Is Dollar Tree Stock Outperforming the Nasdaq?

With a market cap of $19.8 billion, Dollar Tree, Inc. (DLTR) operates discount variety stores across the United States and Canada under the Dollar Tree and Dollar Tree Canada brands. The company offers a wide range of consumables, variety of merchandise, and seasonal goods, catering to everyday needs as well as holidays and special occasions.

Companies worth more than $10 billion are generally labeled as “large-cap” stocks and Dollar Tree fits this criterion perfectly. Supported by a nationwide logistics network and its e-commerce platform, DollarTree.com, the retailer serves individuals, small businesses, and organizations with affordable products and bulk purchasing options.

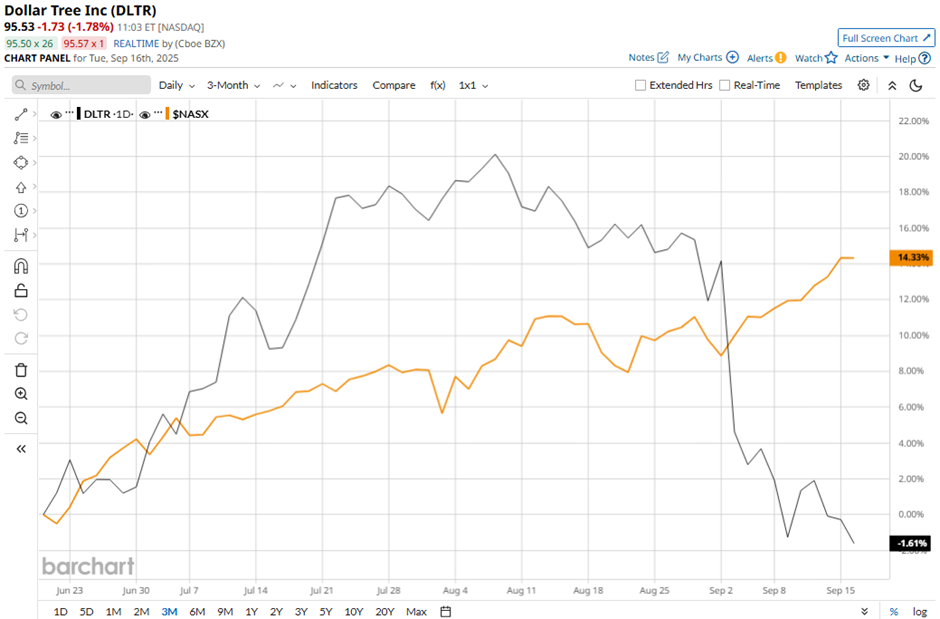

Despite this, shares of the Chesapeake, Virginia-based company have declined 18.8% from its 52-week high of $118.06. DLTR stock has decreased 3.2% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 13.4% increase over the same time frame.

In the longer term, DLTR stock is up 27.9% on a YTD basis, outperforming NASX’s 15.7% gain. Moreover, shares of the company have soared 33.3% over the past 52 weeks, compared to NASX’s over 27% return over the same time frame.

The stock has been trading above its 50-day and 200-day moving averages since April. However, it has fallen below its 50-day moving average since September.

Despite reporting stronger-than-expected Q2 2025 adjusted EPS of $0.77 and sales of $4.57 billion, shares of Dollar Tree tumbled 8.4% on Sept. 3. Investor sentiment soured as management forecasted weak Q3 earnings, guiding adjusted EPS to be roughly in line with last year’s $0.57, far below analyst expectations. Additionally, concerns about rising costs from U.S. tariffs, elevated SG&A expenses, and operating margin contraction of 20 bps to 5.2% weighed on the stock.

Nevertheless, rival Target Corporation (TGT) has lagged behind DLTR stock. TGT stock has declined 34.2% on a YTD basis and 41.8% over the past 52 weeks.

Despite the stock’s outperformance, analysts remain cautiously optimistic on DLTR. The stock has a consensus rating of “Moderate Buy” from the 24 analysts in coverage, and the mean price target of $112 is a premium of 17% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English