Hallador Energy Company's (NASDAQ:HNRG) Shares May Have Run Too Fast Too Soon

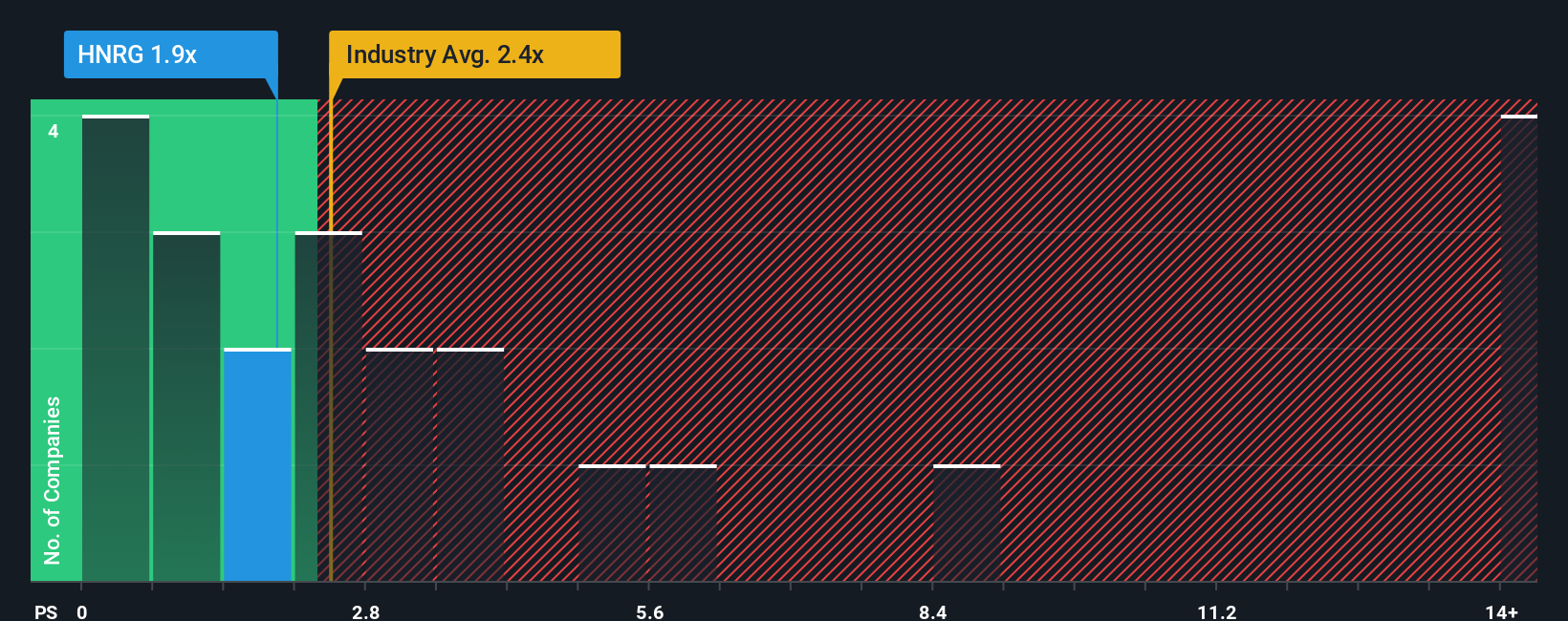

With a median price-to-sales (or "P/S") ratio of close to 2x in the Renewable Energy industry in the United States, you could be forgiven for feeling indifferent about Hallador Energy Company's (NASDAQ:HNRG) P/S ratio of 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Hallador Energy

What Does Hallador Energy's P/S Mean For Shareholders?

Hallador Energy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hallador Energy's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Hallador Energy?

Hallador Energy's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. Still, the latest three year period has seen an excellent 55% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 9.1% each year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 13% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's curious that Hallador Energy's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Hallador Energy's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Hallador Energy's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Hallador Energy that you need to be mindful of.

If you're unsure about the strength of Hallador Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English