3 Undervalued Stocks Estimated To Be Up To 37.3% Below Intrinsic Value

As the U.S. stock market experiences fluctuations with the S&P 500 and Nasdaq recently slipping after hitting record highs, investors are closely watching the Federal Reserve's meeting for potential changes in borrowing costs. Amidst this environment, identifying undervalued stocks can offer opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $7.00 | $13.79 | 49.2% |

| Pinnacle Financial Partners (PNFP) | $95.36 | $186.59 | 48.9% |

| Phibro Animal Health (PAHC) | $39.53 | $77.67 | 49.1% |

| Peapack-Gladstone Financial (PGC) | $29.20 | $56.54 | 48.4% |

| Northwest Bancshares (NWBI) | $12.43 | $24.41 | 49.1% |

| Investar Holding (ISTR) | $22.80 | $44.89 | 49.2% |

| Horizon Bancorp (HBNC) | $16.25 | $31.81 | 48.9% |

| Glaukos (GKOS) | $80.64 | $161.26 | 50% |

| Exact Sciences (EXAS) | $53.43 | $103.39 | 48.3% |

| AGNC Investment (AGNC) | $10.19 | $20.18 | 49.5% |

Let's review some notable picks from our screened stocks.

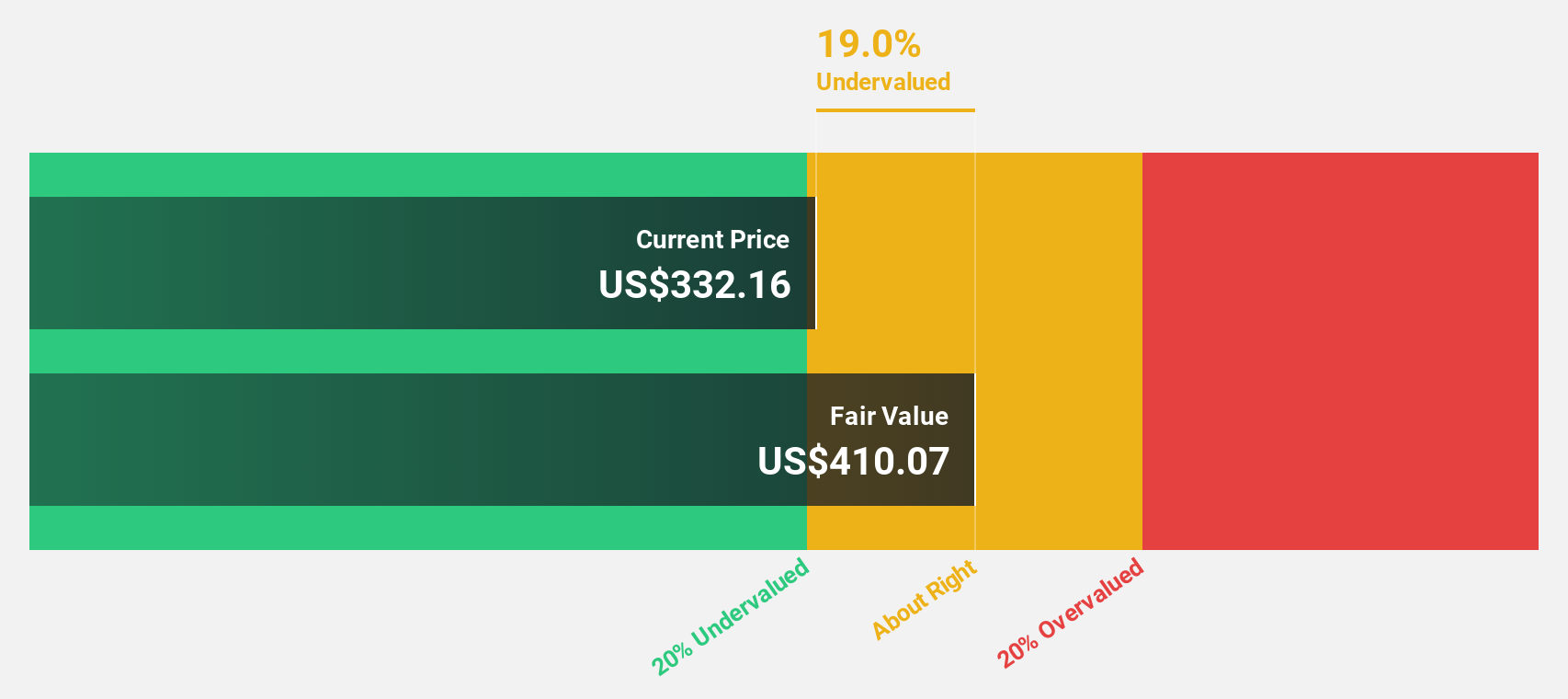

IES Holdings (IESC)

Overview: IES Holdings, Inc. operates in the United States by designing and installing integrated electrical and technology systems, as well as providing infrastructure products and services, with a market cap of approximately $7.50 billion.

Operations: The company's revenue segments include Residential at $1.34 billion, Communications at $1.03 billion, Commercial & Industrial at $418.64 million, and Infrastructure Solutions at $465.63 million.

Estimated Discount To Fair Value: 10.8%

IES Holdings is trading at US$369.74, below its estimated fair value of US$414.61, suggesting it may be undervalued based on cash flows. Recent earnings showed significant growth with third-quarter sales reaching US$890.16 million and net income at US$77.23 million, up from the previous year. Despite some insider selling, the company forecasts annual earnings growth of 19.4%, outpacing the broader U.S market's 15.4% projection.

- Our expertly prepared growth report on IES Holdings implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of IES Holdings.

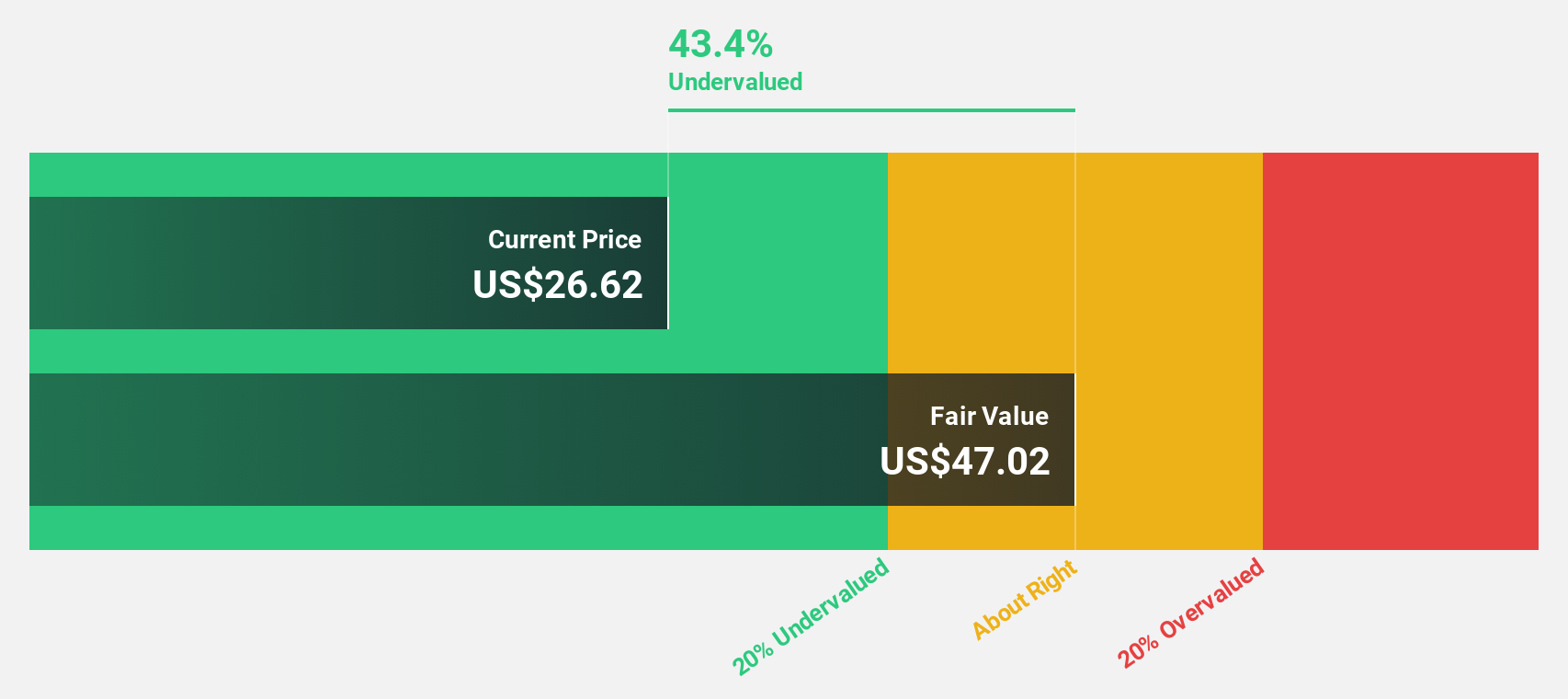

Excelerate Energy (EE)

Overview: Excelerate Energy, Inc. offers liquefied natural gas (LNG) solutions globally and has a market cap of $2.74 billion.

Operations: The company generates revenue from its Utilities - Gas segment, amounting to $987.64 million.

Estimated Discount To Fair Value: 37.3%

Excelerate Energy is trading at US$23.88, significantly below its estimated fair value of US$38.1, highlighting potential undervaluation based on cash flows. Recent earnings show a revenue increase to US$204.56 million for Q2 2025, although net income declined to US$4.73 million from the previous year. The company forecasts robust annual earnings growth of 27.3%, surpassing the U.S market's average expectation and indicating strong future performance despite current challenges in net income growth.

- In light of our recent growth report, it seems possible that Excelerate Energy's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Excelerate Energy's balance sheet health report.

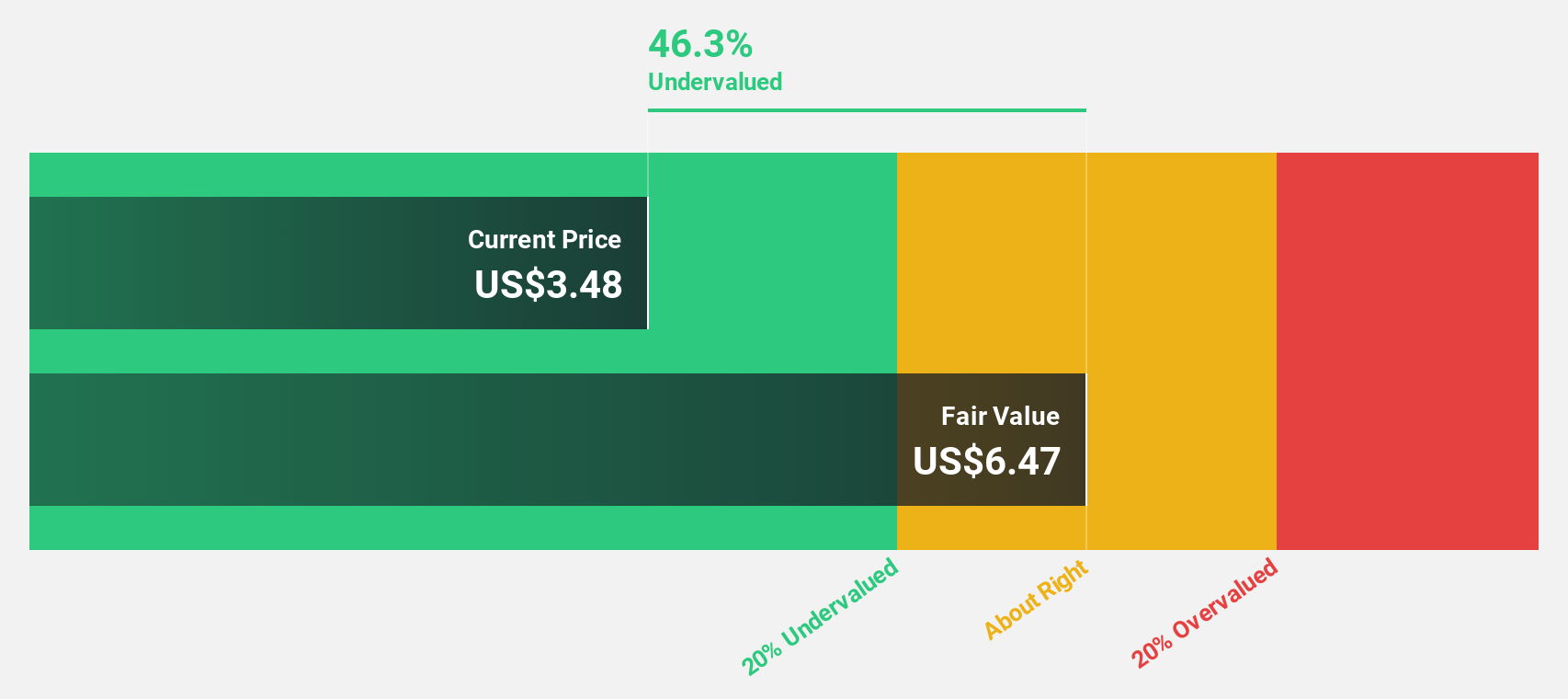

ATRenew (RERE)

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in China, with a market cap of approximately $969.17 million.

Operations: The company generates revenue primarily from its retail electronics segment, which accounted for CN¥18.55 billion.

Estimated Discount To Fair Value: 34.9%

ATRenew is trading at $4.41, significantly below its estimated fair value of $6.77, suggesting undervaluation based on cash flows. The company reported a net income of CNY 72.34 million for Q2 2025, reversing a loss from the previous year and forecasts robust earnings growth of over 20% annually for the next three years. Additionally, ATRenew's revenue is expected to grow faster than the US market average, supported by recent share buybacks totaling $30.25 million.

- The analysis detailed in our ATRenew growth report hints at robust future financial performance.

- Navigate through the intricacies of ATRenew with our comprehensive financial health report here.

Turning Ideas Into Actions

- Discover the full array of 191 Undervalued US Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English