For investors willing to explore beyond established giants, penny stocks—often representing smaller or newer companies—remain a fascinating area of potential growth. Despite being considered an outdated term, these stocks offer opportunities for those seeking value at lower price points, especially when backed by solid financial foundations.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.96 | THB3.91B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.06 | HK$2.49B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.64 | HK$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.97 | SGD393.13M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.19 | SGD12.55B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB5.00 | THB10.1B | ✅ 3 ⚠️ 3 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.43 | SGD161.09M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 981 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Wealthink AI-Innovation Capital (SEHK:1140)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wealthking Investments Limited, with a market cap of HK$1.33 billion, operates as an investment holding company in Hong Kong.

Operations: The company generates revenue primarily through its investment holding segment, amounting to HK$275.63 million.

Market Cap: HK$1.33B

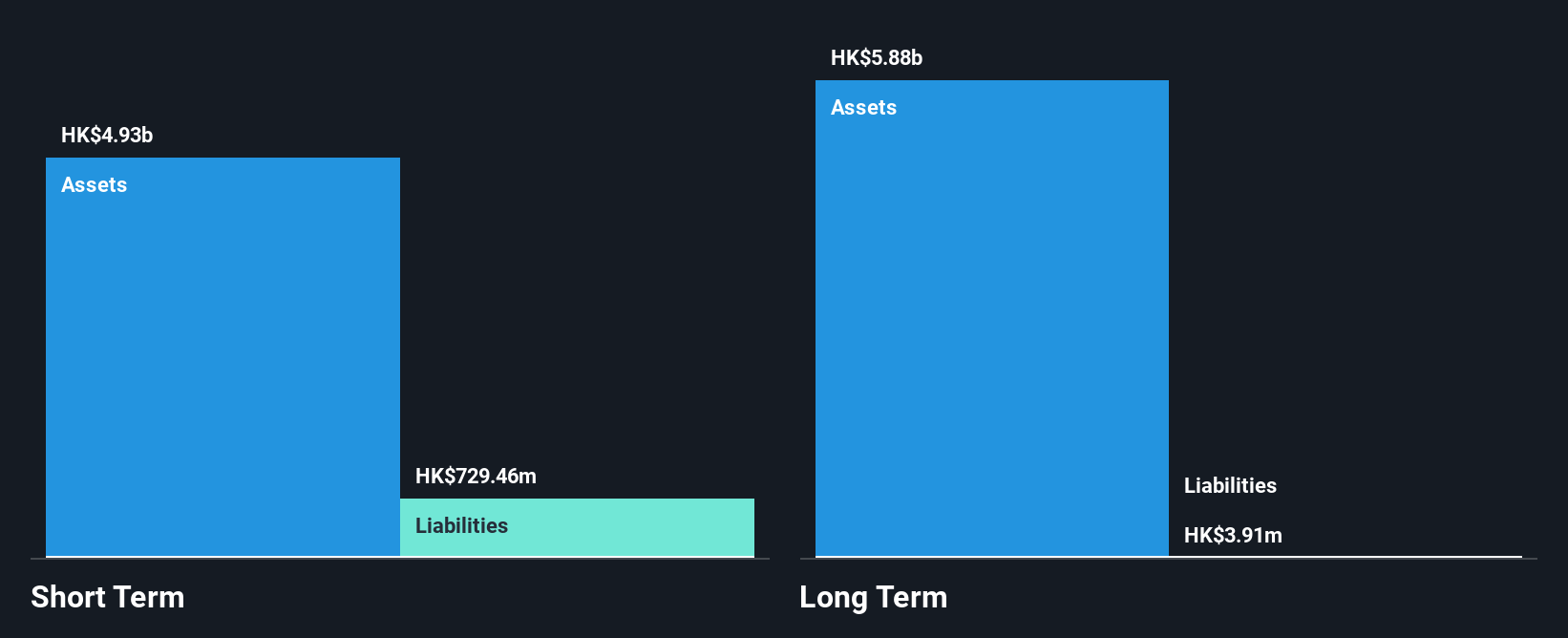

Wealthink AI-Innovation Capital's recent financial performance highlights its position within the penny stock category, with a market cap of HK$1.33 billion and revenues of HK$273.07 million for the year ending March 31, 2025. The company has shown profit growth, reporting net income of HK$64.16 million compared to HK$53.65 million the previous year, although sales have declined slightly from HK$308.33 million. Its short-term assets significantly exceed both short and long-term liabilities, indicating solid liquidity management despite negative operating cash flow and low return on equity at 0.6%. Recent board changes include appointing Ms. Wang Yun as Company Secretary, enhancing corporate governance expertise with her extensive background in governance and fintech sectors.

- Jump into the full analysis health report here for a deeper understanding of Wealthink AI-Innovation Capital.

- Learn about Wealthink AI-Innovation Capital's historical performance here.

OKP Holdings (SGX:5CF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OKP Holdings Limited is a transport infrastructure and civil engineering company operating in Singapore and Australia, with a market cap of SGD349.94 million.

Operations: The company's revenue is derived from three main segments: Maintenance, which contributes SGD66.95 million; Construction, accounting for SGD151.86 million; and Rental Income, generating SGD4.83 million.

Market Cap: SGD349.94M

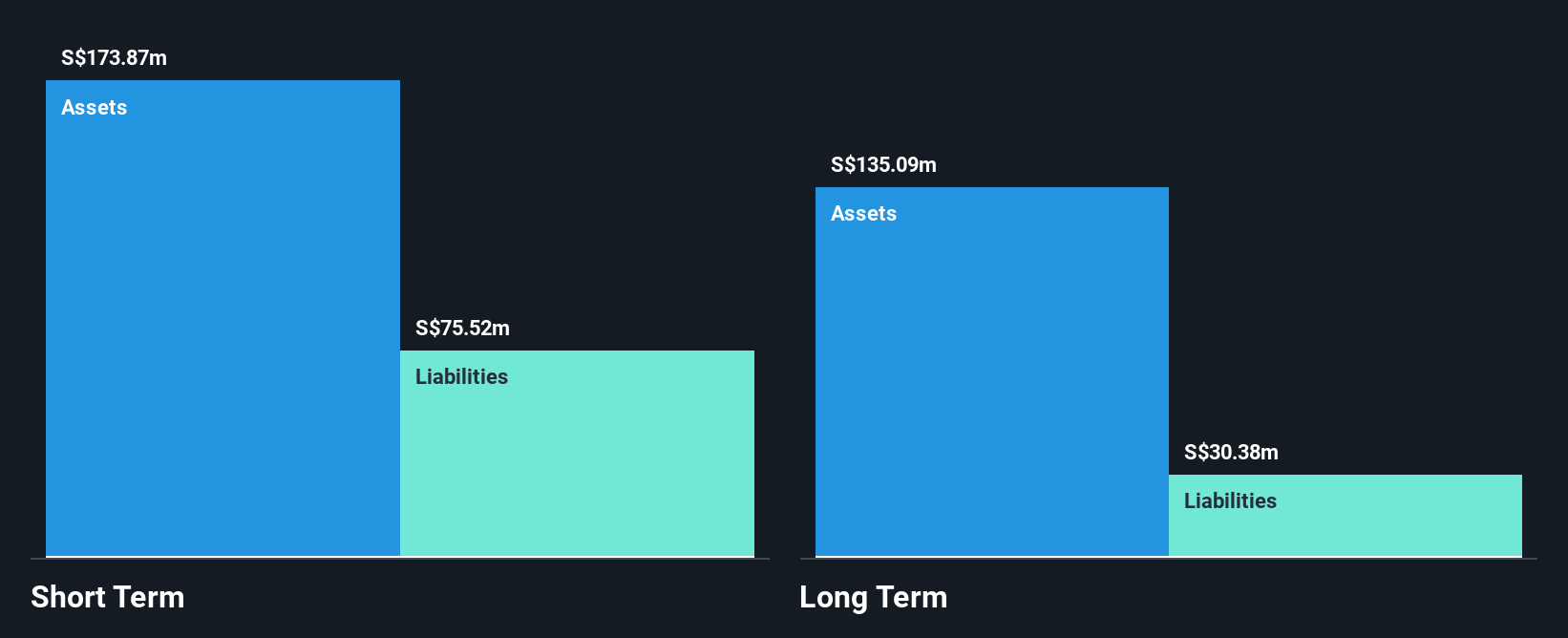

OKP Holdings Limited's recent earnings report for the half-year ending June 30, 2025, revealed a strong financial performance with sales of S$104.33 million and net income of S$19.13 million. The company's debt is well-managed, with cash exceeding total debt and operating cash flow covering debt obligations effectively. OKP's short-term assets surpass both its short-term and long-term liabilities, showcasing robust liquidity management. Earnings growth has accelerated significantly over the past year at 95.9%, outpacing industry averages, although return on equity remains low at 18.5%. The experienced management team further supports operational stability and strategic execution.

- Click to explore a detailed breakdown of our findings in OKP Holdings' financial health report.

- Examine OKP Holdings' past performance report to understand how it has performed in prior years.

Zhejiang Yasha DecorationLtd (SZSE:002375)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yasha Decoration Co., Ltd operates in building decoration, curtain wall decoration, and intelligent system integration, with a market cap of CN¥5.26 billion.

Operations: The company generates revenue primarily from the Building Decoration Industry, contributing CN¥10.86 billion, followed by the Manufacturing Industry with CN¥308.68 million.

Market Cap: CN¥5.26B

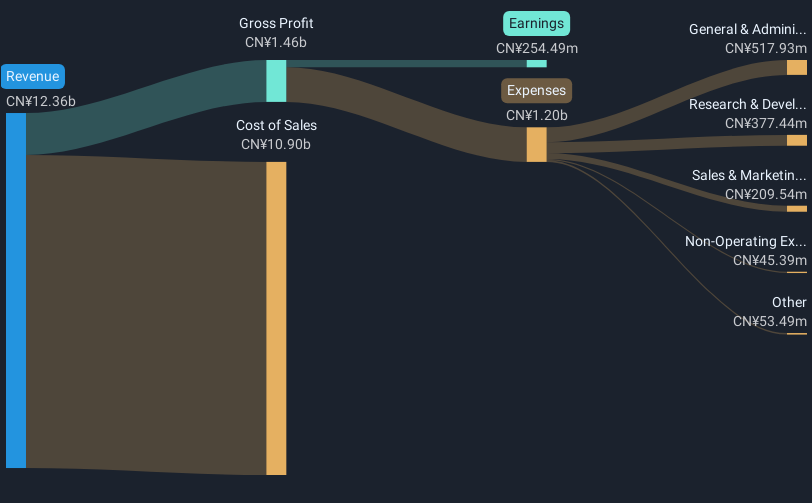

Zhejiang Yasha Decoration Co., Ltd reported half-year revenue of CN¥4.89 billion, slightly down from the previous year, but net income improved to CN¥153 million. The company's financial health is underpinned by strong liquidity, with short-term assets exceeding both short-term and long-term liabilities significantly. Interest payments are well-covered by EBIT at 12.8 times, and the debt-to-equity ratio has decreased over five years to 16.6%. Despite a low return on equity of 3.6%, profit margins have improved over the past year, supported by stable earnings growth and undiluted shareholder positions. Recent board changes may influence strategic direction moving forward.

- Dive into the specifics of Zhejiang Yasha DecorationLtd here with our thorough balance sheet health report.

- Gain insights into Zhejiang Yasha DecorationLtd's future direction by reviewing our growth report.

Taking Advantage

- Take a closer look at our Asian Penny Stocks list of 981 companies by clicking here.

- Seeking Other Investments? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English